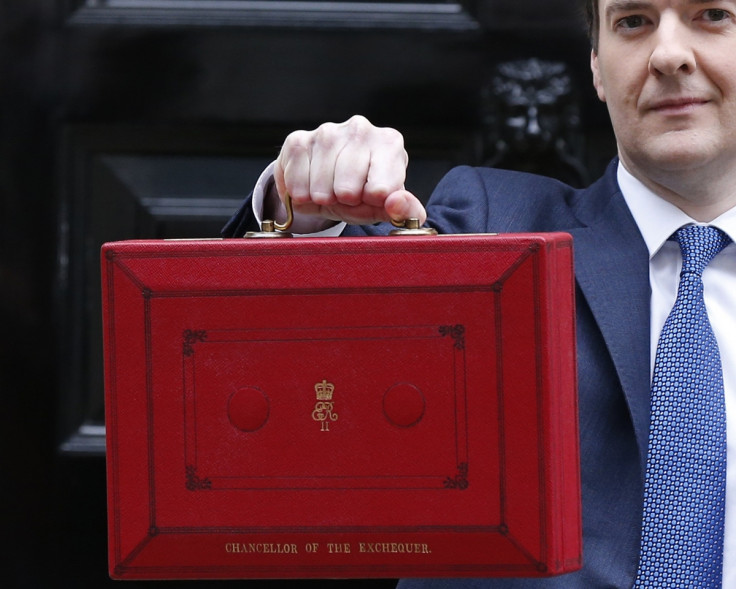

Budget 2014: Britain to Bank £4bn on Tax Avoidance Crackdown

Chancellor George Osborne has claimed that £4bn will flow back into the economy after he gives the HMRC more powers and a bigger budget.

In the Budget 2014 announcement, Osborne said: "While the vast majority of wealthy people pay their taxes, there is still a small minority who do not.

"We will now require those who have signed up to disclosed tax avoidance schemes to pay their taxes, like everyone else, up front."

At the end of February, the taxman pledged to crack down on companies avoiding and evading tax.

Jennie Granger, director general for enforcement and compliance of HM Revenue & Customs (HMRC), added that most people with offshore assets "do the right thing and tell us about them but "for the minority who do not, the net is closing around them".

Switzerland is thought to have attracted more than £1.3tn (€1.5tn, $2tn) in offshore deposits and has come under close scrutiny over the last few years.

However, after years of negotiations, the Swiss government backed a variety of global schemes to provide more transparency over its clients and banking activities, in a bid to help authorities root out billions of dollars of tax.

In June last year, world leaders at the G8 summit in Northern Ireland chalked up an agreement on tackling tax avoidance and evasion.

What is the Difference Between Tax Avoidance and Tax Evasion?

Tax avoidance is the legal way of reducing one's tax bill by using a number of accounting methods to achieve this. Tax avoidance methods usually involve complicated ways in changing one's business structure through incorporation, establishing an offshore company in a tax haven, or even deducting tax for materials or equipment use. The company also fully discloses this information to the tax authorities.

Tax evasion is an illegal way of reducing one's tax bill. This involves deliberately misrepresenting or concealing the true state of their affairs to the tax authorities to reduce their tax liability, and includes, in particular, dishonest tax reporting.

© Copyright IBTimes 2025. All rights reserved.