Alibaba IPO: NYSE to Provide Operational Updates for Mega Flotation

Alibaba's share sale scheduled to be priced later in day

The New York Stock Exchange (NYSE) has said that it will hold an industry conference call to provide operational updates for Chinese e-commerce giant Alibaba Group Holding's initial public offering (IPO).

The call will begin at 830 ET on 19 September and is for members of the trading, technology and operations segments of the industry. It will not provide order imbalance and detailed price information, Reuters reported.

Alibaba's impending flotation, potentially the world's biggest ever, is scheduled to be priced later in the day and will start trading on 19 September under the symbol "BABA".

The expected price range for the listing is $66 - $68 a share.

The firm, which handles more e-commerce than Amazon.com and eBay combined, will now raise almost $22bn (£13.52bn, €17.1bn) at the top of the new initial public offering (IPO) range.

The company is seeking a valuation as high as $167.6bn.

To claim the title of the world's largest IPO, the stock sale will have to overtake Agricultural Bank of China's (ABC) public share sale, which raised $22.1bn in 2010.

Alibaba Options

Investors will be able to trade options in Alibaba Group's stock on US options exchanges, two weeks after its highly vaunted public share sale this week on the New York Stock Exchange.

The Chinese e-commerce giant's options will be listed on the Chicago Board Options Exchange Holdings and International Securities Exchange Holdings' options exchanges on 29 September, pending the company's public share sale on 19 September, the exchanges have said.

The two exchanges have together accounted for nearly 29% of trading in American stock and exchange options this year, according to data from OCC, formerly the Options Clearing Corporation.

IPO Price Boosted

Earlier in the week, Alibaba raised the price range on its looming New York flotation to between $66 and $68, following strong demand from investors.

The company and some shareholders had previously offered 320.1 million American depositary shares at a $60 to $66 indicative range. It raised the price on 15 September but left the number of shares unchanged.

Alibaba reportedly received enough orders for its impending US flotation, covering the entire deal within just two days of its 8 September launch.

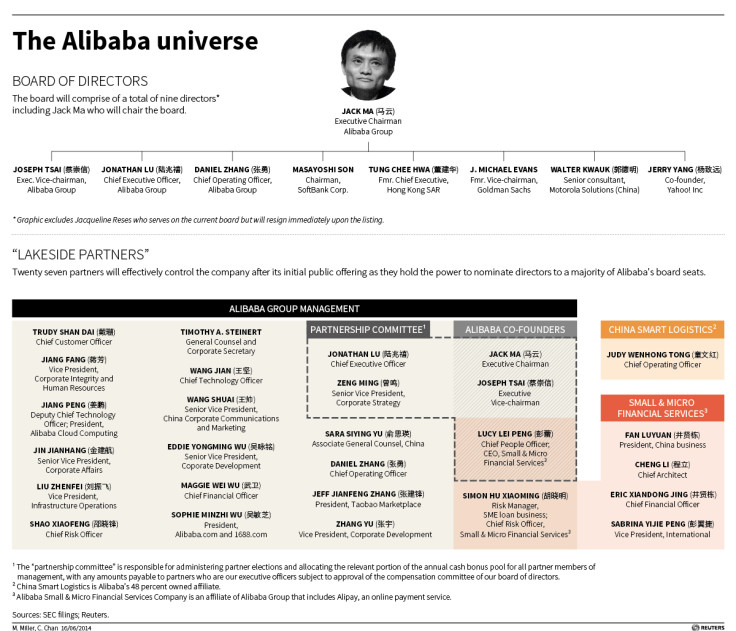

Alibaba's move to list itself in the US followed failed negotiations with the Hong Kong Stock Exchange and the city's regulators over a dual voting structure in 2013.

Alibaba wants its partners - the founders and senior employees - to be able to control the composition of its board post a listing, a privilege not available at the Hong Kong bourse but granted in the US.

© Copyright IBTimes 2025. All rights reserved.