Europe's banks sucked into global rout as high rates reality hits home

European bank shares tumbled on Friday in the wake of a dramatic sell-off in U.S. lenders as concern spread that the sector will be vulnerable to the rising cost of money.

European bank shares tumbled on Friday in the wake of a dramatic sell-off in U.S. lenders as concern spread that the sector will be vulnerable to the rising cost of money.

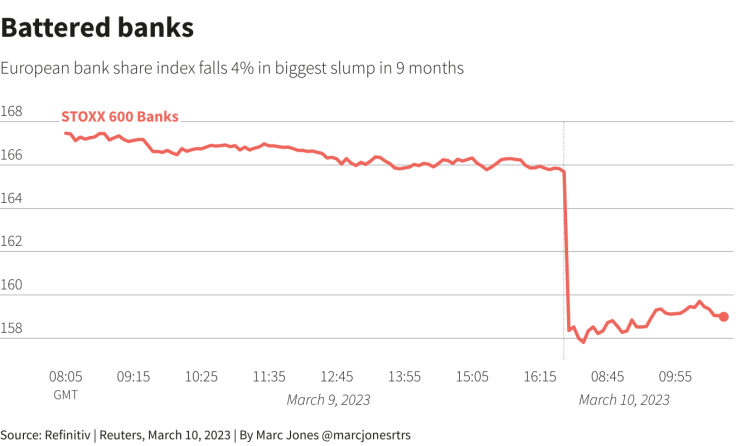

Europe's STOXX banking index fell more than 4%, set for its biggest one-day slide since early June, with declines for most major lenders, including HSBC, down 4.5%, and Deutsche Bank, down 7.9%. Shares in Italy's UniCredit and Intesa Sanpaolo also fell sharply.

The global rout in bank stocks was prompted by Silicon Valley Bank (SVB), a major banking partner for the U.S. tech sector, which was forced to raise fresh capital after selling a package of bonds at a loss to meet depositor demands for cash.

"The market is treating this as a potential contagion risk," said Antoine Bouvet, senior rates strategist at ING in London.

"It makes sense to me that a remote probability of a U.S. banking system-wide crisis should also come with a small probability of contagion to Europe," he said.

Already bruised, the sector could face another bout of turmoil later on Friday if U.S. employment data points to a further racheting up of interest rates.

Shares in major U.S. banks such as JPMorgan Chase & Co and Citigroup were set to fall again when Wall Street reopens.

Europe's battered banks

LEVERAGE PROBLEM

The crisis at SVB underscored the risks to banks from the end of easy money. Banks typically invest heavily in government bonds, in particular those of their home country. A spike in interest rates has led to a sell-off in bonds, leaving banks exposed to potential losses on the securities they hold.

John Cronin, an analyst at Goodbody, said investors were worried about the falling value of banks' investments and how that could hit the capital underpinning their business, as well as savers switching banks for a better deal.

Offering higher deposits to attract customers could also eat into bank profits.

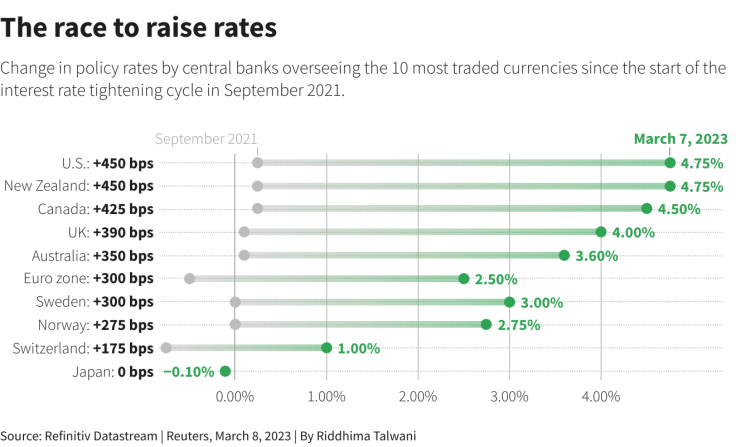

Global borrowing costs have risen at the fastest pace in decades over the last year as the Federal Reserve lifted U.S. rates by 450 basis points from near zero, while the European Central Bank hiked the euro zone's by 300 bps.

Other parts of Europe and many developing economies have done even more. There are concerns, however, that price inflation is staying high, something that would drive further rate hikes.

Neil Wilson, Chief Market Analyst at Markets.com, said that the SVB episode could be the "straw that breaks the camel's back" for banks after worries about ever higher interest rates and a fragile U.S. economy.

"It is leverage in the system that is the problem," said James Athey, investment director at Abrdn. "Monetary policy way too easy for way too long."

The race to raise rates

(Writing By John O'Donnell; Additional reporting by Jo Mason, Marc Jones, Iain Withers and Yoruk Bahceli; Editing by Elisa Martinuzzi and Toby Chopra)

Copyright Thomson Reuters. All rights reserved.