US Tech Firms Try to Derail G20 Tax Avoidance Clampdown

The world's largest technology firms are trying to derail the G20's efforts to clamp down on global tax avoidance by writing to the Organisation for Economic Co-operation and Development to say that multinational groups are not gaming national tax systems.

The Digital Economy Group, which lobbies on behalf of US tech firms, made a final hour attempt to block G20 reforms by claiming that any leakage of tax revenues stemming from the complex corporate structures of digital groups is merely coincidental.

"Enterprises that employ digital communications models do not organise their business operations differently as a legal or tax matter," said the group in the letter to the OECD.

"We believe that [digital] enterprises operating long-standing business models, subject to established international tax rules, should not become subject to altered rules on the basis that they have adopted more efficient means of operation."

While sources say that The Digital Group membership includes Google, Amazon and Apple, the lobby group will not confirm its clients list.

Tackling Tech Tax Avoidance

Tech company tax avoidance has come under close scrutiny in the UK after politicians have repeatedly slammed some of the world's biggest digital groups for operating in Britain yet paying little or no corporation tax.

Last month, the Public Accounts Committee (PAC) slammed Britain's taxman for being too corporate-friendly and has urged HMRC to start taking companies to court in order to force them to pay more tax.

According to PAC's annual report on tax collection performance, the panel of politicians said that the HMRC is too lenient on big business and, as a result, the UK is losing billions of pounds worth of extra tax collection.

In May last year, Google came under fire from the PAC, lead by Margeret Hodge, and the public for only paying £6m (€7.3m, $9.9m) in corporation tax in 2011, despite recording annual revenues of £2.5bn in Britain that year.

From 2006 to 2011, Google generated £11.8bn in UK revenues.

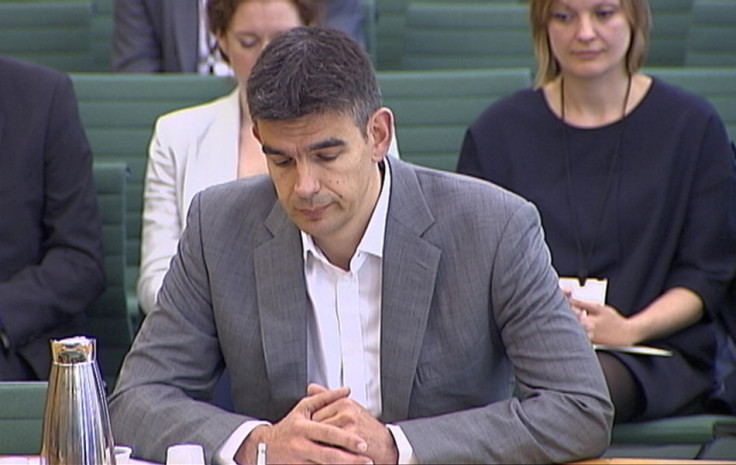

"Everything I said back in November is true. Literally 99% of the companies paying for advertising with Google do not have contact with the UK," said Matt Brittin, Google's vice-president for sales and operations in northern and central Europe.

"No money changes hands in the UK. Firstly, the rights to what we sell and are sold are owned by Google in Ireland, under intellectual property rights.

"We are talking about buying advertising on a platform created in the US. In the UK, we cannot sell what we don't own, we cannot agree a price, we cannot agree on volume discount and we can't close a deal from Britain."

Meanwhile, reports suggest that Apple has sheltered $40bn from taxation using Ireland's loophole.

Reforms Underway

G20 countries are working on a number of reforms to seal up corporation tax loopholes and, already, a number of countries have started to make key changes to its tax law while also launching individual investigations.

In October last year, announced as part of the Irish government's 2014 budget, a tax loophole, which allowed Apple to avoid paying any tax on billions of dollars of revenue, was closed.

The change in the tax law means that companies registered in Ireland for tax reasons will no longer be allowed to be 'stateless' in terms of their residency.

Italy also launched an investigation into Apple's tax declarations for 2010 and 2011 after claiming the tech giant hid €1bn from local authorities.

According to two unnamed judicial sources cited by media sources, Milan prosecutors believe Apple hid €853m in taxes in 2011 and €206m in 2010.

© Copyright IBTimes 2025. All rights reserved.