Stocks and shares ISA: 10 best companies to invest in for 2016/17

Now that the end of the 2015/16 tax year is upon us, the rush to put savings away in an ISA will calm down. The majority of UK households typically find their household wealth (that is, the value of all their assets less any debt owed such as mortgages or personal loans) concentrated in two types of assets – residential housing and cash. In my view, too much of the average household's wealth is kept in these two asset classes.

Disproportionate wealth tied up in housing

Around 68% of all the flats and houses in the UK are owner-occupied – that is, the person or family that live there are typically the owners of the property too, often with the help of a mortgage.

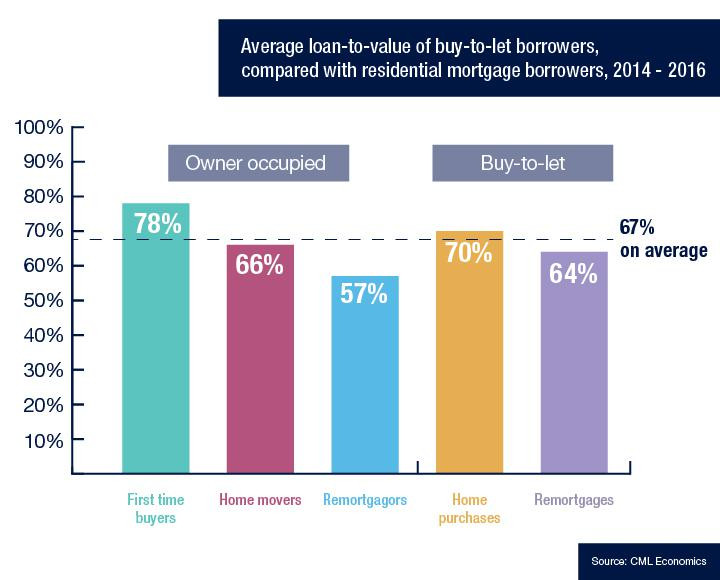

The average owner-occupied flat or house where there is a mortgage has a loan-to-value (LTV) ratio of 67% (Chart 1). Put another way, this means that the average household with a mortgage still has 33% of the flat or house value in equity.

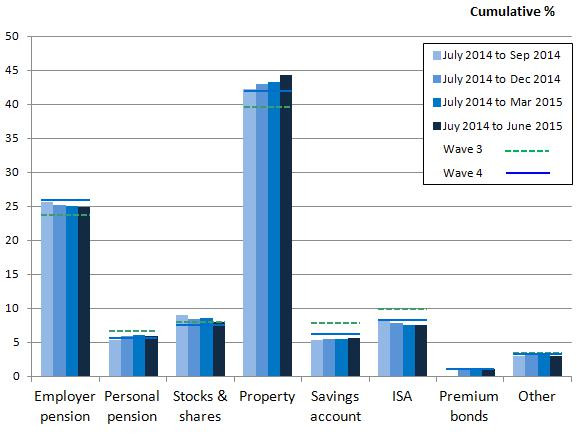

What that means is that the remainder of the property's value is an asset to the householder, representing the largest chunk of their overall wealth. Given the strong performance of UK housing over the past couple of decades (in spite of the sharp fall in 2008-09), it is unsurprising that property is still seen as the preferred investment route for most people (Chart 2).

The net value of property to UK households, after the value of outstanding mortgages had been deducted, stood at a massive £3.6tn ($5.1tn, €4.5tn) as of the end of 2014, according to the Office for National Statistics.

A number so large, that it is impossible to visualise or even comprehend. The average wealth of UK households was over £326,000 at the end of 2014, of which property represented by far the largest chunk at 50%, followed by cash and private pensions.

The good news? That this high level of home ownership combined with strong house price gains now puts the worth of the average UK adult at £83,000 (according to Credit Suisse), and fourth in the world wealth table, only behind New Zealand (1), Australia (2) and Belgium (3).

Despite abysmal savings rates, people also keep a lot of cash

As is typical at the end of each tax year in March/April, many people are reminded through the deluge of adverts from banks and fund management companies to take out an ISA before that year's ISA allocation expires.

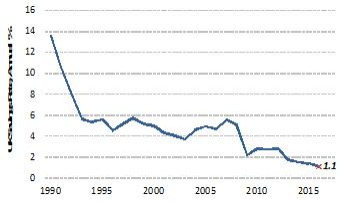

But where do those savings typically go? Well, the most likely destination is still a cash deposit, which today typically earns 1.2% or less per year in (untaxed) interest (Chart 3).

Compared to history, that is the worst level of remuneration from a bank or building society for holding onto your money! In return for keeping your cash for an entire year, you receive the measly sum of £1.25! That is not even enough for half of an average Starbucks coffee.

So what are your ISA options? Surely not shares, given the risk

It is true that the recent history of the UK stock market is not particularly reassuring for your average saver. Over the last year, for example, the FTSE 100 stock market index has fallen by 12%, turning £100 invested in April 2015 into just £88 today (although you would also have received just under £4 in dividend income, partly offsetting this loss).

But as I always say about stocks and shares, they do tend to build wealth, but only over the long-term, over a number of years.

Lower-risk ways of investing in the stock market

I believe that ISA investors today should look to stocks and shares that:

- Have historically been less risky than the stock market, and

- Which today pay out a high level of income via dividends.

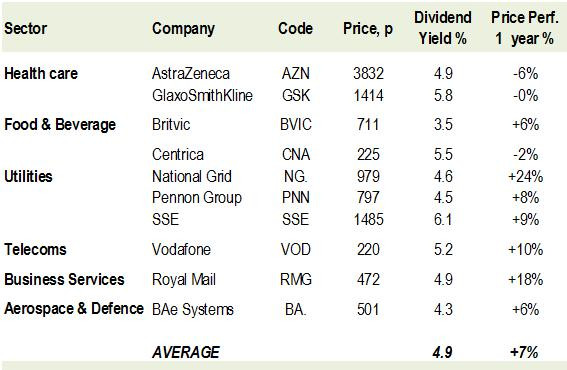

This would lead investors today to look at areas such as Healthcare (prescription drugs), Food & Beverages and Utility companies (electricity, gas and water suppliers).

These ten blue-chip companies would have made you over 11% over the last year via price gains and dividend income, and:

- Are all household names,

- Have lower-than-average risk profiles,

- Have as a group gained 7% in share price over the last year, and

- Offer a near 5% annual income from dividends for this year, far better than for the FTSE 100 as a whole.

Bottom line: Do not be seduced by the buy-to-let property "gold rush", and equally avoid leaving your ISA savings to languish in cash.

Of the 10 higher income stocks listed above, my current favourites are the drug company AstraZeneca and the logistics company Royal Mail. Both offer dividend yields of almost 5%; compare that to the 1.1% available in an instant cash ISA.

© Copyright IBTimes 2025. All rights reserved.