Cost of Living Crisis: No George Osborne, UK Pay isn't Rising in Real Terms

Good news, everyone. Pay is actually rising in real terms for the bottom 90% of earners in the UK, or so says Chancellor George Osborne and his Treasury team, and we can all feel a bit better about the apparent recovery.

The finance ministry claims its analysis of wages data from the Office for National Statistics (ONS) shows only the top 10% of earners are seeing a below-inflation rise in pay.

Everybody else is saw a 2.5% hike in take home pay against consumer price inflation (CPI) of 2.4% in the year to April 2013.

This is mostly because of the government's lifting of the personal allowance threshold, the amount of money a person can earn before they start paying income tax.

But it all relies on the integrity of consumer price inflation as a measure of the cost of living.

The ONS explicitly says in its methodology that CPI is not a measure of the cost of living, despite most of us using it as a blunt reference point for exactly that – myself included.

"The CPI is not a 'cost of living' index, a concept that means different things to different people," says an ONS handbook.

"To many it would suggest the changing costs of basic essentials, but in practice it would be very difficult to agree on a definition of 'essentials'.

"The index simply indicates what we would need to spend in order to purchase the same things we bought in an earlier period, irrespective of whether particular products are 'needed' or are 'good for you'."

Look below the headline number and you'll see how CPI inflation can be affected by odds and sods like rising tuition fees or higher air fares because of planes' fuel costs.

Would it not be better to take measures compiled by the likes of the Joseph Rowntree Foundation (JRF), an anti-poverty thinktank, to assess how lower income groups are affected by the rising cost of living?

Minimum Income Standard

JRF has its own Minimum Income Standard report where it works out how much households need to earn to meet a basic standard of living. For this it has its own basket of goods, separate to the one used by the ONS, in which are items bought on an everyday basis by those on lower incomes.

There are no air fares to consider. No education costs from sending Oscar and Barnaby to boarding school. Just what you need to put food on the table and all the other essentials on top.

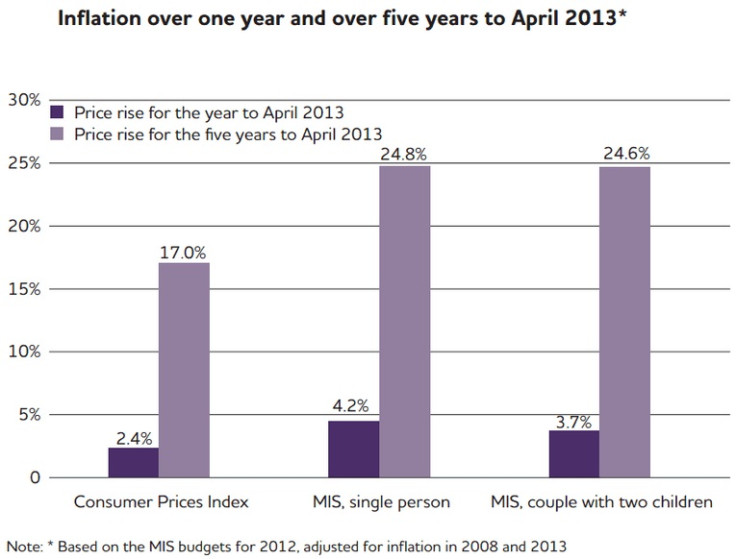

This is then used to calculate the Minimum Income Standards Prices Index (MIS):

As the chart shows, JRF believes price inflation for a basket of goods that ordinary households buy week to week was 4.2%. CPI was 2.4%.

Though the report is a little dated – from April 2013, like the Treasury's analysis – it gives a clear picture of how far ahead of the ONS's CPI reading MISPI is. Ordinary baskets of goods for ordinary people are rising much faster than wages.

Welfare

It isn't just inflation that makes the government's claim misleading. Even if you accept the premise that pay is rising faster than prices, there is more to household income than wages alone.

Billions of pounds have been slashed from the government's welfare budget under its austerity programme to get rid of the deficit in public finances. This has meant reduced welfare payments, or none at all, for many people who used to receive them.

Child benefit and housing benefit, for example, are two payments made to many working households. They have been scaled back, denting the incomes of those families.

In real terms, wages are clearly far below where they were before the financial crisis. Any sign that pay is rising more quickly for most people is to be welcomed and the Treasury's analysis should be praised for breaking down the data into more detail.

But it is wrong to imply that there is no cost of living crisis because pay growth for many people appears to have caught up with CPI. The problem is much deeper, and much more complex, than that this simplistic measure of the UK's cost of living.

© Copyright IBTimes 2025. All rights reserved.