HSBC boss Stuart Gulliver apologies to MPs for 'unacceptable' Swiss tax avoidance scandal

The head of HSBC has apologised for the "unacceptable" tax avoidance practices a Swiss branch of his bank committed in the mid-2000s.

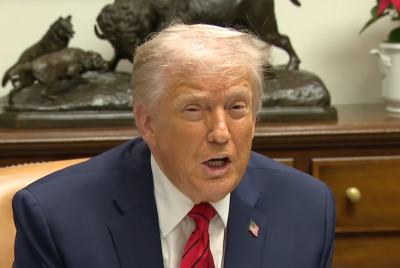

Gulliver, who was appointed chief executive of the world's second largest bank in 2011, made the remark at the start of a grilling from a group of MPs.

He also told the Treasury Select Committee the data leak of secret accounts had caused "damage" to trust and confidence in HSBC and "created further reputational damage" to the firm.

"The lack of controls and practices which now – judged with the benefit of hindsight – we would not be at all comfortable with if they were happening today, and which have clearly resulted in damage to trust and confidence in HSBC and created further reputational damage to our firm and have therefore hurt clients, customers, shareholders, our staff and people at large," Gulliver said.

The bank's chairman Douglas Flint, who also appeared before the MPs, shared Gulliver's apology.

Gulliver assured MPs the bank had made reforms to the subsidiary under his stewardship, including reducing the number of its clients from 30,000 to 10,000 and the implementation of a tax transparency initiative.

The chief executive also explained the subsidiary now only takes clients from 38 countries, well below the 150 from before.

Meanwhile, Gulliver claimed to have improved HSBC's operations across the board as chief executive. He told MPs that he has cut the company's headcount and reduced the firm's separate business operation from 88 to 11.

"I hope the British public see that the action steps I gave taken leave HSBC in a better state," he said.

Gulliver's tax affairs

The MPs went on to press Gulliver on his own tax affairs, after allegations emerged that he had put his salary into a Panamanian company with a Swiss HSBC account.

The bank boss told chair Andrew Tyrie the set up did not offer any tax benefits but gave him privacy from fellow HSBC employees. The chief executive had previously revealed he had closed the account in 2009.

"It was purely about privacy. Privacy from colleagues in Hong Kong and privacy from colleagues in Switzerland," Gulliver said.

"The computer system showed everyone's pay and I was amongst the highest paid and I wished to preserve my privacy."

Gulliver also stressed that he used the Panamanian company with a Swiss HSBC account before he joined the board of HSBC.

The chief executive also explained that he has the "same tax advantage" as any non-domiciled resident, which means he pays a £30,000 (€40,943, $46,504) charge for his overseas assets not to be taxed by the UK.

He added: "The amount of tax I have paid is the fair and appropriate amount of tax. The absolute lion's share of my earnings have been taxed at UK tax rate."

The Telegraph and HSBC

In addition, the MPs asked Gulliver if his bank had pressured The Telegraph over the paper's coverage of the banking scandal.

"No, because we realise that actually having a free and vibrant press creates the very body of those publications that supports our advertising and therefore makes them credible for our clients," he said.

No, because we realise that actually having a free and vibrant press creates the very body of those publications that supports our advertising and therefore makes them credible for our clients

The comments come after the publication's former chief political commentator, Peter Oborne, alleged reporters were "discouraged" from writing negative article about the bank because of the advertising its buys in The Telegraph.

The Barclay brothers-owned title hit back at Oborne and claimed the allegations were "unfounded".

"Like any other business, we never comment on individual commercial relationships, but our policy is absolutely clear," a spokesperson said.

"We aim to provide all our commercial partners with a range of advertising solutions, but the distinction between advertising and our award-winning editorial operation has always been fundamental to our business.

"We utterly refute any allegation to the contrary. It is a matter of huge regret that Peter Oborne, for nearly five years a contributor to the Telegraph, should have launched such an astonishing and unfounded attack, full of inaccuracy and innuendo, on his own paper."

© Copyright IBTimes 2025. All rights reserved.