This New Dating App Is Only for People With a Credit Score of 675 and Above

The app has been criticised for being "classist"

After launching in 2021, last year, financial platform Neon Money Platform became the first Black-owned tech business to bring out a credit card with AMEX.

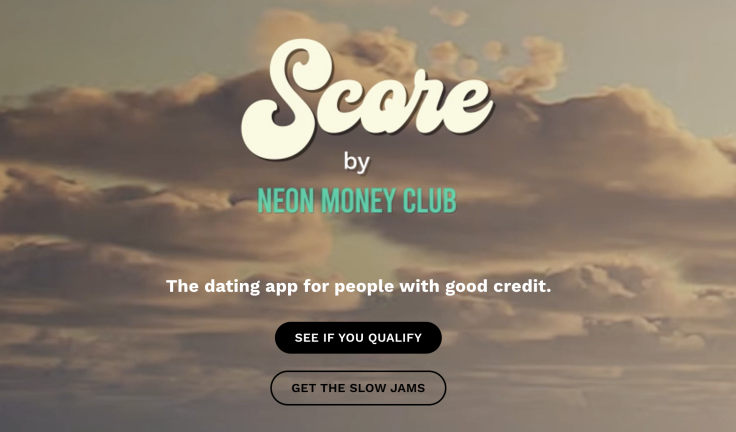

One of its other initiatives was to connect "financially like-minded" singles with an excellent credit score, so Neon Money Club launched its dating app, Score.

Since then, the financial platform has been criticised for entertaining "elitist" culture.

This news comes after a Florida woman said she went viral on the dating app Hinge for revealing her high credit score on her profile. The US national said she was invited on 17 dates in one month.

According to Neon Money Club, its new romance app addresses the importance of finances in new relationships.

Neon Money Club Co-Founder Luke Bailey told TechCrunch that he believes the current methods of raising financial awareness have become mundane.

"We need to take the conversation to areas where finance isn't traditionally discussed," he said.

"Before you can educate people, you need to get their attention. With Score, we're bringing the conversation to dating."

Before signing up, users take a test to see if they qualify as someone with enough good credit scores to join the app, which has a minimum credit score of 675.

For those who aren't eligible to make an account, Neon Club Money has pledged to send out resources that will support them with improving their credit score and ultimately help them improve their financial knowledge.

For the "financially like-minded" individuals who can join the app, Bailey said they will be able to use the "swipe left or right" set-up inspired by the world's leading dating app, Tinder.

View this post on Instagram

"We need more creative and diverse voices in the world of finance," the co-founder continued, urging the industry to "open more doors for others like us."

Connell Barrett, an executive coach for Dating Transformation, slammed the new app for encouraging divorce and entertaining "classist" views.

"The concept of Score is classist and elitist," he said, noting: "Singles face plenty of issues today, from dull dates to catfishing to dating app fatigue, but struggling to find someone with good credit is not a big problem."

"It may be the worst idea to hit the dating industry since Ashley Madison began helping married people have affairs."

"They should change the app's name from Score to Bore."

A National Data Report report revealed that 54 per cent of American nationals believe that having a partner who is in debt is a significant reason to consider divorce.

The financial platform has responded to the criticisms against its new dating app, noting that the site serves as a conversation starter and only intends to pair people for 90 days.

Neon Money Club also argued that the singles are not paired based on their credit scores, meaning someone with a credit score of 700 could be matched with someone whose Score is 900.

Regarding the "classist" accusations, the co-founder also acknowledged how a high income can lead to a low credit score.

"There needs to be more awareness about the doors that can be opened with a good credit history," Bailey added.

© Copyright IBTimes 2025. All rights reserved.