SSI Double Payday Shock: Why You Get Two Huge Checks in October and December And Zero Money Coming in November

More than seven million Americans relying on Supplemental Security Income (SSI) will face an unusual schedule this autumn. Beneficiaries will receive two payments in October and December, but no deposit in November, a shift caused by how the Social Security Administration (SSA) handles weekends and holidays.

While the total annual amount remains unchanged, the disruption has triggered concerns among advocacy groups who warn that many recipients may mistake the extra payments as 'bonus' income.

How the SSI Payment Shuffle Works

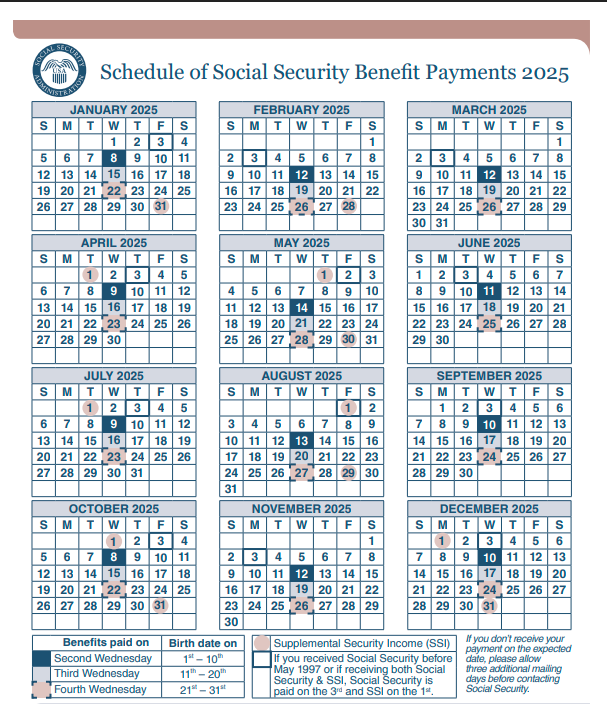

The Social Security Administration (SSA) confirmed that recipients will receive two payments in October—on 1 October and 31 October, 2025. The second deposit in October covers November's instalment, meaning no cheque will arrive in November. The same pattern will repeat in December, with deposits landing on 1 December and 31 December 2025, the latter covering January 2026.

Payments are made either through direct deposit or Direct Express debit cards, ensuring access even for beneficiaries without traditional bank accounts.

According to the SSA's 2025 Payment Calendar, this adjustment does not provide extra money but simply reschedules the regular 12 monthly payments.

This irregular calendar affects more than seven million SSI recipients nationwide. The programme supports older adults, people with disabilities, and low-income individuals who qualify based on financial need.

Why Payments Are Doubled in October and December

The SSA's system issues SSI benefits on the first day of each month, unless that date falls on a weekend or public holiday. In such cases, the payment is advanced to the last business day before the specified date.

Because 1 November 2025 is a Saturday, November's benefit will be paid on 31 October. Similarly, 1 January 2026 is a federal holiday, so January's benefit will be issued on 31 December 2025.

That means recipients see two deposits in both October and December but none in November. The SSA stresses this does not mean extra money; there are still 12 payments total in 2025, rescheduled.

What It Means for Beneficiaries on Fixed Incomes

For recipients living on fixed incomes, the skipped November deposit can feel like a cut even though the money arrived early. Advocacy groups note that some beneficiaries misinterpret the second October payment as 'bonus' income, which risks overspending before November's bills come due.

The SSA has published payment calendars on its website to help reduce confusion and advises recipients to track their deposits carefully. The National Council on Ageing and other nonprofit advisers suggest treating the second October cheque as November's funds and setting it aside for rent, utilities, or groceries. In past years, when this same shift occurred, call centres and advocacy hotlines saw an uptick in questions from confused beneficiaries worried they had missed a payment.

Looking Ahead: Future Double-Payment Months

The unusual schedule underscores how millions of Americans depend on predictable SSI payments. With high inflation and rising housing costs, any disruption, real or perceived, can add stress.

Similar double-payment months will occur again when the first of the month falls on a weekend or holiday. According to the SSA's calendar, this will happen in August 2026 and May 2027.

While the system ensures beneficiaries are never left waiting until after a weekend or holiday, advocates argue that more transparent communication, such as text alerts or mailed notices, would reduce uncertainty. For now, recipients are being reminded that there will be two payments in October, none in November, and two again in December. No one is losing money, the cheques are simply arriving early.

© Copyright IBTimes 2025. All rights reserved.