'Debt Rehabilitation Specialists' Prepare to Visit Hundreds of Homes as Lenders Fear Mortgage Defaults

Britons with interest-only mortgages face a knock on the door from so-called "debt rehabilitation specialists" as lenders fret about those nearing the end of their terms but who cannot afford to repay the debt.

One such specialist, Ascent Performance Group, said it plans to conduct "fact-finding missions" through home visits to those with interest-only mortgages, which were popular in the 1980s and in many cases are nearing the end of the loan period.

These visits will be to assess the borrower's ability to repay the mortgage and, if necessary, work out new arrangements if there is a danger of default.

What is an interest-only mortgage?

A type of mortgage in which the borrower is only required to pay off the interest that arises from the principal that is borrowed. Because only the interest is being paid off, the interest payments remain fairly constant throughout the term of the mortgage. However, interest-only mortgages do not last indefinitely, meaning that the borrower will need to pay off the principal of the loan eventually.

Source: Investopedia

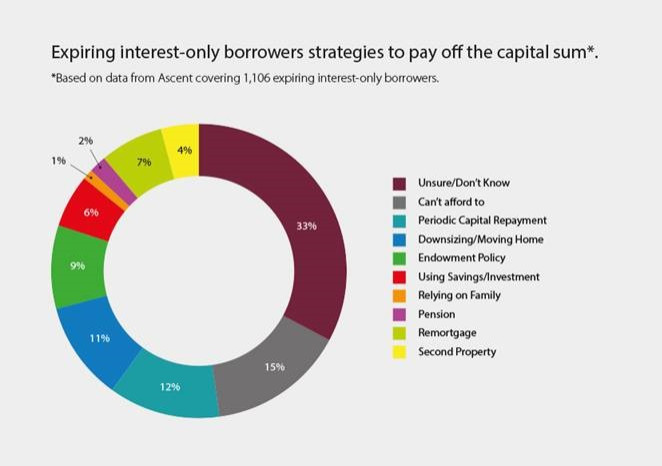

Ascent said its records of 1,106 cases show that 15% of interest-only mortgage holders say they cannot afford the final repayment of the capital they owe, which is £77,000 on average. A third in total are unsure of how they will pay off the debt.

"The FCA wants action from lenders to find out whether these customers have the ability to repay their loans, but this is proving difficult," said Mark Higgins, chairman of Ascent Performance Group.

"This is because there is no obligation in place for customers to notify lenders of this information and so most chose not to.

"Our 'fact-finding' home visits are intended to help lenders provide clear controls around the management of interest-only loans. This will enable them to, vitally, demonstrate best practice to regulators that all efforts have been made to discover if customers have adequate loan repayment strategies set up.

"It will also help customers, in a fair manner, to face up to the issue before they potentially risk losing their home."

© Copyright IBTimes 2025. All rights reserved.