Trump tariffs yet to sting China; pain could begin in January

Analysts warn the 25 percent tariffs from 2019, could slow Chinese growth, raise U.S. inflation and put more downward pressure on emerging markets.

The 10 percent tariffs on Chinese imports to the U.S. are not significant enough to meaningfully impact the Asian country's economy this year, analysts said, despite claims by U.S. President Donald Trump that the pressure is working on China.

But more worrying, analysts who spoke to International Business Times warned that an escalation in the trade war could potentially disrupt global trade flows and cast a shadow over longer-term economic prospects in 2019.

Trump claimed in an interview to Fox News on Oct. 11 that the tariffs had a big impact, that the Chinese economy had been hit substantially and that he could do a lot more to China.

Arjen van Dijkhuizen, senior economist at ABN Amro, said the tariffs imposed so far are not so significant from a macro point of view, but that further escalation will have a more serious impact.

"In our view, 10 percent import tariff is not that prohibitive in terms of real trade flows," Dijkhuizen said. "If you look at typical fluctuations in exchange rates or input prices, cost prices; and if you also regard certain flexibility in the profit margins of importers and exporters; 10 percent tariffs are not operative and do not impact trade flows much."

DBS, whose analysts traveled to China, said in a note seen by IBT that there was unease in Beijing, but no panic yet about the prevailing currency weakness, corporate debt overhang, slowing growth momentum or tightening U.S. monetary policy. It said expectations for a sizeable fiscal support were building.

Yung-Yu Ma, chief investment strategist at BMO Wealth Management, said China is slowing but should still be able to manage its slowdown amid the tariffs. On the other side, he said, the effects of the tariffs so far from a U.S. business perspective were "probably in the category of major annoyance" and not to the level that surpasses a rounding error to GDP growth.

The Chinese economy advanced 6.7 percent year-on-year in the second quarter of 2018, easing from a 6.8 percent growth in the previous period.

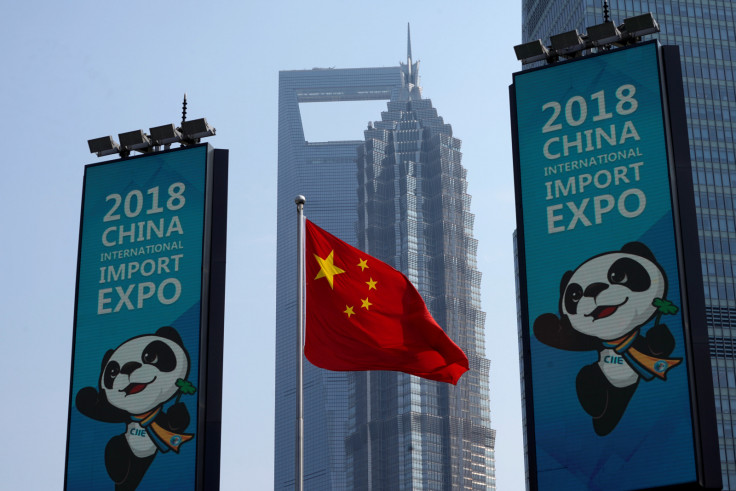

After China and the U.S. imposed 25 percent tariffs on $50 billion on each other's exports, the trade war between the two escalated when Trump added 10 percent tariffs on $200 billion worth of imports on September 17, which is set to be raised to 25 percent from January 1, 2019.

In retaliation, China imposed duties on $60 billion worth of U.S. products. Trump had threatened to impose tariffs on the remaining $267 billion of Chinese imports if there was any further retaliation by China.

Dijkhuizen saw an upside risk to 2018 China growth forecasts of 6.5 percent, and expected downside pressure to build if there is no agreement and the tariffs were raised to 25 percent on January 1 next year.

DBS said in its note that China growth will head towards 6 percent if exports slow in Q4 2018 or early next year, although the chances of a credit-driven policy stimulus is expected to rise considerably in that case.

JANUARY 2019 TARIFF ACTION TO BITE

Yung-Yu Ma, chief investment strategist at BMO Wealth Management, said if the tariffs on $200 billion of Chinese imports were to go up to 25 percent in January and another round of tariffs imposed on the remaining $200+ billion of imports from China, the effects will become more meaningful, slowing Chinese growth and adding to inflationary pressures in the U.S.

Carsten Hesse, European economist at Berenberg, expected the negative impact from 25 percent tariffs on the U.S. growth by about 0.3-0.4 percent, and on Chinese growth by about 0.6 percent or more. He said the trade war with China will raise inflation in the U.S., pushing up interest rates and giving the Federal Reserve more ammunition to raise rates faster.

"And that's when we think the next recession could be, in 2021, when interest rates are really forced to increase at about 3.5-4 percent because of rising inflation and stimulus program," he said.

Yung said the effects of a further slowdown in China, which accounts for more than 30 percent of total global growth, will have a ripple effect.

"Emerging markets are already under some strain due to a rising U.S. dollar and rising U.S. interest rates. Direct contagion effects from the U.S. and China tariffs are likely to be modest, but the overall downward pressure on growth adds to an already challenging environment in emerging markets," he said.

Yung said the Chinese currency, which is down about 10 percent since the beginning of this year, could likely depreciate another 5-10 percent if the trade war escalates. China's central bank has allowed the yuan to gradually decline. The yuan weakened to 6.9180 against the U.S. dollar Monday.

"If the U.S. can quickly take a positive direction with other trading partners and the friction is only a U.S.-China issue, then that is likely to be contained and not too damaging. But, if the trade war escalates on multiple fronts – U.S.-EU, etc. – then the combined effects could become very meaningful," Yung said.

DBS said in its note that the Sino-U.S. trade war is likely to worsen further and the negative impact on trade and other economic parameters will only surface gradually over time.

"Should the Trump administration levy tariffs on the remainder of China exports by 25 percent on Jan. 1, 2019, it will be the maximum stress point to force Beijing to have a policy response. Until then, there won't be any material impact on China headline numbers," the note said.

DBS said its analysts saw Chinese companies considering a combination of margin squeeze, productivity enhancement, and re-routing of trade to deal with impending tariffs in the near term. "What was troubling was the growing sense that there are no short-term resolutions to the China-U.S. conflict," it said.

'DEAL NOT EASY WITH CHINA'

Some analysts are surprised at how far the trade dispute has deteriorated, but think that a stronger U.S. economy and less pressure from the Republicans and Congress could be behind the delay in getting a deal through with China.

Berenberg's Hesse said he had expected a meeting and a deal between Trump and Chinese President Xi. "It's clearly Trump making the calls here. He could have changed his mind, but the U.S. economy is doing well, the S&P is doing well, while the Chinese markets are sinking, and Trump knows that he is winning this trade war and as long as this is the case, he fully doesn't see a reason to change it."

"The trade dispute with China is deeper, its not only that the U.S. has a massive trade deficit but also of the accusations that China is stealing technology and is not giving U.S. companies the same access to their markets," Hesse said.

"It's beyond the issues with Europe, or Mexico or Canada. That's why a deal is more difficult with China than it was with others – simply lesser issues," he added.

"He (Trump) wants that U.S. stays ahead, economically and is not taken over by China. If he can delay it by a few years, then he thinks that he did the right thing. Maybe China offers so much that Trump will think that he can sell himself as the winner," Hesse said.

ABN Amro's Dijkhuizen said, "the market seems quite relaxed because there are three months and we have the midterm elections ahead. By the year-end there is also the G20 Summit."

DBS also believes that markets have priced in a 'no-deal' in the near term. "As it is now, with tariffs on half of China exports to the U.S. already announced, and with midterm elections in early November, we think the other half of the tariffs on exports will be beyond this year, and likely a long-drawn out affair," DBS said in its note.

© Copyright IBTimes 2025. All rights reserved.