Selling Britain's Soul to China Comes at a Price: Beware of Banking but Welcome FDI

Britain is in dire need of foreign direct investment, in order to bolster energy security and grow various sectors, to usher in a new era of economic growth.

However, while the UK government has made it clear that it intends to sell Britain's soul to China, it could come at a costly price.

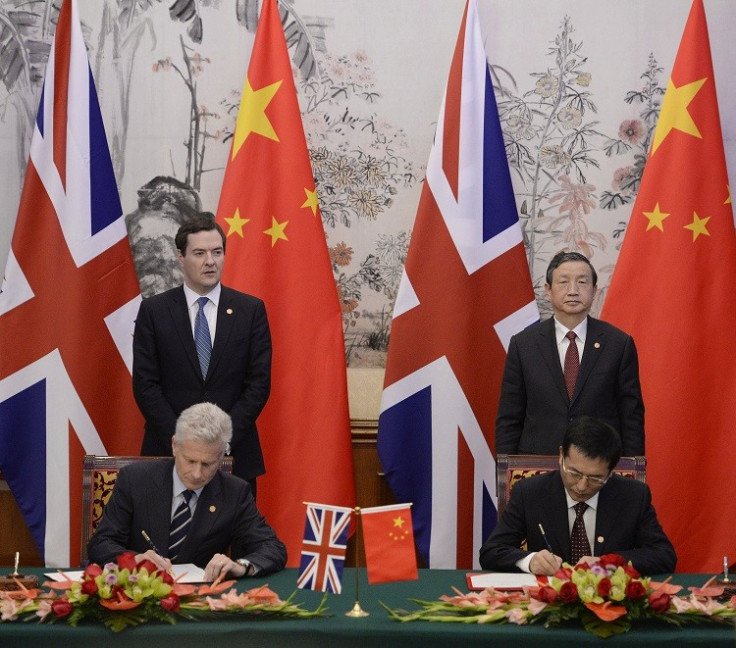

Over the last week, we have seen Prime Minister David Cameron, Chancellor George Osborne and London Mayor Boris Johnson, all unveil various deals with the economic superpower, ranging from major nuclear investments, to relaxing rules for China's banks setting up shop in the UK.

While China may be the saving grace that Britain so desperately needs, to push the economy into a stable pace of growth, there are many looming concerns that could prove expensive and dire if the right safeguards are not put in place.

Beware of Banking

Britain's banking industry is on the cusp of a sea change but without properly preparing for how China-based banks will be supervised and regulated, when they set up shop in the UK, it could undo all the progress that lawmakers have made.

While it is bad enough the the financial crisis of 2008 still reverberates around the globe, the seemingly daily spate of market manipulation and mis-selling scandals only exacerbate the need for a radical overhaul of the industry.

Finally, we seem to be getting there.

The Parliamentary Commission on Banking Standards have filed a blueprint on what we need to do to prevent future financial catastrophes from happening while, of course, how new laws to punish wrong-doers can also act as a deterrent as well deliver a bout of justice.

As part of the UK's trade mission in China, Osborne revealed that Chinese banks will be able to apply for British branches, even if they are headquartered in their country, by cutting red tape and regulatory barriers.

However, if state-owned banks, such as Bank of China and Industrial and Commercial Bank of China (ICBC), were to operate through UK branches, they would be largely subject to Chinese regulation, which notoriously has a lighter touch than Britain's prudential law.

Re-Routed Risk?

While Britain secures its place as the largest western centre for offshore renminbi (RMB) trading, the moniker could come with a risk.

UK regulators are battling to exert greater control over foreign-owned banks, in a bid to strengthen and make the financial system safer, but loopholes could expose Britain to overseas risk.

Osborne revealed that 62% of RMB payments, outside mainland China and Hong Kong, already take place in London and a large proportion of trading is dominated by UK-based banks HSBC and Standard Chartered, through their offices in Hong Kong.

Since there no bank outside Asia that has the clearing authorisation for RMB trades, these transactions have to be routed back to China before completion.

If the UK wants to bolster its risk management, it will have to seal that all important deal to gain authorisation from China.

Stock Market Scandals?

As part of Britain's drive to forge stronger ties with China, it is inevitable that the government will eye changes to stock market listings for Chinese companies.

But Britain can learn from others' mistakes.

Foreign market participants view the domestic stock market as risky and its bond market is seen as underdeveloped compared to the West.

Abroad, the country has been marred by overseas listed stock scandals, over the last few years, which has rocked investor confidence.

In July 2012, a company that has been synomous with China stock scandals, Sino-Forest Corp, said it terminated a proposed asset sale, in favour of a plan that will result in the company's creditors acquiring all of its forestry assets.

In 2011, the company's shares tanked after a short-seller accused it of exaggerating the size of its forestry assets and the forestry group's stock has since been de-listed by the Toronto Stock Exchange.

One of Canada's main securities regulators, the Ontario Securities Commission has since charged the company and some of its former executives with fraud.

If Britain was to open its doors to China company listings, accounting rules and supervision would have to be enforced.

Going Nuclear

Perhaps one of the brightest spots from the UK roadshow in China, is the fact that Osborne gave the green light to Chinese companies taking a stake in the development of the next generation of British nuclear power stations.

The government said that any Chinese investment is likely to be a minority stake but in the future Chinese businesses could hold a majority slice in new power stations.

"[This] is another demonstration of the next big step in the relationship between Britain and China - the world's oldest civil nuclear power and the world's fastest growing civil nuclear power," said Osborne.

"It is an important potential part of the government's plan for developing the next generation of nuclear power in Britain. It means the potential of more investment and jobs in Britain, and lower long-term energy costs for consumers."

Indeed, Britain is in desperate need of strengthening its energy security, which could significantly drive down energy prices.

Nuclear is not only one of the cleanest forms of energy but it also holds the key to cutting household bills.

The UK has one of the worst capacities for gas storage, meaning that Britain has to import a majority of its gas needs from overseas. In August, the government revealed that UK gas imports hit record high of 1 trillion cubic feet in first six months of 2013.

Since 2004, the majority of this supply has come from imports, meaning consumer energy bills, are vulnerable to fluctuations in the international price.

On top of that, Britain's nuclear infrastructure needs requires billions of pounds in investment.

However, if energy companies invest billions of pounds into nuclear power plants, such as RWE npower, uproar over rising prices and lack of corporation tax payments prove to be a political point loss for Britain's coalition party.

But Welcome FDI

Britain has largely thrived and managed to avoid some of the worst economic pitfalls than some other European countries because of its long history in siphoning significant FDI.

For example, Barclays managed to avoid a government bailout after Qatar stumped up billions while other piles of Middle Eastern cash have propped up some of the UK's best known retailers, property groups, and tourist attractions.

Britain still lags behind in sorting out its energy security crisis and allowing Chinese investors to take up some of the slack maybe just what the country needs.

We only need to look at the recent news that Chinese investment in Manchester Airport's new business centre, which is tipped to create as many as 16,000 jobs in the North West of England, can do wonders for the real economy.

Furthermore, relaxing visa requirements for Chinese new students could be a coup for the UK as this demographic provides around quadruple what British nationals provide for the higher education system each year in fees alone.

Overall, we should welcome FDI wil open arms and maximise on the talent China can provide to boost various sectors but we should also tread carefully and put the right safeguards in place to avoid an unmitigated banking system disaster.

© Copyright IBTimes 2025. All rights reserved.