UK Banking Outlook Slashed to Negative on Lawsuits, Fines and Compensation

Moody's has downgraded the outlook for the British banking industry as the total amount lenders would have to stump up, in the form of fines, settlements and compensation for a raft of major market manipulation scandals and investigations, is unclear.

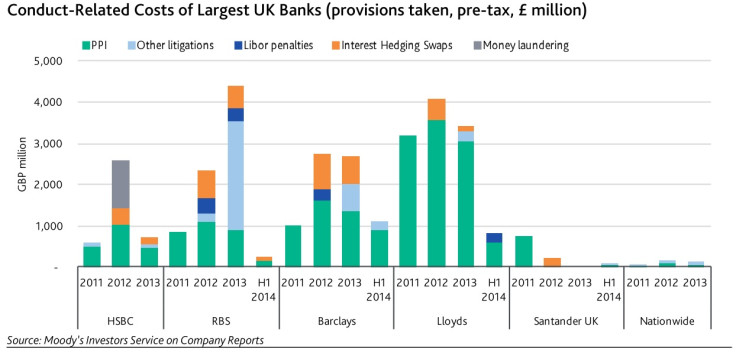

The ratings agency said in a statement that it had to change the outlook for British lenders, focusing on HSBC, Barclays, the Royal Bank of Scotland, Lloyds Banking Group, Santander UK, and the country's largest building society, Nationwide, as litigation costs and possible fines and settlements remain "difficult to predict".

"UK banks remain exposed to further conduct-related costs [Figure 1], which are highly unpredictable and increase earnings volatility, as demonstrated by the banks' accounting for conduct-related provisions," said Moody's in a statement.

"Nevertheless, we believe that some conduct-related provisions have peaked, in particular for the mis-selling of payment protection insurance, and will decline relative to previous periods.

"Lastly, some large UK banks are included in investigations that UK and international authorities are undertaking in relation to benchmark interest-rate and foreign-exchange-rate manipulations.

"[Lloyds recent fine] shows how even banks without large investment banking activities are exposed to legacy remediation costs. Although the timing and the outcome of these investigations is difficult to predict, they add material risks to the profitability metrics for the affected institutions."

Britain's biggest banks have now set aside around £21bn (€26.5bn, $35.4bn) to deal with the payment protection insurance (PPI) scandal.

PPI was originally designed to provide loan repayment cover, should the customer fall ill, lose their job or have an accident. However, millions of customers have now submitted complaints stating that that they never wanted or needed the policy in the first place.

Banks have also spent billions of pounds in dealing with the mis-selling of interest rate hedging products and face more years of coughing up millions in compensation payments to SMEs for consequential loss claims.

Elsewhere, while Barclays, Lloyds, RBS and a number of others have settled with authorities over Libor fixing charges, regulators across the globe are still investigating a number of other lenders over allegations of manipulating key foreign exchange rates.

Meanwhile, Moody's said there was another range of issues for why Britain's banking sector outlook had to be cut.

"We have changed our outlook for the UK banking system to negative from stable. This change reflects our view that the improved operating environment and banks' stable financial fundamentals will not fully offset the negative credit implications of the finalisation of the UK resolution and bail-in regime and the related 'ring-fencing' framework," it said in a statement.

"As a result of their final implementation, our current systemic support assumptions for UK banks will likely decline during the outlook period, as indicated by the existing negative outlooks on the long-term ratings of the six largest UK financial institutions."

The UK resolution and bail-in regime and the structural ring-fencing is aimed at hiving off retail banking operations from investment banking units, in a bid to protect ordinary investors and SMEs from more risky parts of the group.

© Copyright IBTimes 2025. All rights reserved.