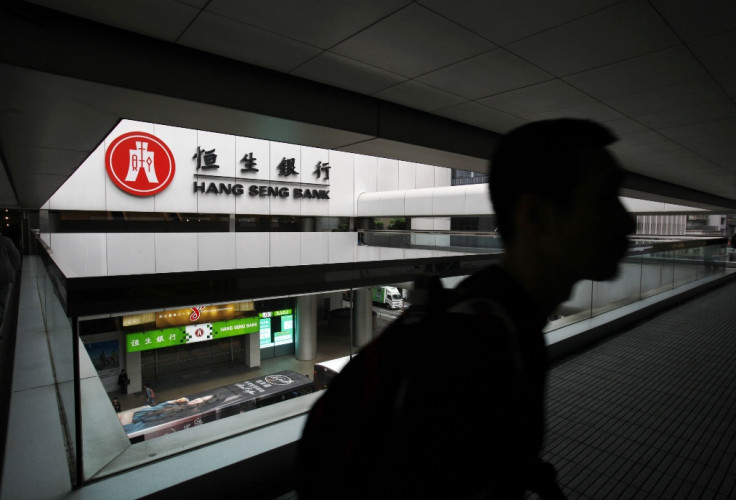

HSBC's Hang Seng to sell stake in Industrial Bank for $2.7bn

Shares in HSBC-subsidiary Hang Seng Bank rose on 13 May on news that Hang Seng will sell a second stake in China's Industrial Bank to boost its capital position and to fund expansion.

Shares in Hang Seng Bank finished 2.91% higher in Hong Kong trade after it announced that it will offload the stake for as much as 16.81bn yuan (£1.73bn, €2.41, $2.71bn).

Hang Seng Bank, 62.14% owned by HSBC, said in a statement late on 12 May that it will sell 950.7 million shares of the Shanghai-traded lender at 17.68 yuan apiece, or a 5.96% discount to the previous close.

Hang Seng added that it will retain 0.88% of the Chinese bank on completion of the deal.

Goldman Sachs Gao Hua Securities and UBS Securities are the joint placing agents.

Hang Seng Bank runs commercial and retail banking business in Hong Kong, mainland China, Macau and in Singapore.

A sharp rise in Hong Kong shares has encouraged some financial investors to cash out their holdings, resulting in a wave of block deals in Hong Kong over the past few weeks, Reuters reported.

The sale of the up to 4.99% stake is the second chunk of Industrial Bank that the Hong Kong-based lender has put on the market this year, after it raised about $2bn in February.

© Copyright IBTimes 2025. All rights reserved.