UK house prices: Property famine for first-time buyers after buy-to-let investor feast

An 80% leap in the number of property transactions in March as buy-to-let investors bought up cheaper homes at the bottom of the market ahead of an April tax hike caused a housing drought for first-time buyers, sending prices spiralling.

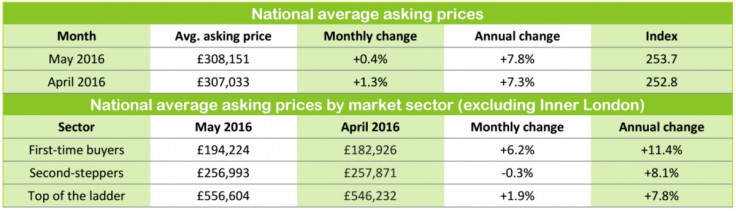

Rightmove, a property listings website, said the average asking price for a first-time buyer property — studio flats and one or two bedroom homes — shot up 6.2% over a single month to £194,224 in May 2016. By comparison, the average asking price for all properties rose 0.4% across the same period to £308,151.

From 1 April, Chancellor George Osborne hiked stamp duty by 3% for all purchases of additional property, a move to cool demand in the buy-to-let market and reduce competition for first-time buyers trying to gain a foothold on the property ladder.

"Buy-to-let investors have had a bricks and mortar feast between the chancellor's announcement in November and the tax deadline at the end of March, and the result is a famine of suitable property and higher prices," said Miles Shipside, Rightmove director and housing market analyst.

"First-time buyers are still eager to secure some of the very limited suitable supply in many parts of the country. Estate agents have perhaps been focused on getting investor sales through to completion before the tax hike, and some may have been surprised by the continuing momentum and scarcity of stock to meet ongoing demand.

"The net effect is eye-watering increases in asking prices in some towns, and is further stretching first-time buyers' affordability even though they are competing against fewer buy-to-let investors in the market."

© Copyright IBTimes 2025. All rights reserved.