Investing for the long haul: Be mindful of equity market noise but remember to switch it off occasionally

It seems timely to consider the benefits of investing for the longer term while remaining mindful of market volatility.

Amongst all the noise, it is often difficult to take a step back and consider investment as very much a long-term proposal. On any given day, it would appear that the market has switched from "risk on" to "risk off" and then back again.

The full ramifications of Brexit have yet to emerge, the US presidential elections are causing concern given the perception of two unlikely candidates, and the Chinese economy continues to confound.

Meanwhile, the extraordinary stimulus programmes undertaken by most developed Central Banks have yet to prove their worth conclusively as global growth remains sluggish, there are pockets of the Eurozone where unemployment (and youth unemployment in particular) shows little signs of improving and the whipsawing of commodity prices (especially oil) add to the confusion.

The weakness of sterling has been positive for the FTSE 100, where the majority of constituents have overseas earnings, the quality of which has therefore improved virtually overnight.

Set against this background (and despite the lack of yield elsewhere), professional investors and companies have been unwilling to commit capital wholesale either into the market or indeed into their own businesses.

Perhaps not surprisingly, therefore, individual investors are also faced with the conundrum of when – or whether – to invest.

There are a number of crucial considerations to this end, not least of which are the individual's attitude to risk, income or capital growth requirements and investment time frames.

In future columns we will look at the former in more detail, but it seems timely now to consider the benefits of investing for the longer term.

An early quote attributed to the newspaper editor Arthur Brisbane, speaking to the Syracuse Advertising Men's Club in 1911, was "Use a picture. It's worth a thousand words."

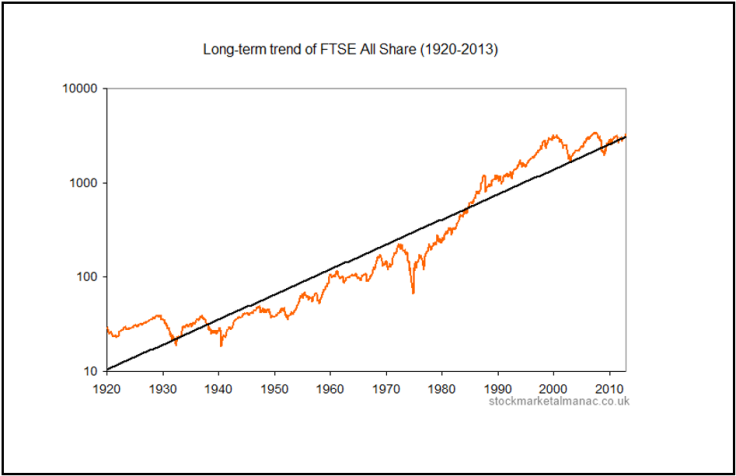

The following graph tracks the FTSE All Share from 1920 to 2013 and fits that bill.

(Source: Stock Market Almanac)

The trend over the long-term is self-evident, but it requires close examination to pick out some of the major investment milestones over the years.

Between 1973 and 1974, for example, was one of the weakest periods in global stock market history due, inter alia, to the collapse of Bretton Woods, the US dollar devaluation after the Watergate affair and an oil crisis, all of which led to an unsurprising recession.

The effect of that time on the graph is evident, but was soon repaired.

Meanwhile, the great Stock Market Crash of 1987, the "dot com" boom and (bust) around the turn of the century and more recently the financial crisis of 2008/09 are, in the overall scheme of things, inconvenient truths rather than lasting disasters.

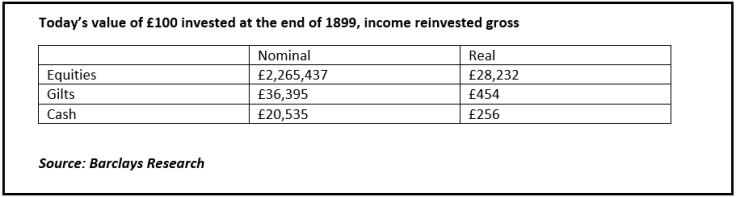

This is quite apart from considering what Einstein described as the "eighth wonder of the world", namely compound interest. The industry's central document for proof of the strength of this phenomenon is the Barclays Equity Gilt Study, published on an annual basis.

The latest study notes that "One hundred pounds invested in equities at the end of 1899 would be worth just £184 in real terms without the reinvestment of dividend income, but with reinvestment, the portfolio would have grown to £28,232."

In nominal terms, the return is exponential. In tabular form:

As investors, we cannot ignore the daily noise and nor indeed should we. It is, after all, necessary in identifying current trends affecting companies, sectors, economies and of course markets.

By the same token, invested in the right companies with a long-term horizon, the outcome can be measured and shown as fact.

This psychological detachment is a helpful part of the investor's armoury. Detecting the "right" companies as part of this strategy will be the basis of future columns. In the meantime, be mindful of the noise but also remain able to switch it off occasionally.

Richard Hunter is the Head of Research and investment committee member at Wilson King Investment Management . The former Hargreaves Lansdown, Natwest Stockbrokers and Fyshe Horton Finney industry veteran is a Fellow of the Chartered Institute for Securities & Investment (FCSI) with over 30 years of stock market experience.

© Copyright IBTimes 2025. All rights reserved.