Why Did the PBoC Inject $81bn into China's Financial System?

PBoC's latest liquidity infusion is not a policy shift.

The People's Bank of China on 17 September leaked to the press that it had pumped 500bn yuan into China's top lenders.

The central bank move is expected to help arrest a slowdown in growth in the world's second largest economy.

But why inject $81.4bn (£50bn, €63bn) now?

Explaining the PBoC's move, Capital Economics said that when the infusion was likened to "a form of stealth stimulus", the injections were actually the sort of "run-of-the-mill operations" that keep enough money in the financial system ahead of the upcoming National Day holidays, when the demand for cash rises, and [for] "the implementation of new banking rules."

Capital Economics also pointed out that the PBoC was "erring on the side of caution by offering more than it usually would."

Meanwhile, Danske Bank said in a note that Chinese lawmakers could be compelled into more "substantial easing" particularly if manufacturing PMIs "decline below 48 in [the] coming months."

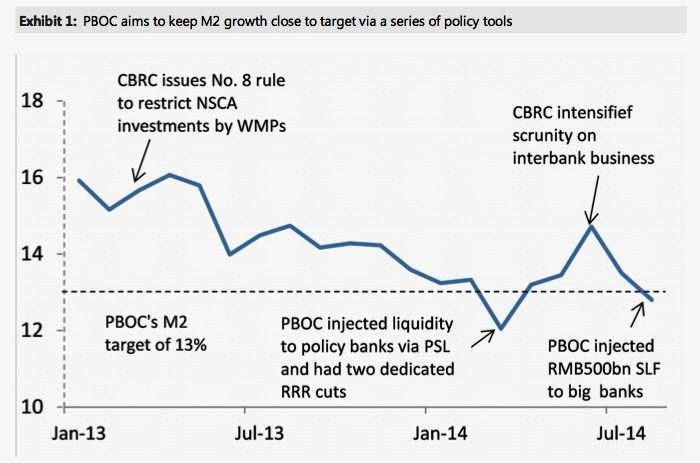

Another likely reason for the PBoC's move is that China's money supply just slipped below the targeted 13% annual growth rate, noted Morgan Stanley's Richard Xu.

Xu added that the PBoC has been pumping money more often in 2014 – particularly whenever the banking regulator inspects shadow banking, or the lending by institutions, outside of China's formal banking system.

ANZ Research has estimated that China's shadow banking sector may have reached around 33tn yuan by mid-2014, the equivalent of nearly 58% of 2013 GDP or 20% of total bank assets.

While some analysts equated the PBoC's injection to 'quantitative easing', that is not exactly the case, Quartz reported.

The Quartz report said: "The goal of QE for the [US] Federal Reserve was to lower mortgage rates and long-term borrowing costs. Pumping more money into the system was a byproduct.

"In China, it's the converse. The PBoC must keep banks flush with cash; rates fall as a result. The latest injections are reportedly three-month loans, too short to boost bank lending. If the PBoC were 'stimulating', it would, as it did months ago, slash banks' reserve ratio requirements. But that would whip up inflation, re-inflate the housing bubble, and increase the chance of a debt crisis."

The central bank's move came after dismal factory output data, together with weaker readings in industrial power consumption, retail sales, inflation, investment and imports, raised calls for Beijing to do more to prevent the economy from suffering a sharp slowdown.

Remaking China

Premier Li Keqiang, speaking at a business conference in Tianjin on 10 September, promised to remake the Chinese economy and said his country will be able to meet the year's major economic targets.

Structural reforms have reduced the risk of a hard landing in the economy, Li said at the World Economic Forum event.

China's economy expanded by 7.5% in the second-quarter of 2014, after hitting an 18-month low of 7.4% in the first-quarter.

© Copyright IBTimes 2025. All rights reserved.