Could petrol spike to £1.30/lt on Opec's production cut, weaker pound and Brexit jitters?

UK inflation was bumped up by rising fuel prices, British drivers should brace themselves for more.

UK inflation is lurking at its highest level in over two years, according to data published recently by the Office for National Statistics (ONS). However, what ought to spook British drivers is the devil in the detail. A break-up of ONS figures suggests much of the increase – which came in at 1.2% in November, up from 0.9% in October – was driven by higher fuel prices.

All the signs are that what we fork out at the petrol station forecourt is going to rise. For starters, the pound is currently 17.2% lower versus the dollar since the vote in favour of Brexit on 23 June. That puts an immediate pressure on fuel importation costs, with crude oil being priced in dollars, and the UK being a net importer since North Sea production peaked in 1999.

Additionally, the Brexit vote adds another level of complexity. While Remainers and Brexiters are busy haggling over what the actual economic impact of a decision to leave the European Union might eventually be, the here and now revolves around short-term macroeconomic uncertainty for refiners focused on catering to the needs of UK demand for petroleum products.

On average, around 20p in a litre of petrol is the industry's take. However, remove the refiners' costs and their profits plummet to 4-8p. Should input costs rise, as every indication suggests they would, refiners would feel inclined to pass on their costs to consumers. Recent developments increase the likelihood of such an event.

On 30 November, producers' cartel Opec unveiled a 1.2m barrels per day (bpd) cut in its output to 32.5m bpd; a first reduction in eight years. Ten days later, in another extraordinary development, major non-Opec producers, including Russia, unveiled their own cut of 558,000 bpd to back-up Opec's reduction in a first pact of its kind for 15 years.

Should the agreement hold up, it would potentially take out 1.76m bpd of crude oil for the first two quarters of 2017. Over the last fortnight, Brent – the preferred global benchmark – jumped from languishing in the mid-$40s to above $55 per barrel, and industry sources suggest the price could stay in the $50-$55 range. That means higher prices at the pump.

According to motorists' organisation the AA, a perfect storm of the oil producers' cut, Brexit jitters and a weaker pound could see the average price for unleaded petrol rise to £1.18 per litre from £1.15 in Scotland, Wales, Northern Ireland and Northern England over the short-term.

However, in London and the south-east, where IBTimes UK has found evidence of prices hitting £1.18 per litre in some forecourts, the figure could rise to the £1.22-£1.25 range. The big question is will we touch £1.30?

It all depends two key factors – (1) whether or not the oil producers' agreement holds up, as history points to a poor record of this happening, and (2) whether refiners and retailers, especially supermarket petrol forecourts, decide to absorb the costs or pass them on to drivers.

Michelle McGrade, chief investment officer of TD Direct Investing and IBTimes UK columnist, believes British consumers in general and drivers in particular should brace themselves for an expensive start to the year. "A higher oil price, together with a stronger dollar, could make things tougher for consumers because not only will petrol be more expensive, but this combination could fuel a stronger surge in inflation than originally expected, not least because inflation is highly correlated to oil price."

But some reckon, the producers' agreement might just unravel and provide a bit of relief. FXTM Research Analyst Lukman Otunuga said: "It should be kept in mind that the agreement is not legally obligatory and there are no fines in place for cheating which could spark speculations of members pumping incessantly in the New Year."

"If confidence starts to diminish over the success of the proposed cut, bears could jump back into the markets."

However, oil producers in general and Opec in particular insists, it's the individual governments that are responsible higher prices at the pump via their policy of heavy taxation on fuels.

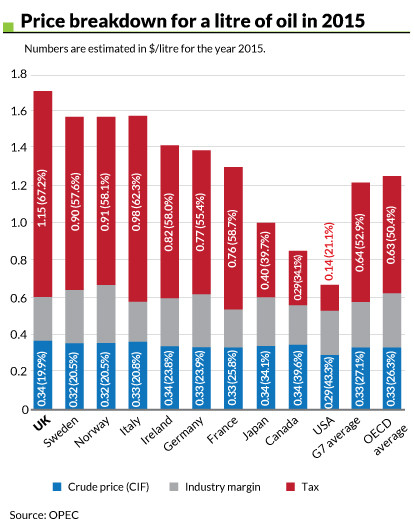

According to Opec's research, during 2015, the share of total tax of the final retail price at petrol forecourts amounted to over 50%. "Therefore, the real burden on consumers comes from taxes, not from the original price paid for crude," Opec said.

By that token, the UK government is among the most guilty (see bar chart). In fact, the British tax levy on fuel came in at 67.2%, which is the highest in Europe and well above Germany (55.4%) and France (58.7%). It also capped the G7 taxation average of 52.9% and the OECD average of 50.4%, and was more than three times as much as the US levy of 21.1%.

So next time chancellor Philip Hammond stands up at the dispatch box – unveiling a freeze of the fuel duty, in step with his predecessor George Osborne – its worth remembering the Treasury is already taking a bigger share per litre than both oil producers and refiners put together. Whether petrol touches £1.30 or not, few expect any quarters from the Treasury.

Gaurav Sharma is the Business Editor of IBTimes UK. He has been a financial journalist for over 15 years, with a core specialisation in macroeconomics and commodities. Follow Gaurav on Twitter.

© Copyright IBTimes 2025. All rights reserved.