Edmund Shing: Time to invest in Barclays, Lloyds and HSBC as PPI woes batter UK banks?

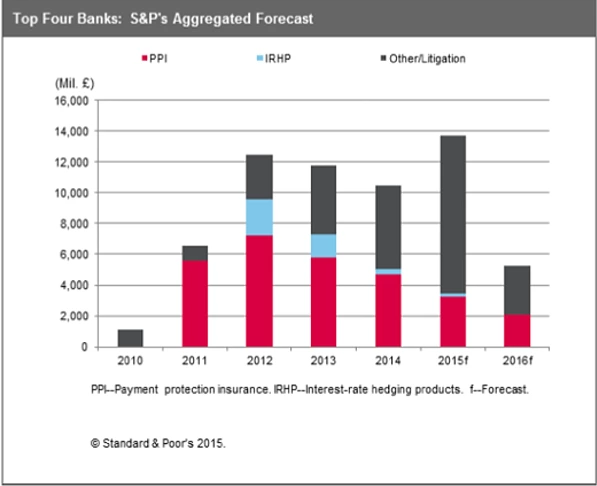

UK banks have been pretty bad boys, all in all. They have been caught out for a succession of mis-selling scandals, including PPI (Payment Protection Insurance). They have so far paid out £26bn (€35bn, $39.5bn) in compensation and fines for PPI. Including other mis-selling scandals, the total cost of compensation and fines now runs to a cool £42bn (Figure 1).

So, have we seen the end of these scandals? Not yet...

The UK's high street banks, including Barclays (code: BARC), Lloyds (code: LLOY), HSBC (code: HSBA) and RBS (code: RBS) face a further estimated £10-15bn in claims for PPI, according to Nick Baxter of the Professional Financial Claims Association.

City watchdog the Financial Conduct Authority (FCA) has just set a 2018 deadline for consumers to make further PPI claims. The claims industry thinks this will result in a further flood of claims against these banks as a result.

Standard & Poors reckons the big four UK banks face a further £19bn in compensation costs and fines over the next two years. This is a massive amount, but amazingly enough it is actually less than the £22bn that these banks have paid over the past two years.

Bad news for the banks? Actually, more like good news

For investors in these banks, is this announcement by the FCA bad news? Probably not, if truth be told. In fact, you can even argue that the 2018 limit for PPI claims is good news, as it provides certainty over the end of this sorry affair. After 2018, PPI-related costs will no longer drag on banks' earnings, allowing earnings growth to accelerate.

And now looks like a decent time to buy some bank exposure, as the UK banks sector has seen share prices drop by an average of 17% since June of this year, with most of the damage being done over August (Figure 2).

Amazing income payers to pick up

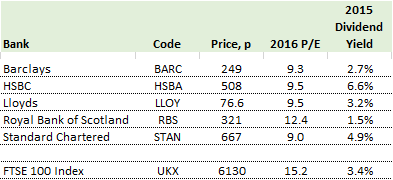

So long as the banks continue to pay dividends out at the current rate (or better), bank shareholders can expect to receive a bumper crop of dividends in the years to come. Out of the biggest five UK listed banks, HSBC comes out top in terms of its dividend yield, ie the income you can expect to receive every year (Figure 3). HSBC offers a hefty 6.6% annual income on shares bought today at 508p.

Note also that each of the banks are considerably cheaper than the overall FTSE 100 index, when judged by price/earnings ratio (P/E; the lower this ratio is, the cheaper the share). The five banks are valued at P/E ratios ranging from 9 to 12.4 times earnings, way lower than the 15.2 times that the FTSE 100 is valued at.

Focus on HSBC

HSBC is a truly global bank, with big operations in the UK (the old Midland Bank), the US, and of course Asia (in China and of course Hong Kong). Overall, the bank earns nearly 40% of its revenue in Asia, and it has made this region the target of its new strategic focus. This should result in faster profit growth going forwards, given the faster economic growth in the region compared to Europe or the US.

The costs from misconduct like PPI looks to have peaked (after paying $11.2bn over 2011 to 2014), and cost cutting should now allow HSBC to raise its profitability level substantially over the next few years.

With the share price over 20% lower today than in May of this year, and a very attractive income yield of way over 6% on offer, this could be an appealing prospect for those investors who like a bit of value.

Edmund Shing is Global Head of Equity Derivative Strategy at BNP Paribas in London. He holds a PhD in Artificial Intelligence.

© Copyright IBTimes 2025. All rights reserved.