easyJet Sees Tough Environment Ahead, Expects No Change in H2 Performance

easyJet Plc, Europe's second-largest low-cost carrier, in its pre-close trading statement said at constant currency basis it expects total revenue per seat for the first-half will be better than expected at a little over 10 percent. The group is scheduled to release its 2012 interim results on Wednesday.

"In a difficult environment for all airlines, improvements in revenue management combined with marketing and website initiatives have enabled easyJet to take advantage as weaker competitors have left the market over the last couple of months," said easyJet.

According to the airline carrier operator, pre-tax loss for the first-half ended March 31 is expected to be in the range of £110 - £120 million, against the previous expected range of £140m to £160m. The group benefitted from the continued focus on cost control and better marketing for the year, which delivered improvements in ground handling and airport charges, the total cost per seat ex-fuel for the first-half is now expected to rise around 1.5 percent.

"Although the economic environment remains weak, easyJet's strategy of affordable fares and our focus on making it easy for our customers ensures that easyJet is well positioned to deliver good results for shareholders. We continue to expect the environment for airlines to remain difficult. We will continue to deliver for our customers, focus on operational excellence, manage our costs tightly and allocate our capacity to the markets that will deliver the best financial return," said CEO Carolyn McCall.

In line with the last year around 30 percent of second-half seats are now booked. Capacity in the first-half of the year was planned to be flat (adjusting for disruption in the first part of the prior year), with growth of around 4 percent for the full-year.

Due to absence of snow disruption in the first-quarter, easyJet expects to grow seats flown by around 3 percent for the first-half of the year and by around 5 percent for the full-year. The group said expectations for the second-half financial performance remain unchanged.

"EasyJet was driving better-than-expected yields, as well as benefiting from the failure of competitors. Margin management and cost efficiencies had also helped," said analyst James Hollins from Investec.

"EasyJet's pre-close trading update is encouraging, with outperformance relative to guidance estimates both in revenue and costs per seat. Benign winter weather and competitor capacity cuts have, we believe, been the key drivers, but the management team is also continuing to deliver," said Numis Securities.

The broker increased its pre-tax profit view to £250m from £230m for the full-year and upgraded its rating to 'Hold' with a target of 440 pence per share.

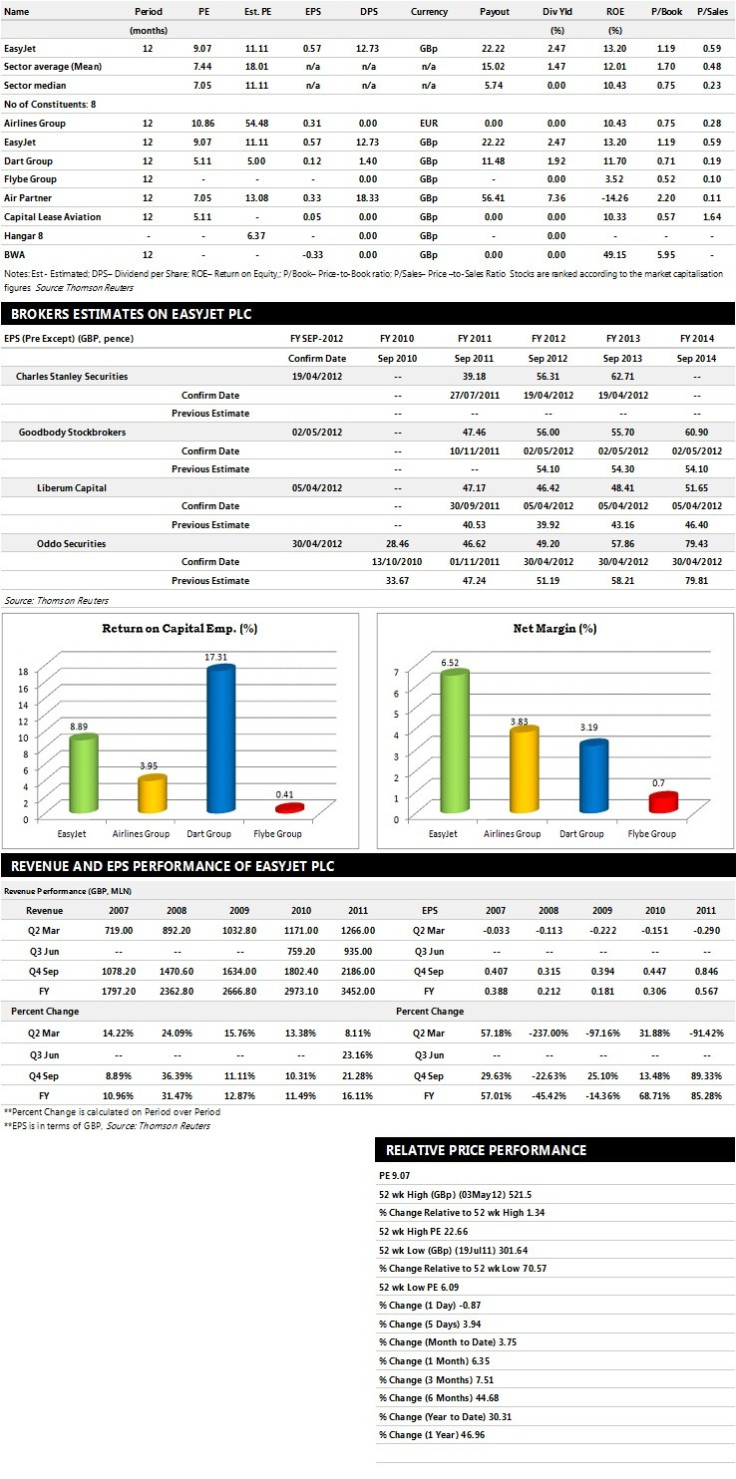

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top eight companies based on market capitalisation.

Brokers' Views:

- Goodbody Stockbrokers gives 'Outperform' rating

- Oddo Securities assigns 'Outperform' rating with a target price of 577 pence per share

- Liberum Capital recommends 'Buy' rating with a target price of 552 pence per share

- Charles Stanley Securities assigns 'Outperform' rating

Earnings Outlook:

- Goodbody Stockbrokers estimates the company to report revenues of £3,886.90 million and £4,199.80 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £278.60 million for both the periods. Earnings per share are projected at 56.00 pence for FY 2012 and 55.70 pence for FY 2013.

- Oddo Securities projects the company to record revenues of £3,872 million for the FY 2012 and £4,249 million for the FY 2013 with pre-tax profits (pre-except) of £285 million and £335 million respectively. Profit per share is estimated at 49.20 pence and 57.86 pence for the same periods.

- Liberum Capital expects easyJet to earn revenues of £3,811.72 million for the FY 2012 and £4,059.47 million for the FY 2013 with pre-tax profits (pre-except) of £260.49 million and £259.96 million respectively. EPS is projected at 46.41 pence for FY 2012 and 48.41 pence for FY 2013.

© Copyright IBTimes 2025. All rights reserved.