Scottish Independence: BoE Warns RBS HQ to Move and 'Volatile' Scottish Economy Responsible for Own Bank Bailouts

Bank of England governor Mark Carney has warned lawmakers that if Scotland decides to leave Britain it will be responsible for bank deposit guarantees and emergency funds if financial institutions remain headquartered in the country.

Speaking at a Treasury Select Committee hearing, Carney said it is also likely that the Royal Bank of Scotland's (RBS) headquarters will have to be moved to London, as European Union law stipulates that the country, which is registered as the firm's HQ, is responsible for common deposit guarantees and bank bailouts.

Britain's business secretary Vince Cable also said over the last two months that it is likely that the RBS's headquarters will move to London permanently, if Scots vote for independence.

"If the circumstances were to come to pass that there were the prospect of a change to the monetary arrangements in the United Kingdom that fell to the wrong side of the risks that were clearly outlined in my speech, we would provide clear and public advice on those," he added.

Meanwhile, Carney also warned politicians that since Scotland's economy is "volatile" and is especially vulnerable to energy price movements, it could spell trouble for the country if it decides to end the 307-year union with England.

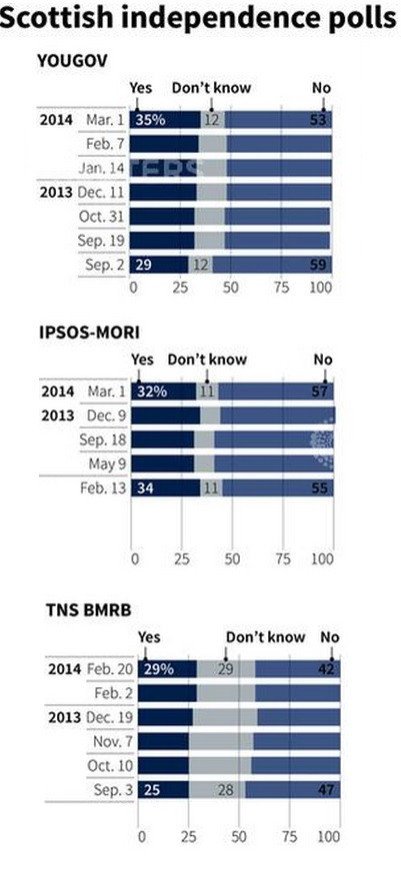

Scottish people will vote in an independence referendum on 18 September this year and will be asked the straight "yes/no" question: "Should Scotland be an independent country?"

However, despite the Scottish National Party (SNP) repeatedly promising voters that most of the financial and regulatory laws will remain the same, UK and European Union politicians have explicitly said that if Scotland breaks away from Britain, it will lose the currency, lose it EU membership, and be forced to create and uphold its own set of laws and watchdogs.

Scotland's financial services accounts for about 150,000 jobs.

Most recently, Alliance Trust revealed in its financial results statement that it has set up a raft of England-based companies in a bid to protect itself against the possibility of Scottish independence.

The Dundee-based investment manager's chief executive officer said in its results statement that it was necessary to start establishing non-Scottish companies as it hedges its bets against Scotland breaking away.

"The referendum in September is creating uncertainty for our customers and our business, which we have a responsibility to address," said Katherine Garrett-Cox.

Garrett-Cox added that the uncertainty over whether Scottish independence would change taxation laws and regulation was a catalyst behind the decision.

At the end of February, insurance firm Standard Life said that it may quit its Scottish home if the nation breaks from the United Kingdom in its referendum on independence in September 2014.

"We have been based in Scotland for 189 years and we are very proud of our heritage. Scotland has been a good place from which to run our business and to compete around the world," said Gerry Grimstone, chairman of Standard Life, in the Edinburgh-based insurer's annual report for 2013.

"We very much hope that this can continue. But if anything were to threaten this, we will take whatever action we consider necessary - including transferring parts of our operations from Scotland - in order to ensure continuity and to protect the interests of our stakeholders.

"We will continue to seek further clarity from politicians on both sides of the debate, so that we can reach an informed view on what constitutional change may mean for our customers, our business and our shareholders."

© Copyright IBTimes 2025. All rights reserved.