Which companies should you invest in to benefit from the shrinking pound?

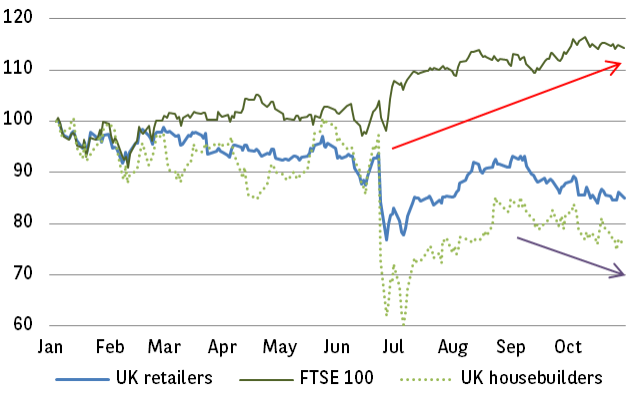

Retailers and housebuilders have been hit hard by the failing pound against the US dollar and the Euro.

The pound has sunk like a stone since June's Brexit referendum, and has certainly not shown any change in fortune over the last month. Against the US dollar, the pound has shed another 6% (see chart 1) and over 5% against the euro.

Going abroad on holiday has only become even more expensive then.

Rising prices threaten our purchasing power

But this is not the only pain that British households are going to suffer from currency devaluation.

As we import an enormous amount of the goods that we consume in this fair isle, the cost of those imports is going to rise in the months ahead.

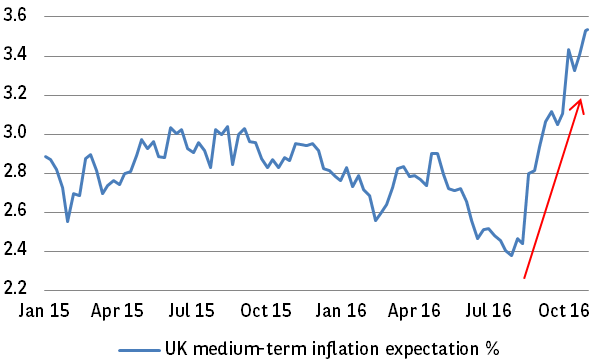

The UK's medium-term (5-year) expected inflation rate has shot up since July from 2.4% to over 3.5% today (see chart 2), reflecting the financial market's forecast of higher high street price inflation to come as a result of weaker sterling.

This currency devaluation is already being quietly passed onto unsuspecting consumers via increasing prices of certain desirable products such as the Apple iPhone.

Apple proudly announced that the iPhone 7 and iPhone 7 Plus would be the same price at launch as their predecessors were. But according to the Macworld web site, UK prices are up to £100 more expensive for these models versus their predecessors:

- iPhone 7 32GB: Now £599, iPhone 6S was £539 (£60 increase).

- iPhone 7 Plus 256GB: Now £919, was £819 (£100 increase).

- iPhone SE 16GB: Now £379, was £359 (£20 increase).

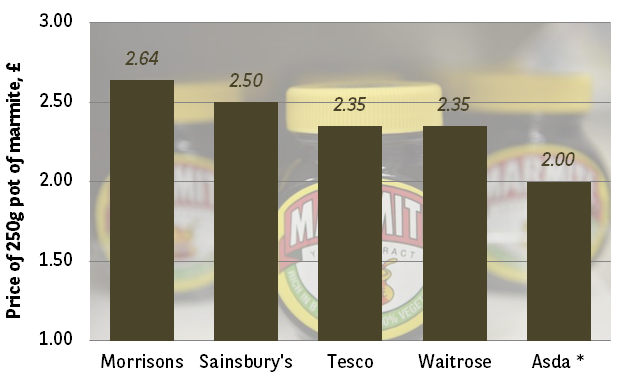

The recent row between Tesco and Unilever over Marmite price rises is further proof of potential price rises coming through to hit consumers. Just this week, Morrisons has snuck through a 12.5% price rise for Marmite from £2.35 previously to £2.64 now, making it the most expensive of Britain's supermarkets for this divisive spread (see chart 3).

Brexit and the pound has weighed on retailers, housebuilders

While the benchmark FTSE 100 index has recovered to around the 7000 level, domestic sectors such as Retailers and Housebuilders have fallen back on fears that the UK's domestic economy is going to slow down dramatically in the year ahead (Chart 4).

Christmas looks like it will be very tough for high street retailers, between the twin threats of rising import prices on the one hand, and the competitive pressures from online shopping on the other.

We can add to this the unseasonably warm weather that the UK has been enjoying. This is bad news for clothing retailers trying to sell winter clothes, and we can begin to understand why investors are shunning the retail sector.

So where to invest today to benefit from the weaker pound? Health care

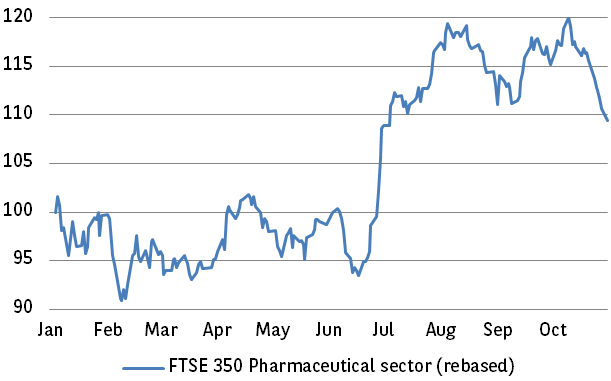

Companies with a global reach are likely to benefit more from a weak pound given their activities overseas. One sector that is global in nature and which offers some value today is the Health care sector, including companies such as AstraZeneca (UK code: AZN) and Shire (UK code: SHP).

Both companies have heavy exposure to the highly profitable US health care market, with Shire increasing their exposure recently through the acquisition of US pharmaceutical company Baxalta.

Today, the health care sector has weakened temporarily (see chart 5) over worries that the incoming US president will force tougher drug pricing on health care companies in the US. I personally believe that this threat is vastly overstated.

From their share price peaks in September of this year, AstraZeneca has lost 11% and Shire 14%, resulting in more attractive entry prices for both.

AstraZeneca currently trades at a reasonable P/E ratio of just over 14x and offers an income yield of just under 5% from dividends. Shire is valued at a very modest 11x P/E, thus both companies can be said to offer good value to investors at present.

© Copyright IBTimes 2025. All rights reserved.