What's going on with Bitcoin? Dramatic price fluctuations show volatile nature of virtual cash

Digital money may be the future, but experts say it remains highly unpredictable.

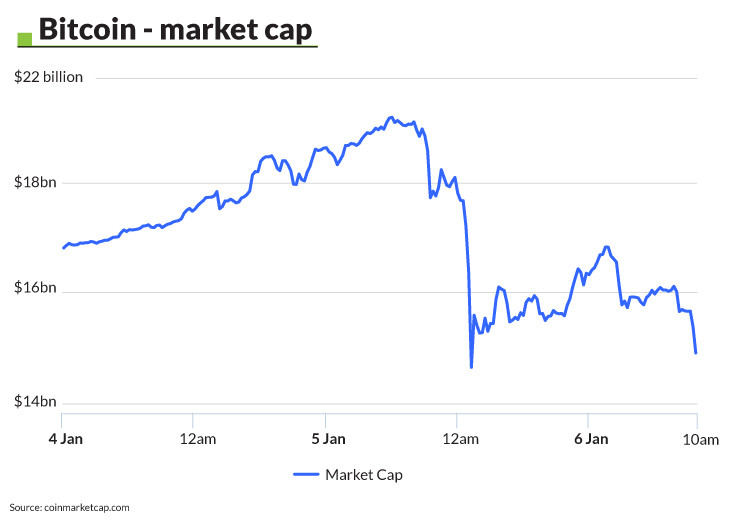

In the past 48 hours, popular cryptocurrency Bitcoin has firmly demonstrated the volatile nature of digital money. Dramatic fluctuations over the course of a day saw the price start at a record high in some markets, before crashing by over 20% in a matter of hours.

On Wednesday (4 January) the price of the virtual currency was recorded at a three-year high of $1,139, however by the end of the next day the price went into meltdown – falling to roughly $885 in a single hour before eventually levelling out at around $970.

This sharp drop meant the digital currency lost over $3bn in overall value in 40 minutes, market reports said. According to Quartz, the value of all the cryptocurrency in circulation fell to $14.6 billion from $17.7 billion, a drop of approximately 17.5%.

By the end of Thursday (5 January), according to CoinDesk's Bitcoin Index (BPI), the price had started to rise again. Despite the alarming volatility of the figures, commentators noted the price was still over 50% higher than it was a year prior.

The problems, experts say, are multi-faceted, but directly linked to both trading on Chinese Bitcoin exchanges and its relationship with the Chinese yuan. As the value of the yuan has dwindled in recent months, the popularity of Bitcoin spiked. Unfortunately, what goes up must come down.

Reuters noted Chinese exchanges claim to account for the majority of global Bitcoin trading, showing why demand in China can impact the price in such a dramatic fashion. On 5 January, the price of yuan jumped by over 1%, suggesting it was on the up. This was bad news for Bitcoin.

"The recent price surge [in Bitcoin] has been driven by a number of factors, although the most influential of those has probably been the Chinese trading volume and yuan devaluation," Charles Hayter, chief executive and founder of CryptoCompare, told IBTimes UK.

"Other contributing elements aiding the bitcoin bull-run have been demonetisation and general global political uncertainty as traders move to safe havens.

"The yuan appreciation yesterday and short squeeze on overnight rate hikes was a contributing factor towards the bitcoin sell off," he continued. "Rumours of Chinese virtual currency controls also helped send the market lower."

An uncertain future?

Volatile by nature, experts maintain the somewhat unpredictable cryptocurrency will continue to grow in spite of these issues. Hayter noted that Bitcoin markets are still in relative infancy and a number of challenges remain, but he remained optimistic about the future.

"The bitcoin markets involve a heavy dose of speculation that is a boon for traders with the volatility it brings" he said. "As a currency this is not a positive attribute but it does serve certain market strategies, especially with its low correlation to traditional assets.

"Bitcoin is young, it's still going to have tantrums but with time this nascency will mature and gradually the volatility will reduce – although there will be periods of increased turbulence throughout this journey."

© Copyright IBTimes 2025. All rights reserved.