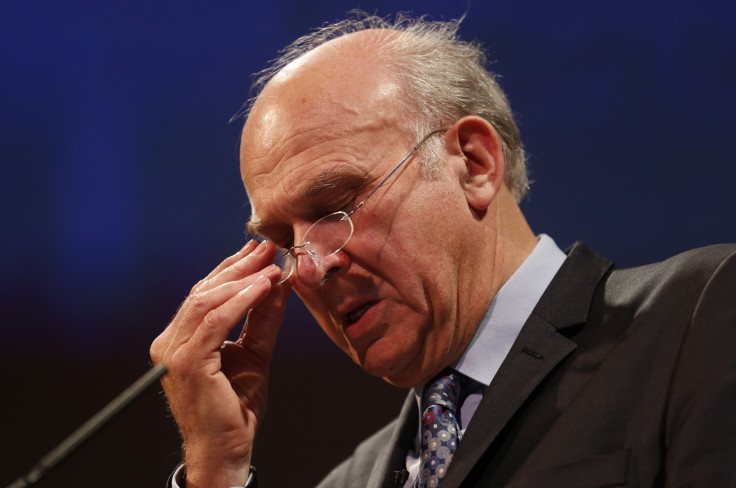

Vince Cable to meet UK bank bosses about rural branch closures

Half of UK's bank branches have been closed since 1989

Business secretary Vince Cable is meeting with a number of banks to address the problem of branch closures in rural areas.

Sky News reported that Cable has summoned Britain's biggest banks for fresh talks about branch closures, after their bosses refused to renew a promise to not close hundreds of rural outlets.

Cable, who held talks with banks in December, has asked executives from the five biggest high street banks, including Barclays, Lloyds Banking Group and Royal Bank of Scotland (RBS), to attend a meeting later in January.

At the meeting, he will strive to get a binding commitment from banks not to close branches which are the last banks in local communities.

"There are a lot of people who are not connected [online] who also need to do basic banking functions, and we mustn't be in a position where large numbers of villages and other small communities are effectively being cut off from banking," Cable told Sky News.

"If the banks cannot perform that service we need an adequate substitute, and they've got a responsibility to help provide it."

The banks are finding it less cost-effective to run a large number of branches as technological changes enable customers to perform billions of transactions remotely.

Half of UK's bank branches have been closed since 1989, according to figures compiled by community banking campaigners.

If the meeting goes ahead, it is likely that banks will try to push Cable to agree to allow them to close a community's last bank under certain circumstances, such as helping to provide alternative banking arrangements.

Barclays' chief executive of retail and business banking Antony Jenkins said the bank "aimed to leave no community without the ability to transact – meaning that, if we do choose to close a branch, we work closely with the local community to determine if there are other ways to support its day-to-day banking needs".

The UK government aims to increase the numbers of people who use banking services, but bank closures are disconnecting Britons in rural areas from essential financial services.

In a government-supported initiative in December, the nine biggest banks in the country said they would launch fee-free basic accounts for consumers.

© Copyright IBTimes 2025. All rights reserved.