UK government to pay off £1.9bn First World War debt

The UK government will repay all of the nation's debt from the First World War, George Osborne is expected to announce.

The Chancellor is also expected to say that the government will adopt a strategy to remove the other remaining undated gilts in the portfolio, where it is deemed value for money to do so.

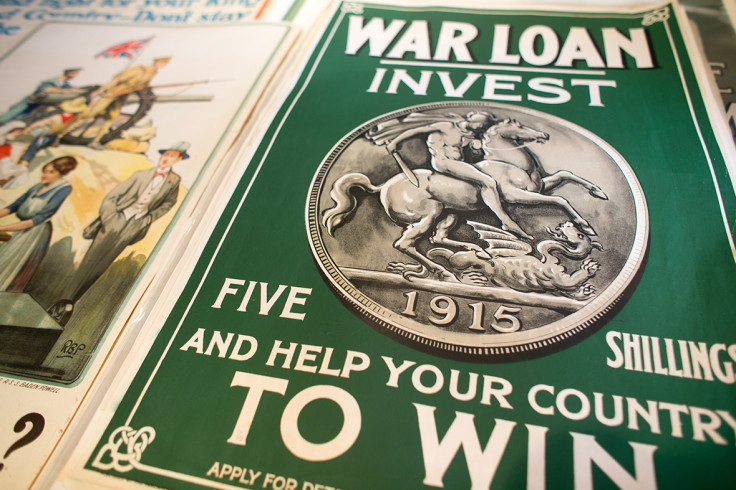

The Treasury will redeem the outstanding £1.9bn ($2.9bn, €2.4bn) of debt from 3½% War Loan on 9 March 2015.

The bond was issued in 1932 as part of a nationwide conversion campaign led by the then Chancellor Neville Chamberlain to reduce the costs of servicing the national debt.

The bond was issued in exchange for 5% War Loan 1929 to 1947, which had been issued in 1917 as part of the unprecedented effort by the government to raise money to pay for the First World War.

"This is a moment for Britain to be proud of. We can, at last, pay off the debts Britain incurred to fight the First World War," Osborne is expected to say.

"It is a sign of our fiscal credibility and it's a good deal for this generation of taxpayers.

"It's also another fitting way to remember that extraordinary sacrifice of the past."

The government said it will be able to refinance this debt with new bonds benefiting from today's "very low interest rate environment".

It follows Osborne's decision to redeem the much smaller 4% Consolidated Loan.

The announcement also represents the start of a strategy to remove all six of the other remaining undated gilts in the government's portfolio, when Osborne deems it value for money to do so.

The gilts include some debt originally issued in the era of the South Sea bubble in the 18th century, as well as to provide for the Bank of England nationalisation.

© Copyright IBTimes 2025. All rights reserved.