Millennial investing: Early bird catches the 'tangible returns' worm

The younger you start investing, the more you are able to reap the rewards of compounding.

Early on in your career it's hard to make ends meet, let alone think about investing. When you are in your thirties, it's a tough ask to think about life when you are 50. But here are three things you should ponder:

(1) Your biggest and best asset is you. Look after yourself and do the best you can in life and your career; salary rises, bonuses and promotions help you increase your wealth.

(2) Enjoy the journey. Often you are in a hurry to achieve and reach the goal of having it all. But there is great pleasure in striving and achieving, and climbing that mountain to success. Don't stress over it – enjoy it. When you reach that dreaded 50-year milestone, you'll have been there and done that, and so striving forward from there is a different game.

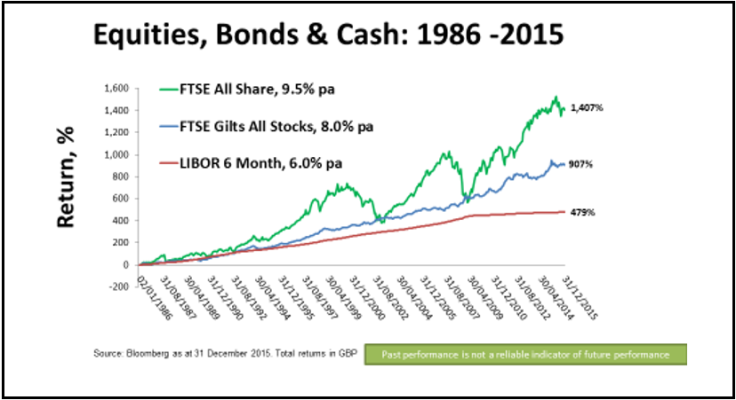

(3) Cash is for rainy day emergencies and for short-term saving objectives. Interest rates are close to zero, so this money won't be working for you at the moment. But there's no need to fret about that. Forces greater than you are bearing down on interest rates at the moment, so you are better off using your time investing in yourself and in the stock market.

You may also want to think about your company's pension fund. If you aren't enrolled, enroll now. There are tax benefits. And if the company offers to put more in if you do too, then do that!

Additionally, invest in a higher risk, mainly equity-based fund. Opt for a multi-asset global fund. This is because you won't be wanting this money till after you are 60 (which might seem like light years away, but comes around faster than you think).

Choosing from a wide variety of investment products can be confusing, that's why financial advice matters in to helping you choose the investment that is right for you based on your appetite for risk. However, it is important that you understand the level of investment risk that funds carry before proceeding.

Regular investing:

- £100 per month for 10 years invested at a modest 5% growth rate should give rise to a savings of £15,500.

- Do this through a tax-efficient wrapper, i.e. an Individual Savings Accounts (ISA).

- Invest in a multi-asset fund, i.e. one that invests globally and one that matches your risk profile.

The biggest piece of advice that I can give you is that once you invest, commit and stay invested!

The stock market doesn't go up in straight lines. It goes up and then down (often just after you invest) then up again. As a human race, we run our lives on our emotions and so too with our investments: we often invest when the market is on a high, and then we lose our nerve when the market falls.

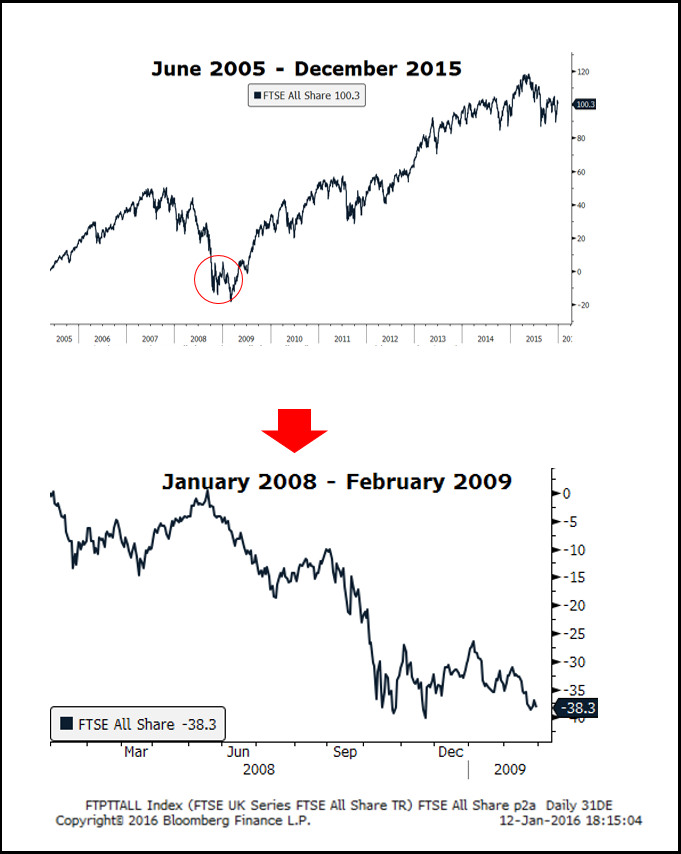

Take 2005 till 2015 – the stock market rose 100% according to the chart below:

In the middle of it we had the Global Financial Crisis and the market fell a hefty 38% in 2008-09. It was tough, and felt as though the world was about to end, but we got through. Those of us who stuck with their investments are now wealthier than those who sold at the bottom. Those who had real nerve and bought at the bottom and added to their investments did even better.

How can I invest and buy a home?

- First consider if buying a home is an investment or a necessity. Often times, your home can become your second biggest asset.

- When we talk to millennials, we learn that investing in a place to live is their highest priority and saving for that deposit is the hardest thing to do. Use what you can – your parents' help, inheritance, bonuses etc.

- Then think cleverly about location; you might have to move out of town, seek out up-and-coming areas and if you are brave, buy something you can renovate to save on costs.

- Think long-term: plan to live there for over ten years, because your upwardly mobile plan may not always go to plan.

- Buy to let is also an option, but only if you have the time for it as tenants can be time consuming. Think about the first tip above - if your talent is best used in your day job then make sure you don't dilute your efforts.

Finally, never forget that you are your biggest asset, so use your talents wisely. The younger you start investing, the more you are able to reap the rewards of compounding and market gains over the longer term. The key is to invest regularly, simply, and non-emotionally, and the time to start is now.

Michelle McGrade is the Chief Investment Officer of TD Direct Investing, the UK brokerage arm of Canada's TD Waterhouse bank. Since the mid-1990s, Michelle has specialised in manager selection and portfolio management, researching managers with different disciplines across the globe. Prior to her role at TD Direct Investing, Michelle worked at both Executive Director and Chief Investment Officer levels at Bank of Bermuda, Coutts, Northern Trust, Investment Solutions and Mediolanum.

© Copyright IBTimes 2025. All rights reserved.