UK Households Paying Down Less Mortgage Debt as Consumers Spend Instead

British consumers were putting the least amount of money into paying down their mortgage debt in a year during September, suggesting they were spending out instead as the economy began to recover.

According to the Bank of England, UK homeowners put £10.4bn into repaying their mortgages during September 2013. This is a slowdown from £12.5bn in October and the lowest since September 2012 when the figure was £10.5bn.

Wages are in real terms decline in the UK as pay growth is far outpaced by consumer price inflation. This means consumers are either wearing down savings or leveraging themselves with more personal debt in order to spend out.

Bank of England figures show UK households are raiding savings. They took £23bn out of long-term savings in 2012, the most for 40 years.

Data from the Office for Budget Responsibility (OBR), the Treasury's independent fiscal watchdog, shows the current UK recovery is being driven by household consumption and the housing boom.

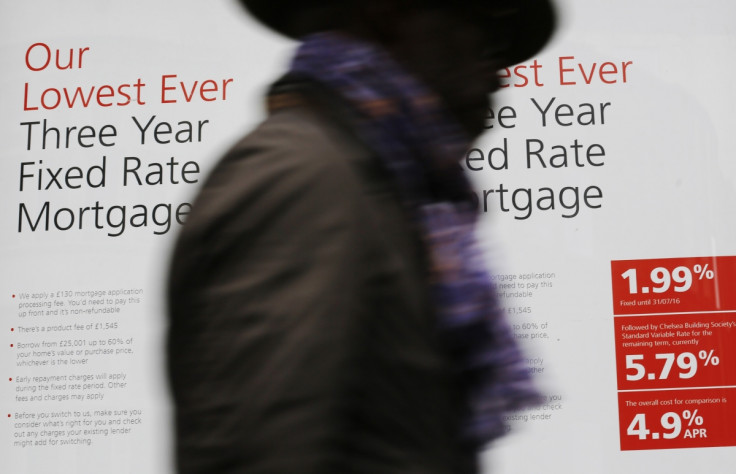

UK house prices are on the rise amid mortgage easing stimulus, such as the Help to Buy scheme, and a constrained supply of new affordable homes.

The Office for National Statistics (ONS) said UK house prices rose at an average of 5.5% across all regions in the year to October 2013.

High house prices before the financial crisis meant homeowners could borrow large amounts against their properties.

A slowdown in mortgage debt repayments coupled with falling wages may concern Bank of England policymakers, who are fearful of the UK repeating the same debt mistakes as before the crisis.

The Bank of England has already reacted to relieve the pressure on the housing market as demand rockets because of easier-to-access mortgages.

It has halted mortgage stimulus under Funding for Lending, which will now focus solely on improving the flow of credit to small firms.

© Copyright IBTimes 2025. All rights reserved.