Love All, Trust a Few: Can companies have analysis without analysts in a Mifid II world?

The EU's revamped Markets in Financial Instruments Directive on brokerage commissions brings with it a new system, reducing access to, and distribution of, company research.

The EU's revamped Markets in Financial Instruments Directive on brokerage commissions – or Mifid II, as we know it – brings with it a new system, reducing access to, and distribution of, company research. The previously free-flowing exchange of analyst research will now be much more constricted, meaning an altered chain of communication between companies, the sell-side and the market. How companies articulate their equity story and the practical mechanics of the company-analyst relationship will be more important than ever.

As corporate managements look to settle into a new state of play, it might well be useful to think about some of the points below.

Companies and analysts – a mutually beneficial relationship

For some 30 years, sell-side research was provided free of charge to institutional investors, largely irrespective of their size and with few limitations on scope. Due to wide distribution, the research trickled down to retail investors, communications advisers, journalists and others interested in the company story, providing a ready source of analysis and a plurality of opinion from a third-party source. Subsequently, analysts have come to have increasing influence on the covered company's management decisions.

As such, for those listed companies that fall outside the large and well-recognized names, sell-side research produced and distributed by investment banks and brokers has proved one of the most effective channels of communication with investors.

While not perfect, and arguably not always entirely independent during IPO or debt offerings, sell-side research is self-consciously based on sound economic analysis and specifically aims at impartiality, interpreting the company's results relative to competitors, its market and the macro economic situation in general. It often points to those footnotes in the financial reports that a non-expert might miss. With its easy accessibility and wide coverage, sell-side research is a fundamental part of the communication framework for any company. However this system, in Europe at least, is about to face a drastic change...

The advent of Mifid II: less research spending means less sell-side analysis

As part of Mifid II, sell-side research can no longer be bundled into trading commissions, and is to be paid for separately. Any provision of unspecified or free research to asset managers and institutional investors is treated as an "inducement", and is banned as such.

While the impact of the directive is as yet largely unclear, most commentators agree that research spending will significantly decrease, leading to proportionately less coverage. Forecasts on the scale of this dip in research spend vary.

Hardman & Co – the capital markets and consultancy firm – suggests a cut of 75%, whereas a Bloomberg poll of asset managers suggests a decrease of 20-30% in research spend. Capital Access Group, which advises companies on investor engagement, assumes a 55% reduction in budgets. Global business advisory firm FTI Consulting references a 45% fall in research cost.

The reduction in funding for research will inevitably lead to thinner coverage, particularly for less obvious investment cases. Furthermore, the commercial reality of research paid at the point of use by main consumers (asset managers) will also inevitably lead to a much more selective distribution of the research to other users who are not covered by the legislation.

Which companies will be most affected?

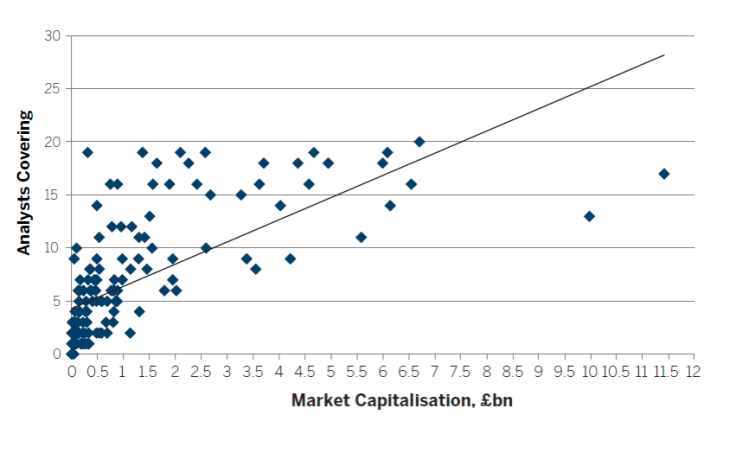

FTI's research provides a solid estimate. The research, led by FTI's Matthew O' Keeffe, has analysed 160 listed firms, plotting market capitalisation against the number of covering analysts. The results are significant – the data shows roughly 60% (90 firms) of the group are under-covered by analysts. Of those, 80 are capitalised under £1bn. Looking at an alternative view, 70 out of 115 companies below £1bn market cap are already inadequately covered by research analysts.

With much of non-sponsored research behind a hefty paywall, many institutional asset managers are likely to boost their in-house research teams, adding capacity to the buy-side research universe. Not only does such a move further restrict the research available to the wider investment community in general, but for companies with lower market cap and higher volatility it presents yet another challenge. A Harvard Business School 2012 study compared sell-side and buy-side investment recommendations. The buy-side analysts endorsed, on average, stocks with roughly half the volatility of those of the sell-side colleagues, with market caps almost seven times larger ($9.1bn vs $1.3bn).

The limitations of buy-side research

Without sell-side analysts, the portfolio managers would simply not see the research published on the less obvious investment opportunities. Buy-side analysis will not replace the lost sell-side capacity for most companies that need coverage.

Mid-caps, emerging markets and newcomers are most affected

For a younger company, or one with operations in emerging markets, and therefore more volatile, restricted sell-side research combined with buy-side tips for larger, more traditional investments poses a simple question: who will recommend them to investors?

And even with a substantially enhanced IR capacity and budgets, the question still remains for IRs and PRs: how do I get credible research on a company in front of an interested institutional manager, or a journalist?

For those companies that cannot find effective channels to engage with the broader investment community, current sentiment points to resulting lower valuations, less liquidity and even higher price volatility. Derrien, who focuses purely on sell-side research, also shows that, on average, the loss of even one analyst reduces the company's investment by 2.4% and leads to a decrease in financing of 2.6% of assets. A lack of sufficient available research to provide substantive analysis to the investment community has the potential for significant consequences.

While companies need to invest in IR and PR capacity....

It is quite clear that for a large section of companies the changes will mean a need for higher levels of direct investor communications and analyst engagement. On one hand, company IR teams will need to be completely aware of which investor a particular analyst is sending research to, whilst at the same time reach those that are not sufficiently covered by available research.

Given that a fund manager is allowed to accept free research from a retained and paid 'house broker', many companies will consider appointing a joint or even triple broker as a way of ensuring substantive research. Sponsored research is likely to steadily grow as both companies and investors are faced with a dearth of available 'independent' research.

.... trust and quality assurance remain key

One consideration, of course, is that self-funded research can be seen by those you're trying to win over as less balanced. Whether paid directly by the company as part of a broking relationship, or through a sponsored research arrangement, paid research involves a close relationship that is simply too close for comfort to be credible. As a result, we could possibly see the market becoming less likely to accept paid research as independent in the foreseeable future.

Companies are not trusted to willingly provide full disclosure when the going gets tough. Debates on executive remuneration, gender pay, tax investigations and patchy governance, have pushed corporate credibility to a low. While many may still see business as more credible than government, it is arguably losing its edge. So, without a verified interlocutor looking at all those corporate nooks and crannies, companies might want to attempt to structure a platform which can best provide substantive analysis from a trusted source.

An arms-length research platform – a possible answer?

Considering the research and industry commentary we're seeing day-to-day, a possible solution could be for a company, or a group of companies, – via their IR or PR – to establish a research platform in a trust or a non-profit partnership structure. The platform would be controlled by a Board of company representatives and independent directors, and the corporate(s) would have a minority representation. The company would commit itself to fund a research body for a specific, though substantial, amount of time with requisite levels of transparency and integrity in communications, adhering to a publically available set of policies. The platform could then directly employ appropriate research analyst capability, situated in the company's relevant financial centers, and tasked with comparative research. Research would be produced only on the participating companies who agreed to fund the platform.

The platform could then distribute research to all parties and provide a fully transparent set of research documents and tools available, as per the platform policies. Crucially, the platform would categorically not supplant the IR or PR function, rather support and aid the function of a sell-side analyst. A possible answer to the practical application of a paid-for but arms-length research is that Stock Exchanges may support such a platform funded from the fees of their members.

While this still means several moving parts in the exchange of information, ultimately it could be an answer for cleaner, faster access and greater transparency across all entities. This, of course, is just one thought of the many that people are bringing to the table as we continue to grapple with the post Mifid II era still very much in its infancy.

What we do know, however, is that Mifid II, already proving contentious, brings change to the traditional system. Discussing the merits of the regulation is something I'll leave to others. Where the interest sits is in the responses companies will make, and what practical measures they might want to put in place to safeguard their interests for the future...

Viktor Pomichal is Senior Director, FTI Consulting. The views expressed are those of the author and not necessarily the views of FTI Consulting, Inc., its management, its subsidiaries, its affiliates or its other professionals.