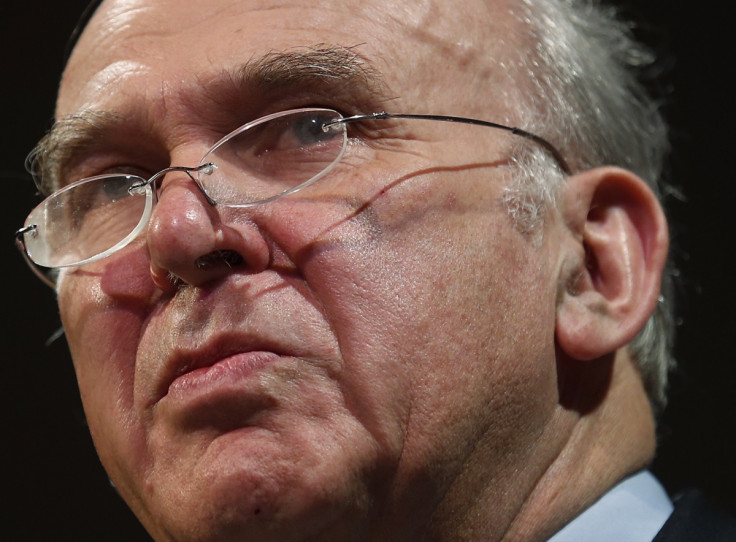

Vince Cable: Lax UK Mortgage Market Risks 'Destabilising Whole UK Economy'

Vince Cable is urging the Bank of England to take action in the booming housing market by curbing the loan-to-income ratio on mortgage lending and prevent it from "destabilising the whole economy".

The UK business secretary said he is "appalled" to hear that some banks are lending out as much as five times an applicant's income and that a 3.5 multiple is much healthier.

House prices are rocketing in the UK, with the Office for National Statistics (ONS) saying the average price hit £252,000 in March 2014, an 8% increase on the year.

But Cable said many parts of the UK are still recovering and there are stark regional differences. The problem is in London and south England, said the Liberal Democrat. ONS data shows the average price of a London property is £459,000 after rising 17% in a single year.

"Clearly the long-term solution is to have lots more houses and government's doing a lot to revive supply – helping builders move finance, freeing up public sector land, freeing up the planning system," Cable told BBC Radio 4's Today programme.

"All those things are crucially important, but in the short run the immediate problem is to stop this boom getting out of control."

He added that it is "crucially important that the banks don't throw petrol on the fire" by dishing out risky loans that are a high multiple of the applicant's income.

"They've already reined it back on the advice of the Bank of England, but this is I think the key area that the Bank of England has now got to operate in to make sure that this boom in house prices, particularly in the south of England, doesn't destabilise the whole economy," Cable said.

Restricting the loan-to-income multiple is one of the suggestions to the Bank of England of the International Monetary Fund (IMF), which has warned on the state of the UK housing market.

The Bank of England has said it stands ready to use its broad regulatory powers to restrict the mortgage market if it thinks there is a risk of a bubble.

Some lenders have already self-imposed caps. Both the Royal Bank of Scotland (RBS) and Lloyds Banking Group will only lend out four times a person's income on mortgages worth over £500,000.

And the Financial Conduct Authority (FCA) is making lenders conduct stricter affordability tests on borrowers to make sure they can afford to make repayments in a number of different situations, such as a hike in interest rates by the Bank of England.

It is the Bank of England's record-low base rate of 0.5% that is one of the concerns surrounding the housing market.

This has made mortgages cheaper and easier to get hold of. But when the central bank lifts interest rates, which is likely to happen in 2015, there is the threat that those who stretched themselves financially to take on a mortgage could default because of higher repayments.

© Copyright IBTimes 2025. All rights reserved.