Trump promised the rich would pay their fair share – but his tax plan would make them much wealthier

US president-elect says plan targets middle and low earners, but analysis shows richest would benefit most.

It is on a stairway made by the backs of working and middle-class swing voters that Donald Trump will ascend to the White House as the 45th president of the United States of America. No longer will they be forgotten or left behind by Washington, Trump reassured them during his campaign, as he railed against the crony capitalism of yesterday's elite.

"I am proposing an across-the-board income-tax reduction, especially for middle-income Americans," Trump, a billionaire businessman and reality TV star, said in a speech at the Detroit Economic Club. And at the New York Economic Club, Trump claimed "the tax relief will be concentrated on the working and middle-class taxpayer. They will receive the biggest benefit – it won't even be close."

But the details of the Republican's vastly expensive plan for multiple tax cuts for individuals and businesses – worth trillions of dollars – suggest he will spend more time remembering his rich friends and associates than the low-earning voters who made him their president.

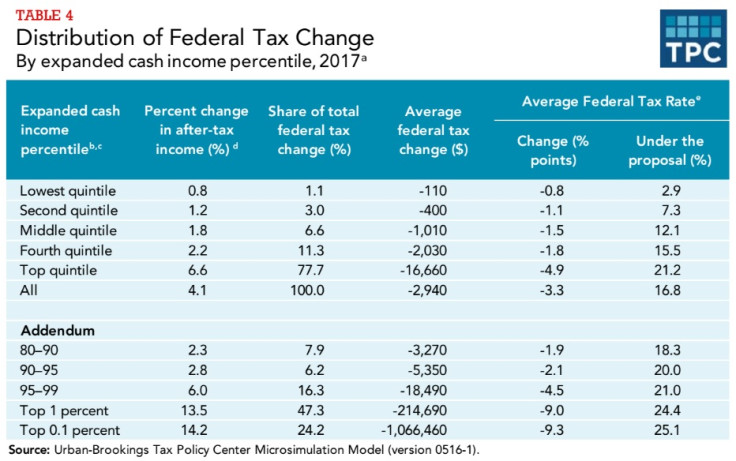

"His proposal would cut taxes at all income levels, although the largest benefits, in dollar and percentage terms, would go to the highest-income households," claims a comprehensive analysis of the impact of Trump's ambitious tax plan by the Tax Policy Center, a thinktank backed by the Urban Institute and Brookings Institution.

"Federal revenues would fall by $6.2tn (£5bn, €5.8bn) over the first decade before accounting for added interest costs and macroeconomic effects. Including those factors, the federal debt would rise by at least $7tn over the first decade and by at least $20.7tn by 2036."

The Center's distributional analysis of Trump's tax plan – how it would affect the different income groups – is revealing. The plan would cut the average American's tax bill in 2017 by $2,940, increasing after-tax income by 4.1%. But the highest-income taxpayers – the top 0.1% of the population whose income is over $3.7m a year – would enjoy an average tax cut of almost $1.1m. That is equivalent to 14.2% of their after-tax income, vastly higher than the average American.

So what about Middle America? Households in the middle fifth of the income distribution would receive an average tax cut of $1,010, or 1.8% of after-tax income, says the analysis. And the poorest? The bottom fifth of households would see their taxes go down an average of $110, or 0.8% of their after-tax income. So the wealthiest Americans will be much better off than the average, and society's poorest will significantly underperform in Trump's tax cuts.

Trump argues his tax cuts for businesses and individuals would create two million extra jobs for Americans and put more money back in everyone's pockets, powering economic growth and the revitalisation of communities that have lost out because of the globalisation agenda. Moreover, he says he would lift millions of the poorest Americans out of tax altogether by raising the income threshold at which they must start paying.

But the Tax Policy Center's analysis said that the resulting fall in federal revenues would be so large, serious spending cuts would be needed to close the deficit and balance the budget. What's more, the deficit would grow to such an extent that any potential economic gains from Trump's tax cuts could be cancelled out by the interest on the US government's ever-growing debt pile. The analysis suggests GDP "would be smaller than it would be otherwise because growing budget deficits would push up interest rates and crowd out investment".

"These estimates are sensitive to assumptions about how savings, investment, and labour supply would respond to policy changes such as the Trump plan, so the effects on GDP could be larger or smaller in both the short and the long run," says the analysis. "Trump, however, promises unspecified spending cuts and also argues that other elements of his economic plan would boost tax revenues, which could negate some or all of the negative effects of rising deficits."

It isn't only the Tax Policy Center which comes to similar conclusions. The Tax Foundation thinktank, cited favourably by the Trump campaign website, said the plan: "would significantly reduce the cost of capital and reduce the marginal tax rate on labour. These changes in the incentives to work and invest would increase the US economy's size in the long run, boost wages, and result in more full-time equivalent jobs."

But it also said that "on a static basis, the plan would reduce federal revenue by between $4.4tn and $5.9tn, depending on policy assumptions about business tax rates. However, due to the larger economy and the significantly broader tax base, the plan would reduce revenue by between $2.6tn and $3.9tn over the next decade, depending on those same policy assumptions. In all cases, it would increase after-tax incomes for all income groups, but reduce revenue to the Treasury."

And the Foundation's distributional analysis shows that the top 1% of income groups would receive an after-tax boost to their incomes of between 10.2% and 16%. But the average American income would only see an uplift of between just 3.1% and 4.3%. The bottom fifth would get a 1.2% income boost, while the middle fifth would enjoy a 1.3% increase. Once again, it is clear that proportionately, the wealthier you are, the better off Trump's tax plan will make you.

"The rich will pay their fair share," Trump told the Detroit Economic Club, "but no one will pay so much that it destroys jobs, or undermines our ability to compete." But under Trump's bumper plan to slash and reform US taxes, assuming he even gets his package through a budget-hawkish Congress, the richest may not end up paying their fair share after all.

© Copyright IBTimes 2025. All rights reserved.