Scotland's Council Tax freeze must have lost its political advantage

Council Tax in Scotland has been frozen since 2007 and currently raises about £1.9 billion in revenue for the Scottish Government each year. As the Scottish Government website explains: "Although the responsibility for setting Council Tax levels rests with local authorities...the Scottish Government has worked with authorities to freeze the Council Tax..."

In much of its literature the Scottish Government makes reference to "working in partnership" with local government but in recent times the central government partner is seen to be levelling a blunderbuss at the heads of the local government associate – some partnership!

For better or worse, former First Minister Alec Salmond, gave a commitment that the 2007 freeze would be extended throughout the life of the 2011 Scottish Parliament, if the Scottish National Party were to be elected with a clear majority, which duly happened.

Councils were to be compensated by a Council Tax Reduction Scheme, for which a total of £343 million has been allotted in Scotland's Budget for 2016 – 2017. Few if any local authorities believe this to be adequate unless they also impose severe cuts in their budgets and "cuts" have become the expected.

The squabbles on the final budget outcomes seem more and longer each occasion these need compiling and the councils put the blame for any closures or cessation of services and accompanying redundancies that result, squarely at the door of Holyrood – a view that appears to be gaining support with many of the public.

Highland Council is a case in point.

The biggest group of councillors in Highland Council, the largest authority in the UK by area, have no political party affiliation and sit as Independents. There are 32 of them (since June 2015) and until relatively recently there would have been many more, for the ways of Scotland's Central Belt where party politics is dominant, have only been slowly creeping north.

The largest party bloc in Highlands is that of the Scottish National Party (SNP) with 20 members, followed by the Liberal Democrats with 12; Labour is a poor fourth with eight and there are eight others of smaller parties.

Independents don't vote as a group and after an acrimonious four-hour Council session, a number of alterations were made to their proposals on where spending cuts would fall. The outcome was much more in line with SNP policies, the group with the central government to back them, and a rise in the Council Tax was dropped.

On 25 February 2016, the Independent administration swallowed, or more likely choked down, £29 million savings "...imposing the worst level of cuts on the Highlands since World War II", as one newspaper commented. If the Council had increased the Council Tax, Holyrood's SNP Finance Secretary, John Swinney would simply have applied his threat and withdrawn central government funds of about 18 million. Mr. Swinney's threat hovered over all of Scotland's local authorities.

Like other councils in Scotland, the size of the cutback was much worse than expected and threw all former planned "savings", into the waste paper bin. Further, not all measures to effect economies met with SNP approval. One such was Highland's previously mooted £1 million reduction in Women's Aid, children's charities, street cleaning and suicide prevention which was struck down during that four-hour session which had "descended into a farce".

The SNP would obviously be anxious to avert any potential for bad coverage on such emotive sectors with a Scottish General Election due on 05 May. Hardly good for a party which does its best to remain populist.

Twenty-nine million pounds loss is a severe one to contend with – the gross shortfall was £39 million – and instead of a Christmas card, on 17 December, all Council staff, including teachers, received an email urging them to consider voluntary redundancy or reduced hours packages. About 400 Council jobs are expected to go and "some" secondary school posts including teacher training. Another measure considered was "using fewer meat products in school meals".

Highland's total Revenue Budget for 2015 – 2016 was £571 million of which the Council Tax (Band D charge £1,163) raised £114 million and £457 million, 80 per cent, came from the Scottish Government.

Conservative MSP Mary Scanlon, whilst deploring the cuts, questioned whether there should be so many council directors on salaries exceeding £100,000 and told the Inverness Courier on 21 February:

"These are essential public services being cut. I don't see enough being done to restructure the management of Highland Council, yet we are talking about our pupils being given lentils instead of meat in their lunches to save money."

Ms Scanlon could have added whether an authority with only some 235,000 needs 80 elected councilors, one for less than 3,000 people?

Highland Finance Director, Derek Yule, has said that 37 senior management posts are to go across all service sectors, and Council Leader, Margaret Davidson, emphasized that the cuts were being imposed because the Scottish Government had insisted on the Council Tax freeze – for the ninth year in succession – adding that it was destroying the "really good" relationship between local and central government.

A spokesman for the Scottish Government insisted that the deal that had been struck with local authorities had been a fair one:

"We recognize the pressure on budgets across the whole of the public sector, which is why it is important to maintain the Council Tax freeze."

Come again!!??

"We are considering ways to replace it (Council Tax) as well as reimburse local authorities to ensure they continue to provide essential services."

No-one should hold their breath on that consideration as the SNP said that they would abolish the "hated" Council Tax, even before they froze it the first time!

Other council areas could have been chosen, similar problems abound. Highland, however, does face having to deliver services over a huge area of 11,000 square miles – bigger than Wales – of often beautiful but rugged terrain and comparatively long distances between communities.

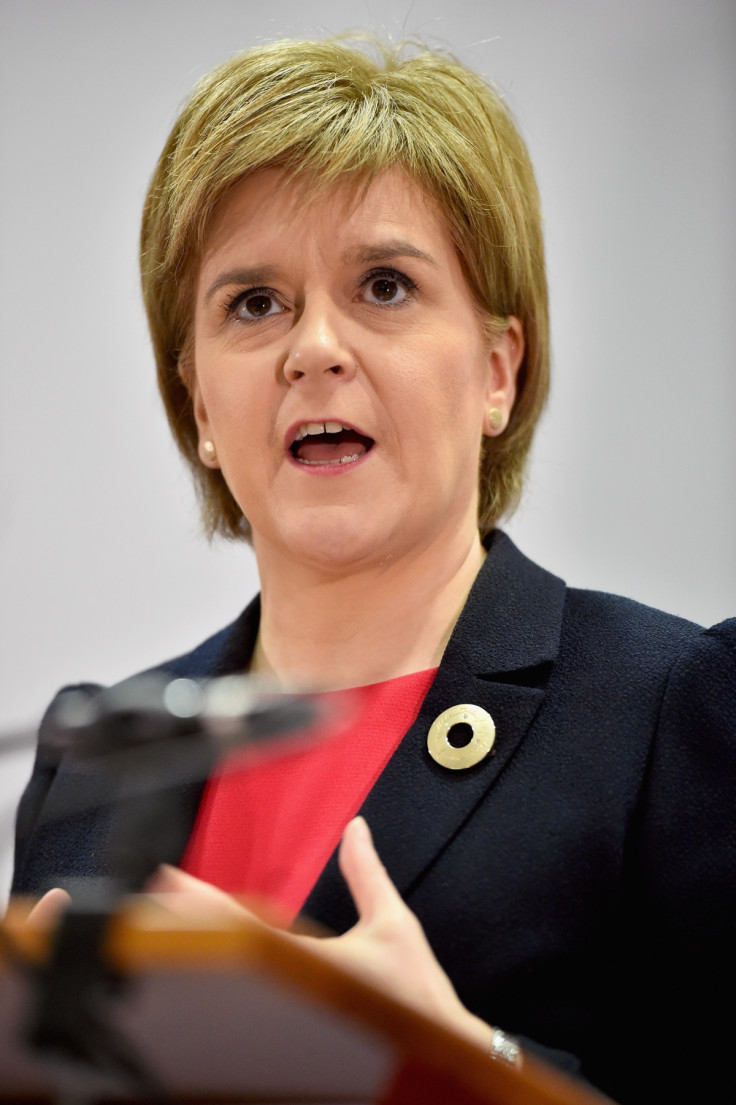

Yet maybe, First Minister Nicola Sturgeon has come to accept that the continuation of the freeze is no longer a political winner for on 02 March she announced it would end and a reformed Council Tax would start in April 2017.

Barely had she finished outlining the proposals – Councils able to raise the tax by three per cent a year and increases in Bands E to H with the extra being ring fenced for Education – when the slating started so that by 06 March the SNP Local Government Minister Marco Biagi, challenged the other parties to come up with constructive proposals.

The Green's Andy Wightman made the best reply if only for encapsulating the purpose of having local government in the first place and proposed its replacement with a local tax system because only this would "give councils the freedom to make their own choices on how they invest in public services, and the ability to raise the finance they need."

© Copyright IBTimes 2025. All rights reserved.