Apple earnings: Services revenue hits record high

Promising results make a return to growth seem likely.

After missing its initial revenue guidance for its fiscal first quarter by nearly $7 billion, there was more uncertainty than usual going into Apple's (NASDAQ:AAPL) fiscal second-quarter results. Fortunately, strength in services, wearables, and iPad helped make up for a continued decline in iPhone revenue. In addition, growth beyond iPhone reinforced why the company is more than its smartphone segment.

Here's a closer look at the quarter's results and Apple's updated capital return program.

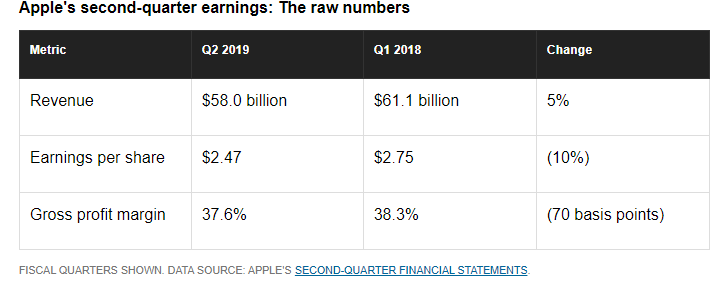

Revenue fell 5 percent year over year to $58 billion, coming in toward the high end of management's guidance range for fiscal second-quarter revenue of between $55 billion and $59 billion.

Once again, revenue was weighed down by lower iPhone revenue, which accounted for 54 percent of total revenue during the period. Furthermore, since iPhone contributes outsize gross profit to the tech giant's overall results, lower revenue from the segment hurt Apple's profitability. The company's gross profit margin was 37.6 percent -- in line with guidance but down 70 basis points from the year-ago quarter. Earnings per share fell 10 percent year over year to $2.47.

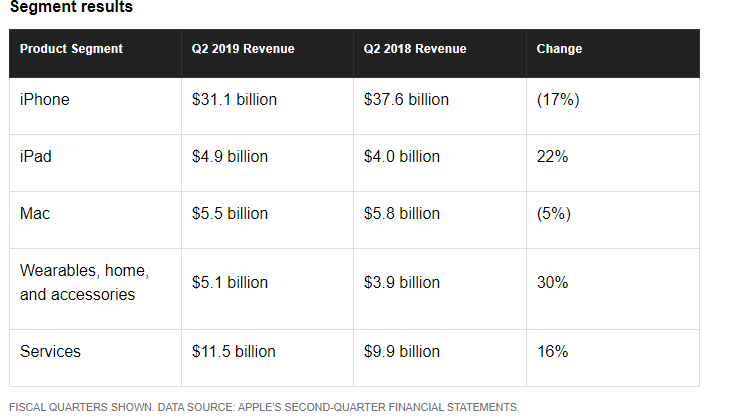

iPhone revenue fell 17 percent year over year during the quarter. However, CEO Tim Cook said during the company's fiscal second-quarter earnings call that declines narrowed significantly in the final weeks of the quarter. "Looking back at the past five months, November and December were the most challenging, so this is an encouraging trend," Cook added. "We like the direction we're headed with iPhone and our goal now is to pick up the pace."

Services revenue rose 16 percent year over to a record $11.5 billion. This growth is important both because services is Apple's second-largest segment and it boasts a meaty 64 percent gross profit margin.

Mac revenue was down 5 percent year over year but management said it believed revenue in the segment would have been up year over year if it weren't for processor constraints during the quarter.

iPad revenue jumped 22 percent year over year, driven primarily by the company's redesigned iPad Pro, which launched late last year.

Finally, the wearables, home, and accessories segment saw revenue surge 30 percent higher, driven by nearly 50% year-over-year growth in its wearables products. "[Wearables] is now about the size of a Fortune 200 company, an amazing statistic when you consider it's only been four years since we delivered the very first Apple Watch," said Cook.

Returning more capital to shareholders

Apple continues to return massive amounts of cash to shareholders through dividends and share repurchases as it works on becoming net cash neutral. The company returned more than $27 billion to shareholders during the fiscal second-quarter alone, spending $3.4 billion on dividends and the rest on repurchasing shares.

And there's more where that came from. Alongside its fiscal second-quarter results, Apple also announced a 5 percent increase to its quarterly dividend and authorized an additional $75 billion for its share repurchase program.

This article originally appeared in IBTimes US.

Daniel Sparks has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.