Charts in Focus: UK Bankers' Bonuses Delayed until Top Tax Rate Trimmed

It was always said that the bonus about working for a bank was the, er, bonus.

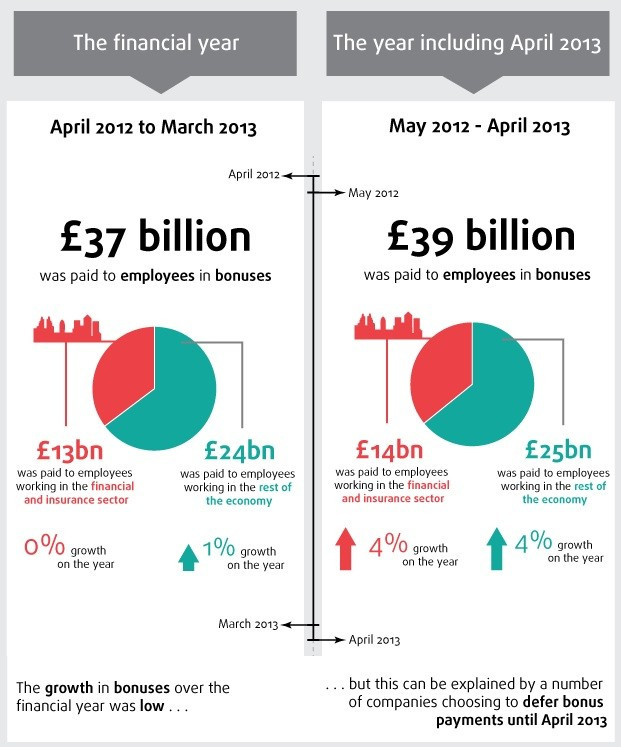

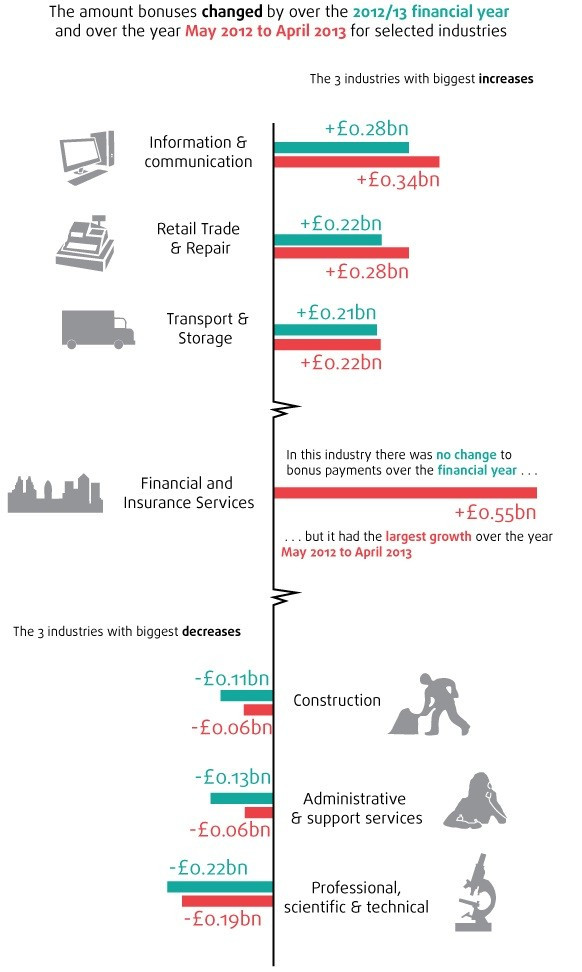

According to the Office for National Statistics (ONS), the total bonus pot for financial services was unchanged on the year in 2012/13, at £13bn.

However, when you take April 2013 into account - and the start of the new tax year - this suddenly jumps 4% to £14bn.

Why? Because Chancellor George Osborne dropped the top rate of tax to 45%, so the sensible - or greedy, depending on your view - people delayed their bonus payments until the threshold dropped so they could keep more of the cash.

It also looks like bankers took the biggest advantage of this opportunity.

Despite the slight lift in 2012/13, the bonus pot for financial services is still subdued compared to yesteryear, and has seen a general decline since the crisis.

Is this down to lower bonus payments for individual bankers, or because there are fewer workers in the financial services sector generally?

A study by the Centre for Economic and Business Research (CEBR) found that the financial services headcount in the City of London had fallen 30% since the financial crisis.

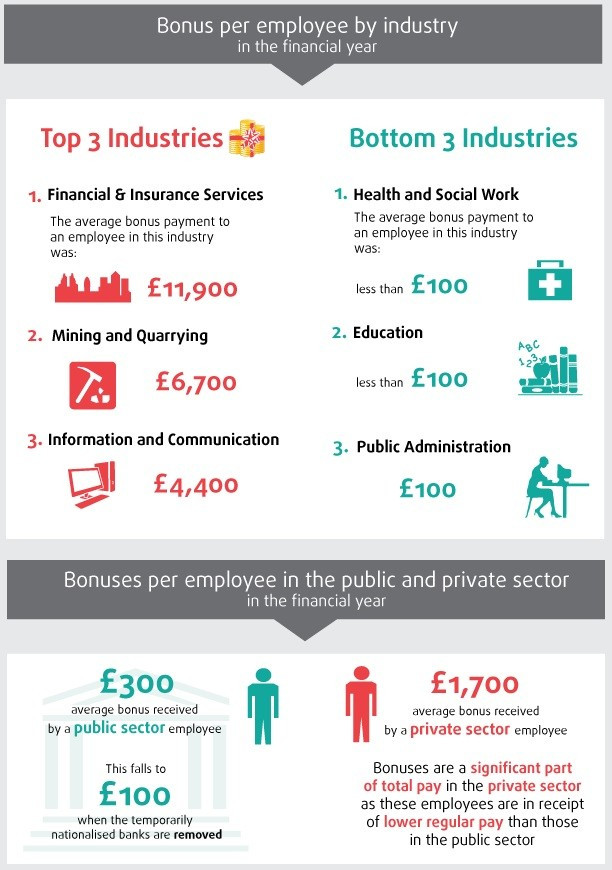

What also supports the argument that the headline bonus figure for financial services is falling because of fewer workers is that the average has little changed from the 2011/12 year to 2012/13.

In the former, it was £12,000. In the latter, it was £11,900, a small annual drop. From this we can assume that fewer workers are taking home more in bonuses, though of course this is still a real terms fall when you account for price inflation.

Aside of the bankers' bonuses, what is also noticeable is how different things are for public than private sector workers.

As the charts show, and as the ONS puts it, bonuses for the main public service sectors such as health, education and public administration have seen "negligible" bonus payments during the year.

However, public sector workers - who are locked a pay freeze under the government's austerity programme, with 1% annual rises effectively a real terms cut in wages - are generally paid more than those in the private sector, who make up the difference with performance-related bonuses.

Related articles:

EU Bonus Crackdown Forces 65% of UK Financials to Increase Basic Salary

EU Bankers' Bonus Cap Undermines Performance-Related Pay

Xactly CEO Christopher Cabrera: Blanket Capping Company and Banker Bonuses Will Hurt Firms' Survival

© Copyright IBTimes 2025. All rights reserved.