UK wages at 32-year high even as labour market fears possible recession

Despite an economic slowdown widely expected to morph into a recession later this year, the labour market remains tight, with upward pressure on wages.

As the UK economy faces the somewhat peculiar twin pressures of a looming recession and tight labour market conditions pushing wage increases, perhaps policy makers ought to turn their thoughts to more structural issues, in addition to short-term factors.

With experts opining that supply pressures are the driving force behind the economic slowdown, the short-term culprits are often talked about: Covid, the Ukraine War, and the lingering impact of Brexit.

Whilst global productive capacity is still recovering from Covid, the Ukraine War has impacted supply chains, significantly skyrocketing the prices of energy and goods in the UK.

In the UK, Brexit has dampened supply further. It has not only caused a brain drain away from Britain's shores, regulatory barriers have caused supply chain disruptions.

However, policy-makers will have to look deeper, sooner or later.

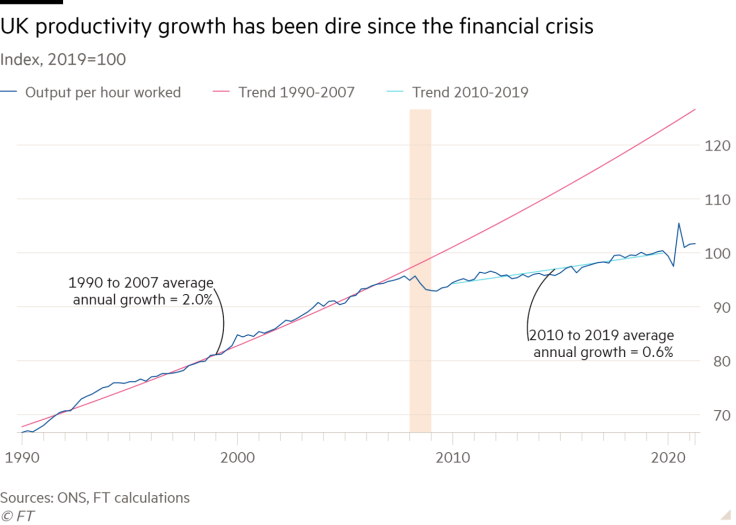

Whilst many developed economies face challenges on the productivity growth front, the UK's problem is particularly acute. The Financial Times has previously reported that in the decade leading up to the pandemic (2010-2019), UK productivity growth was half of what it had been from 1990 to 2007, when the global financial crisis hit.

Even with a cost-of-living crisis unfolding, tight labour market conditions were underscored by record low unemployment of 3.7% in November, the latest month for which data is available - a level that has, in the past, been associated with wage hikes and scarce labour supply.

A recent survey of more than 2,000 businesses found that employers expect to give staff pay increases of 5% this year - the highest since the quarterly survey began in 2012. The survey is run by the CIPD (Chartered Institute of Personnel Development), an association of HR professionals.

More than half of the firms surveyed also reported difficulties filling vacancies.

The latest data from XpertHR, an online HR advisory providing benchmarking data and HR practice guidance, suggests that pay is at a 32-year high - though still unable to keep pace with inflation. Analysing 110 pay awards covering 240,000 employees, it shows that median basic pay in the three months to the end of January 2023 was 6%, a one percentage increase on the previous rolling quarter.

Demonstrating the scale of the issue, the Chancellor recently urged record numbers of post-pandemic early retirees to return to work.

At the same time, the Bank of England is concerned that inflation, which is forecast at 10.7% for the year, could be harder to control if pay packets keep rising.

Whilst the Prime Minister has pledged to halve inflation by the end of the year, it is unclear whether the government will announce new policy interventions to achieve this or simply rely on previous ones.

Diane Coyle, a professor of public policy at the University of Cambridge, indicated the complexity of the challenge, saying, "It's a system problem. And I can give you a list of things that have gone wrong."

Not for the faint-hearted, Coyle's long list included, "low investment, very centralized government decision making, really inadequate skills, training, constant chopping, and changing of policies; an economy that's much too weighted towards financial services and professional services at the expense of manufacturing."

Illustrating her point, a report from the London School of Economics and the Resolution Foundation think tank found that business capital investment in the UK was 10% of gross domestic product in 2019.

This compared to an average of 13% in the United States, Germany and France. And the UK government spends a lot less on research and development, too.

Whilst ministers and the Bank of England tackle short-term supply issues to tame inflation, labour shortages and wage growth, no solution, it seems, is complete without taking a hard look the systematic factors affecting Britons' productivity - and therefore, their living standards.

© Copyright IBTimes 2025. All rights reserved.