UK Economic Growth Stalls at 0.3% — Tough Choices Loom for November Budget

Current account deficit widens to £28.9bn, equal to 3.8% of GDP

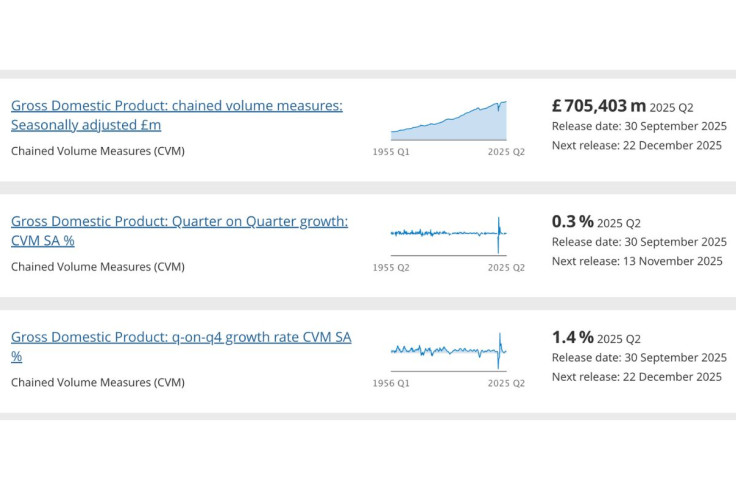

The UK economy grew by just 0.3 per cent in the second quarter of 2025, according to revised figures from the Office for National Statistics (ONS). The estimate, unchanged from the initial reading, marks a slowdown from the 0.7 per cent expansion recorded in the first quarter.

Although weaker than earlier in the year, the figure still placed the UK among the stronger performers in the G7 during the first half of 2025. A rise in exports ahead of United States tariffs helped offset some of the weakness in domestic activity.

The slowdown, however, leaves ministers facing difficult choices as they prepare for the November Budget. With household spending subdued and consumer-facing services in decline, questions remain over how the government will balance growth, borrowing and inflation.

Trade and External Balances

The latest ONS release also showed the UK's current account deficit widening sharply to £28.9 billion in the second quarter, equivalent to 3.8 per cent of GDP. Economists said the figure underlines long-running imbalances in Britain's trade and investment flows, despite a temporary lift from exports.

Budget Options

The weaker growth outlook poses challenges for Chancellor Rachel Reeves as she drafts the Budget. Sluggish activity makes it less likely that tax revenues will rise strongly on their own, raising doubts over how spending pledges and borrowing will be funded, according to the BBC.

Analysts expect Reeves to face pressure to raise taxes in areas such as national insurance, capital gains or business levies, adding to the £40 billion package introduced in October 2024. Others suggest the government could instead deploy targeted stimulus, with investment in infrastructure, green energy or business incentives. Both approaches carry risks, leaving the Treasury with limited room to manoeuvre.

Risks and Constraints

Several factors complicate the government's decisions. The Bank of England remains alert to inflationary pressures, meaning any large fiscal expansion could clash with tighter monetary policy. Households are also showing caution, with the Financial Times reporting that the savings ratio rose to 10.7 per cent in the second quarter. This suggests stimulus measures may not translate directly into higher spending.

Business confidence has weakened significantly. According to The Guardian, rising costs and uncertainty over future tax policy have left firms reluctant to invest, even if new incentives are introduced. Meanwhile, government debt remains high, and bond markets are expected to scrutinise any signal of fiscal slippage. Additional borrowing or unfunded tax cuts could trigger higher borrowing costs.

Given these pressures, the Office for Budget Responsibility is expected to publish more cautious forecasts ahead of the November statement, including lower assumptions for productivity and growth.

A couple of points to take away from this morning's (mostly) unrevised UK GDP data... 🧵

— Julian Jessop (@julianHjessop) September 30, 2025

1️⃣ Q2's growth of 0.3% was still led by government consumption, which contributed 0.3% points.

In other words, excluding public spending on goods and services, growth was *zero*. pic.twitter.com/T2CfiUYD0j

This is a key point. The tiny amount of growth that is still occuring is solely due to increases in govt. spending that are unsustainable.

— Cut My Tax (@CutMyTaxUK) September 30, 2025

UK socio-economic fundamentals are not dissimilar to trends in rest of G7, but the decisions we have taken since mid 2024 have contributed to this close to zero growth we are are now seeing. NICS being a key driver.

— Jonathon Swaine (@jdswaine) September 30, 2025

Economic Implications

The government has made economic recovery central to its political agenda, but failure to deliver stronger growth risks damaging credibility with both voters and markets. Pressure also continues to mount to maintain funding for public services, particularly the NHS, local government and green infrastructure. These areas remain politically sensitive and resource-intensive.

For Reeves, the challenge is to raise revenue without provoking backlash from households and businesses already under strain. Decisions taken in November will shape the UK's economic outlook for 2026, setting the tone for growth, stability and fiscal responsibility.

The 0.3 per cent growth rate recorded in the second quarter is a reminder of the headwinds facing the economy. The Budget will need to balance the competing demands of stimulus, tax measures and fiscal discipline, all against the backdrop of weak demand, stubborn inflation and fragile confidence.

© Copyright IBTimes 2025. All rights reserved.