Ethereum's William Mougayar: 'A successful ICO is not indicative of the success of the ICO'

Author, investor and Ethereum advisor William Mougayar is a long-time champion of decentralisation.

You cannot challenge the conventional wisdom about start-ups, says author, investor and Ethereum adviser William Mougayar. The fact that someone is getting money in the form of a token sale doesn't alter the notion that it is based on theoretical assumptions and nothing more. In some cases token crowd-sellers have not even put a team together yet, he says.

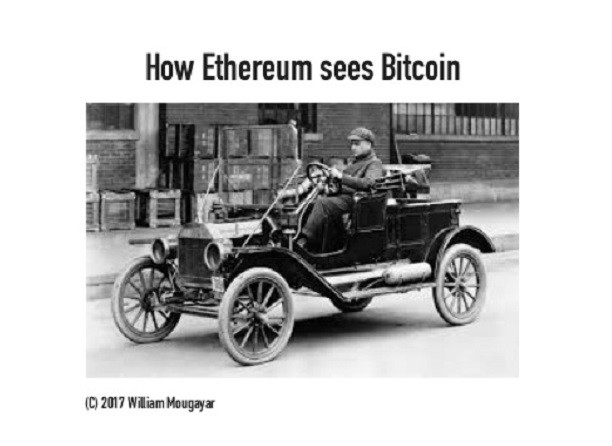

Mougayar has been tracking start-up companies and IPOs since the internet was in its infancy. He sees a clear comparison between the state of the net 20 years ago and the blockchain gold rush to issue and buy into cryptographic tokens of the last year or so.

"'A successful ICO (initial coin offering) is not indicative of the success of the ICO. You cannot collapse success into some white paper you have produced. The blockchain start-ups that have done ICOs are just at the beginning of something. Ask me how they are doing in a year or two years from now. I know for a fact it won't be any different from the statistics of all start-ups: 80% of them will not make it," said Mougayar.

Comparing the present to 20 years ago, he said: "In 97/98 I was tracking internet companies that were going public. The IPOs back are like the ICOs of today. Back then it was so easy to do an IPO with no revenue with no proof of anything.

"There is nothing different with what is going on right now with Ethereum and the blockchain space, from a start-up point of view. You hear about people starting anything on Ethereum like recruiting, social networks, publishing, travel, insurance you name it."

"Back then, everybody said let's do this on the internet; and today we hear people say let's do this on the blockchain."

"You saw a lot of ideas from the physical world simply duplicated on the internet with not much innovation, and today we are seeing initiatives like selling tickets on the blockchain. Let's put whatever on the blockchain because we can. Ask why – and what's the value, and it starts to thin out."

Mougayar is not negative; this is the nature of the start-up world, something about which he is highly optimistic. From his experience, a key part is putting the right team together. "In some cases we are giving money to two or three people that have not hired the rest of the team. With traditional VC money you would rarely give it to two people. With a team of five or six you know a little bit what is going on.

"It takes a lot of variety and a lot of failures to get the successful ones to emerge. Entrepreneurs are always optimistic and being naive is maybe a desirable feature, because if they knew all the roadblocks and risks, many wouldn't do it."

Mougayar, who is the author of the Business Blockchain, also spends a lot of time talking to enterprise about the distributed ledger technology. He notices that big companies do not want to disrupt themselves too much; they tend to pick and choose from the blockchain design what they like, and reject what they don't like.

"The thing that they really like about the blockchain is the distributed ledger technology part. But the DLT is only one of about eight different features that the blockchain enables. Big companies do not want to disrupt themselves. All they want to do is improve themselves. They see the blockchain as another IT project. It's going to save money; it's going improve a process here and there. It's not going to change their business."

Continuing a wide-ranging work tracking and classifying new technological ecosystems, Mougayar has taken it upon himself to map out all the start-ups on Ethereum – an Ethereum directory which is being published on "EthereumAll.com"

Unperturbed by the speed at which this ecosystem evolves and updates, he says: "I created a database of 500 bitcoin companies two years ago, so I can do it. I'm very fussy when it comes to taxonomy, data accuracy and curation rigor."

"EthereumAll.com is not done yet. I would say in two or three weeks it will include 400-plus entries. Right now you can't tell who is doing what because nobody has the full picture. If only Ethereum knew what Ethereum knows."

© Copyright IBTimes 2025. All rights reserved.