OBR: Half a Century Needed to Bring down Britain's Debts

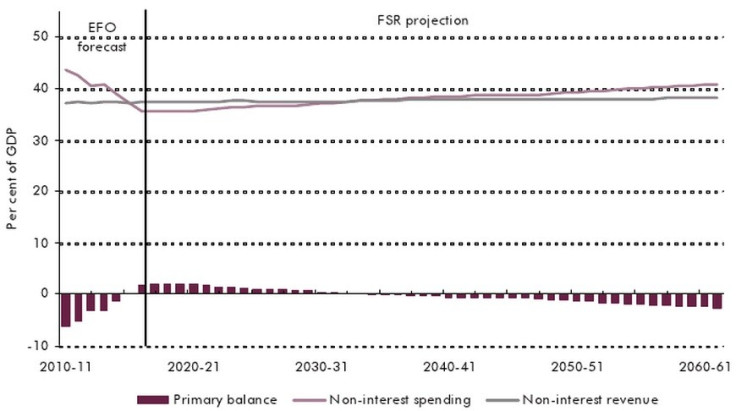

An extra £17bn must be found by the UK government, through spending cuts and increased tax revenues, in order for it to bring debt levels to the same as before the global financial meltdown, according to a report by independent fiscal watchdog the Office for Budget Responsibility (OBR).

Even then, those pre-financial crisis debt levels still would not be reached for another fifty years.

"These calculations depend significantly on the health of the public finances at the end of our medium-term forecast," said the OBR's annual fiscal sustainability report.

The £17bn amounts to 1.1 percent of GDP by today's figures and would have to be cut by 2062 for the economy to return to pre-crisis debt levels.

"Governments need not respond to fiscal pressures with a one-off permanent tightening. As an alternative ... governments could opt for a series of tax increases or spending cuts worth an additional 0.4 per cent of GDP each decade," the OBR report said.

Britain's ageing population will lead to increasing health, social care, and pension costs to the public purse that will reverse the improvement in the structure of government finances over the next five years by as much as half.

OBR projections show that in the medium term, around 2030, Treasury spending will outpace revenues.

"It is clear that the longer-term spending pressures, if unaddressed, would put the public finances on an unsustainable path in our central projection," warns the OBR report, though it adds that there are a number of uncertainties around long-term projections.

Chancellor George Osborne has already shaved billions off of public spending in his government's bid to bring down the budget deficit.

Hundreds of thousands of jobs have been lost in the public sector, as well as some key public services, as the Treasury tightens its belt.

Local authorities have seen around 25 percent of their finances slashed.

Labour, whose 13 years in government saw a significant increase in public spending and the growth of the budget deficit, say the Conservative and Liberal Democrat coalition is cutting "too far, too fast".

The coalition blames Labour's handling of the economy for the reason Britain has to control its deficit, as it tries to keep the markets calm and show fiscal credibility amid economic uncertainty and crisis across the world, most notably in the eurozone.

Gilt yields have hit record lows in recent months. The government maintains that austerity, to appease UK sovereign debt investors, is crucial in keeping Britain's borrowing costs down.

However some point to the £375bn quantitative easing programme by the Bank of England, which sees it buy up gilts in order to improve market liquidity, as the reason yields have been depressed so far.

Britain is in its second recession in four years, as it struggles to recover from the financial crisis.

Dismal growth has led to an increasing number of calls for the government to loosen its fiscal policy and spend more to get the economy moving again, something the coalition has so far refused to do.

© Copyright IBTimes 2025. All rights reserved.