Iris Energy Faces Outrage As JPMorgan Slaps Stock With 'Underweight' Tag

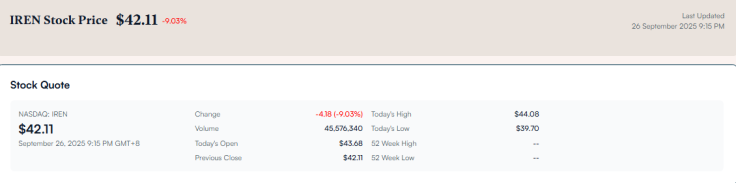

Shares in bitcoin mining and data centre operator Iris Energy (now IREN) slumped after Wall Street giant JPMorgan stripped the high-flying stock of its buy rating, warning investors that lofty valuations have run too far ahead of the company's ability to deliver on its artificial intelligence ambitions.

The downgrade arrives as IREN, formerly known as Iris Energy before its rebrand, trades at multiples that analyst Reginald Smith says simply can't be justified without either a blockbuster computing contract or bitcoin prices shooting significantly higher from current levels.

JPMorgan Pulls the Plug on IREN Bull Case

JPMorgan Chase, one of Wall Street's most influential investment banks, shifted IREN from Overweight to Neutral in July 2025, simultaneously raising its price target to $16 from $12, a move traders refer to as a classic 'downgrade with a raised target' - essentially telling investors that the easy money has already been made.

Smith's research note, which immediately rattled markets, pointed to fundamental concerns about the NASDAQ-listed company's stretched revenue and EBITDA multiples. The timing proved particularly painful for bulls who'd ridden IREN's spectacular 2025 rally, with the stock outperforming both bitcoin and rival miners by wide margins.

The analyst acknowledged IREN's competitive advantages - renewable power agreements, efficient mining operations, and genuine potential in GPU-powered computing. But here's the rub: converting that potential into actual revenue remains frustratingly uncertain, especially as competition intensifies for data centre capacity.

Why Wall Street's Growing Sceptical of IREN's AI Pivot

The core issue troubling JPMorgan isn't IREN's bitcoin mining prowess but rather its ambitious leap into high-performance computing (HPC). The company's betting big on GPU infrastructure to capture artificial intelligence workloads, yet concrete contracts remain elusive.

Market reaction proved swift and brutal. IREN shares tumbled in premarket trading, with some reports suggesting declines of around 7 per cent, although figures varied across trading platforms. The selloff reflected immediate investor anxiety about whether the company can justify its premium valuation without tangible AI revenue.

What makes this particularly significant is JPMorgan's earlier optimism. The bank had previously championed IREN's story, making this reversal all the more striking for institutional investors who closely follow the firm's recommendations.

Valuation Concerns Trump Growth Story for Bitcoin Miners

IREN's predicament highlights broader tensions that are gripping the cryptocurrency mining sector. Companies that once focused solely on bitcoin production are now scrambling to diversify into AI and cloud computing, chasing higher margins and more stable revenue streams.

The maths behind JPMorgan's caution seems straightforward. At current multiples, IREN needs to either secure a massive HPC contract—the kind that would validate its infrastructure investments—or benefit from bitcoin prices climbing substantially above today's levels. Neither outcome appears imminent enough to satisfy Smith's team.

Other analysts haven't entirely abandoned ship. Cantor Fitzgerald reportedly maintains a more constructive view, citing IREN's low-cost mining advantage and AI investment potential, though specific price targets remain disputed across different sources. This divergence underscores how polarising IREN's valuation has become among professional investors.

What IREN Investors Should Watch Next

The path forward for IREN hinges on execution across multiple fronts. Management must demonstrate that they can successfully navigate power costs, which remain the lifeblood of profitable mining operations, while simultaneously expanding their GPU infrastructure without overspending.

Regulatory risks loom large, too. Bitcoin mining is facing increasing scrutiny over its energy consumption, particularly in jurisdictions that are pushing aggressive climate targets. IREN's renewable energy contracts provide some insulation, but they're not bulletproof against shifting political winds.

Perhaps most critically, the company needs to prove its HPC strategy isn't just expensive wishful thinking. Landing even one significant AI customer would dramatically shift the narrative and potentially vindicate the bulls who see IREN as more than just another bitcoin miner.

The Bottom Line on IREN's Downgrade

JPMorgan's downgrade serves as a sobering reminder that even the hottest stocks eventually face valuation reality checks. For IREN, the honeymoon period of pure potential has ended. Investors now demand proof that this bitcoin miner can successfully transform into a diversified digital infrastructure player.

The clock's ticking for management to deliver tangible results. If they succeed in securing major HPC contracts whilst maintaining mining efficiency, today's sceptics might look premature. But if execution stumbles or bitcoin prices crater, JPMorgan's caution could prove prescient, with other banks potentially following suit with their own downgrades.

For now, IREN finds itself at a crossroads where promise must quickly be converted into performance. In a sector often intoxicated by potential, JPMorgan just called time at the bar.

© Copyright IBTimes 2025. All rights reserved.