UK online retailers contend with technical debt as consumer expectations shift

As retailers face the challenge of aligning consumer desires with their business capabilities, a mounting concern known as "technical debt" has emerged.

Due to the current economic environment, which is characterised by rising inflation and the cost of living crisis, online retailers in the UK are encountering considerable difficulties.

A recent report from the Office for National Statistics (ONS) painted a dire image for the eCommerce sector, showing a 2.3 per cent fall in online sales across major retail segments over the previous year. Online retailers must now more than ever carefully listen to their customers in order to change their operations to meet those needs and take into account the latest consumer trends in this unstable market.

The growing expectation gap between what consumers want and what retailers can provide, coupled with increasing business costs and declining consumer disposable income, has resulted in a genuine concern known as "technical debt" for retailers. Many retailers are overwhelmed by the abundance of choices and struggle to prioritise specific target areas that can make or break a sale, such as delivery and seamless checkout experiences. Both consumers (46%) and retailers (33%) have identified shipping and returns as their top pain points.

To address these pressing issues, Primer, a no-code automation platform that enables simple commerce experiences, has released a new research paper titled 'A Nightmare on E-Street.' This comprehensive study examines the challenges and emerging trends in eCommerce from both customer and seller perspectives.

Gabriel Le Roux, Co-Founder of Primer, emphasised the need for online retailers to future-proof their businesses amidst the current unstable market conditions. Le Roux believes that despite the horror of trying to do more with less, effective and simple solutions can have a significant positive impact. The study offers merchants a roadmap for eCommerce, helping them identify consumer pain points and implement effective business plans for 2023 and beyond.

The report highlights that controlling delivery costs is a critical concern for retailers. High shipping costs are cited by 46 per cent of Brits as their primary complaint when shopping online, and almost half (48%) admitted that these charges would be the main reason for abandoning their carts. Surprisingly, online merchants are not prioritising investments in shipping and refunds as they look to the future. In fact, when asked about the best opportunities for future growth, "streamlining fulfilment and shipping" ranked fifth, behind expanding product offerings and increasing social media presence.

Even more surprising is the fact that online merchants are not prioritising investments in shipping and refunds as they approach 2024 and beyond. Incredibly, 'streamlining fulfilment and shipping' (25%) came in fifth place for responding when asked which area of their business they believed held the best opportunities for future growth, trailing only 'expanding their product offering' (27%) and 'increasing their social media presence' 26 per cent in terms of importance.

Given that the average online shopping cart in the UK costs £213.84 and that retailers estimate that 37 per cent of all shopping carts are abandoned before the customer completes the payment process, ignoring consumer demands for inexpensive delivery (and speedy checkout) could have a significant negative impact on their bottom line.

According to Direct Commerce, a non-profit trade body, online merchants are advised to prioritise perfecting their delivery service in 2023. This can be achieved through strategies like subscriptions to Asos, Deliveroo, or Uber Eats, or incorporating delivery charges into the overall price to offer the perception of "free" delivery.

Consumers who are "time poor" today may put off making a purchase due to more than just high delivery charges.

Furthermore, business checkout procedures must also be quick and easy, according to Direct Commerce. According to Primer's research, 76 per cent of shoppers indicated that they would quit their shopping cart if it took too long; 41 per cent would do so after just four minutes, and 15 per cent would give a retailer little more than two minutes before giving up.

Gabriel Le Roux reiterated the importance of optimising the checkout experience and removing obstacles to purchasing. In order to stay up with new technologies and consumer payment trends, UK merchants have improved their payment systems over the past year.

However, businesses must make sure that these modifications meet the expectations of their customers, he added. Le Roux asserted that this is the case notwithstanding the possibility that UK retailers are aware of the importance of maintaining their payment system. Consumers expect quick and easy checkout procedures, therefore that is where businesses should concentrate their efforts.

Technical debt emerged as a common concern among British retailers, with 47 per cent citing it as the cause of their most pressing problems. Although the top three concerns of British retailers differ, 'shipping and returns' (33%) and 'attracting and retaining staff' (33%) as well as 'developing and maintaining their eCommerce store' (32%) all make the list.

Retailers are starting to recognise the benefits of decreasing technical debt in all facets of their organisations as technology changes so quickly. In fact, reducing technical debt is the top area of future investment for 34 per cent of UK retailers. In this context, automation is crucial since it frees up time and resources for organisations by minimising administrative responsibilities. Over 91 per cent of retailers have already made an investment in automation or intend to do so during the next 12 months.

While automation holds promise, the research revealed that the rise of AI poses challenges for the retail sector. Approximately, according to the report, 67 per cent of UK retailers are open to integrating AI tools into their customer journey, with 30 per cent actively pursuing its use. However, retailers should be mindful of consumer concerns regarding privacy and the individualised shopping experience that AI brings, the research maintained. The research also stressed the importance of striking a balance between AI and more traditional forms of automation, such as inventory management, order fulfilment, and payment automation.

Additionally, the research stated that 37 per cent of British shoppers are concerned about their privacy and despise the personalised purchasing experience, while another 27 per cent are concerned about artificial intelligence (AI). Furthermore, the study showed that 64 per cent of consumers are concerned about AI being used in their purchases.

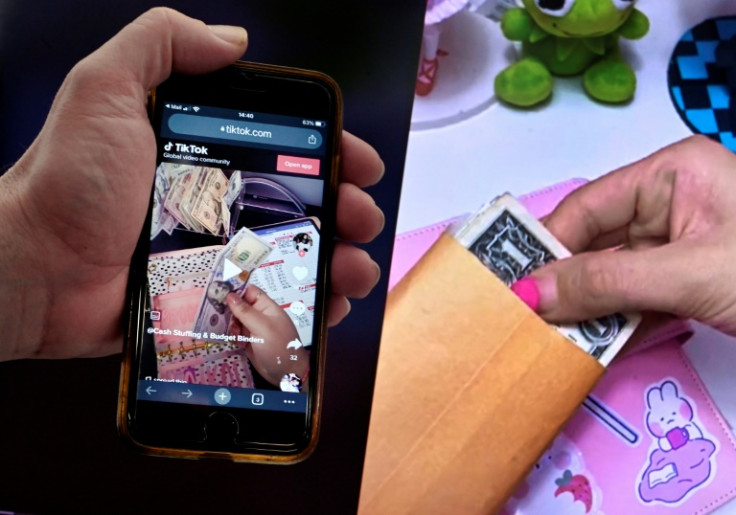

One of the top retail growth sectors for 2023 is social eCommerce. The research mentioned that more than half (54 per cent) of Brits either have or plan to make future purchases via social media.

Notably, both younger generations — Gen Z and Millennials — are actively using social media to shop. While Gen Z has the highest percentage of members who have used social media to shop — 42 per cent— and has another 37 per cent of members who plan to use it in the future—Millennials aren't far behind with 39 per cent — and have 32 per cent — of members who have already used social media to shop, according to the study. It further stated that 50 per cent of Gen Xers and 33 per cent of baby boomers feel that social commerce has potential benefits that go beyond younger generations.

For retailers, having a variety of payment choices is essential because 69 per cent of Brits would leave their online shopping carts empty if their preferred payment method was not allowed, according to the report. The research made it known that PayPal surpasses credit cards (17%) and debit cards (26%) to take the top spot for payment methods (31%) in the UK.

With 50 per cent of Brits trusting the platform with their personal information, compared to 47 per cent for debit/credit cards and just eight per cent for Klarna, the report attested to PayPal has a strong reputation for security and dependability. PayPal surpasses credit and debit cards to be named Britain's most trusted payment option.

© Copyright IBTimes 2025. All rights reserved.