London house prices set for shock fall in 2017 and slowdown will spread across UK

Knight Frank says London will be the only region of the UK to see house prices fall in 2017.

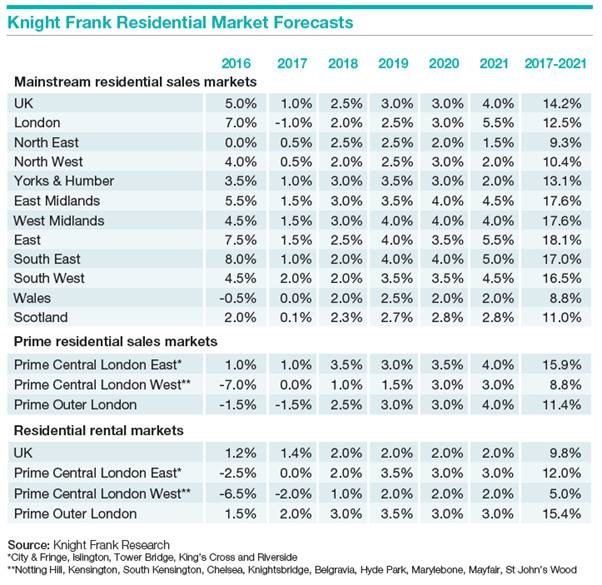

House prices in London will fall by an average of 1% in 2017, according to a forecast by the estate agent Knight Frank, the only region of the UK to see a drop. It will follow 7% house price growth in the city during 2016.

The south-west will be the fastest-growing region, recording 2% growth, down from 4.5% this year. House prices are predicted to rise by 1% in 2017 on average for the UK as a whole, a marked slowdown from the 5% growth in 2016.

"Looking into next year we believe that the slowdown in prices which has been evident in central London over the past 12-months will spread to the wider region, with Greater London prices down marginally in 2017," said the forecast.

"This slowdown in the capital will likely be experienced across the rest of the country with price growth down notably on 2016 levels.

"The main drivers for weaker market performance relate to economic uncertainty surrounding the Brexit process, which we believe will impact negatively on consumer confidence in the run up to and just after the serving of the formal 'notice to quit' the EU. In addition, the impact of reforms to the taxation of landlords will reduce demand from investors which will limit upwards pressure on prices."

But Knight Frank said house prices would be underpinned, despite Brexit, by an ongoing undersupply of homes and ultra-low mortgage rates. Further ahead than 2017, these factors will help support greater price growth. London will pick up again to a 2% rise in house prices in 2018, driven by a recovery in the city's prime property markets, helping lift the wider UK to 2% growth.

The London market has been hit by a series of tax hikes on expensive and investor homes, starting at the end of 2014 with higher stamp duty on homes worth over £1m.

© Copyright IBTimes 2025. All rights reserved.