Tax credits debate as it happened: Heidi Allen attacks cuts in barnstorming maiden speech

Labour will hope to widen rifts within the Conservative Party when they lead a debate on George Osborne's proposal to slash tax credits in the House of Commons on 20 October. The Opposition Day Debate comes as the chancellor faces more resistance from within his own ranks over the controversial plan.

Former shadow home secretary David Davis and Stephen McPartland are the only Conservative MPs to vote against the measures so far. But grumblings against the reform, which will see the tax credits earnings level slashed from £6,420 ($9,946) to £3,850 in April 2016, have grown.

The discontent comes after the independent Institute for Fiscal Studies (IFS) argued that Osborne's new National Living Wage, which will rise to £9 an hour by 2020, will still leave low paid workers short, despite ministers' claims that it would make up for the tax credit cuts.

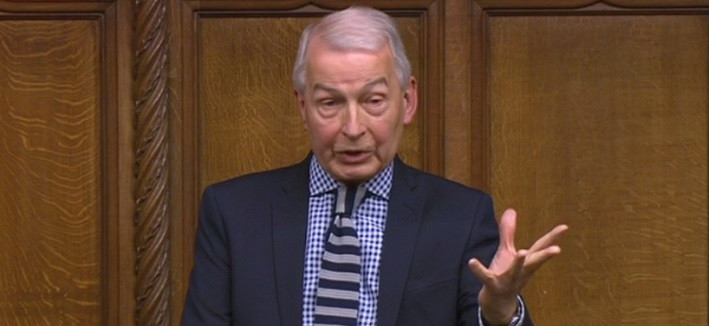

Elsewhere, Labour's shadow chancellor John McDonnell has promised to reverse the Osborne's move. However, momentum is building around Labour backbencher Frank Field's proposal to "tweak" Osborne's plan. The Work and Pensions Committee chair wants to introduce a second earnings threshold for people earning £13,100 or less.

But the "cost neutral" plan would require the government to hike the rate at which tax credits are clawed back by those with an annual income of more than £13,100.

Meanwhile, Osborne has gone on the offensive and the Treasury has claimed the tax cuts will save £15bn a year. The projection, which includes the chancellor's reforms since 2010, also shows that spending on tax credits is expected to drop from £40bn in 2016/17 to £25.3bn.

Ken Clarke gave way to Frank Field, who chairs the work and pensions select committee. The Labour MP for Birkenhead said he spoke about the need for deficit reduction before and was not coming to the debate as a "Johnny come lately". He said the reforms would harm those who earn the "fraction" of MPs' salaries.

Cutting tax credits would be a "huge mistake", according to the Adam Smith Institute. The think-tank argues the National Living Wage will fail to offset cuts in the benefit and will "add insult to injury" by pricing workers out the labour market.

"Working tax credits are the best form of welfare we have, and cutting them would be a huge mistake. The government has long claimed to want to make work pay for everyone, but cutting tax credits would disincentivise work and hurt those at the bottom of society," deputy director Sam Bowman said.

"Contrary to the government's claims, the National Living Wage will do little to help those affected by these cuts and, according to the Office for Budget Responsibility, it risks adding insult to injury by pricing tens of thousands of workers out of the labour market altogether.

"There is little evidence that tax credits 'subsidise' employers, except to the extent that they make more people willing to work in the first place, creating a larger pool of workers. The politics of this looks dangerous, too: when it's working families at the bottom of the income distribution that are being hit hardest, it's hard to say that we are 'all in this together'."

Tory grandee Ken Clarke has used his speech as an opportunity to give Labour a bit of a kicking. He reminded the opposition that "Labour had still not woken up to the fact it was not credible on the economy" and had an "uncertain collection of rather populist proposals that did not add up."

The former Chancellor also stuck the boot into the SNP, saying its MPs were using the debate to gives a "harrowing description" of consequences that were a "deliberate attack on the poor."

"Fortunately I see no prospect of the SNP, no matter how successful electorally, getting a UK majority," he quipped.

On the cuts to tax credits he said always thought they were "one of the most flawed innovations that was brought into our system" and while it might have had some "worthy intention" it was done for political reasons.

Heidi Allen has been lauded this afternoon for her maiden speech in the House of Commons. The Conservative's South Cambridgeshire MP was part this year's new intake and used her first speech in the house to say she we are talking about real people.

Allen, who said too any people would be adversely affected by the changes, started by saying she had been "trying flipping hard to avoid doing it [her maiden speech]" but that she could "sit on my hands no longer."

Listen to her frank and often barnstorming speech below:

With 30 minutes until the MPs debate tax credit reforms in the House of Commons, Labour's Frank Field, chairman of the Work and Pensions Select Committee, has written at Labour List how changes to the tax credit system alone will not "cover the shortfall in the poorest workers' budgets that is being opened up by the cuts to tax credits."

He adds that while Labour will attempt to shoot down the reforms, "we know deep down that the motion will be voted down by Tory MPs".

During the same interview, Owen Smith, Labour's shadow work and pensions secretary, described the reforms as "absolute smoke and mirrors" as only 25% of people who have their tax credit cut were on the National Living Wage.

"It is a tax on working people, it is a tax on working mothers: seventy per cent of the cuts will fall upon them," he said.

Conservative MP for Stevenage Stephen McPartland has told Daily Politics that David Cameron and George Osborne should have raised the issue of tax credit cuts before the general election.

"For me I was not aware there was going to be an issue with tax credits. We knew there was going to be savings to welfare we did not now how they were going to be. For me it is about mitigating the impact of these cuts and there is nobody saying we should not reform tax credits. I think all parties agree we have got to reform tax credits but the issue is actually mitigating it so that these people who are on the lowest incomes do not receive these huge reductions."

Away from this afternoon's debate, reporter Ian Silvera is at the Mall awaiting the motorcade of China's President Xi Jinping as he begins his four-day state visit to the UK. His trip is expected to herald £30bn of inward investment in British industry but first up he will be greeted by the Queen and Duke of Edinburgh before a welcoming ceremony at Horse Guards Parade.

Conservative MP for North Dorset Simon Hoare has written to his constituents saying he will back the government, adding "I must confess to never having been a fan of tax credits."

Hoare says the "strange set up" will be mitigated by companies like "Lidl and Asda" who plan to start paying employees a living wage.

Labour's Louise Haigh hits back at the Tories

Tax credits, Europe division, steel and solar industries in free fall, jnr Drs, splits on spending cuts. And Labour is 'calamitous'.

— Louise Haigh MP (@LouHaigh) October 20, 2015

© Copyright IBTimes 2025. All rights reserved.