Juncker Unveils €315bn European Investment Package

European Commission President Jean-Claude Juncker has unveiled his €315bn (£250bn) investment plan for Europe, telling the parliament in Strasbourg that "Christmas has come early".

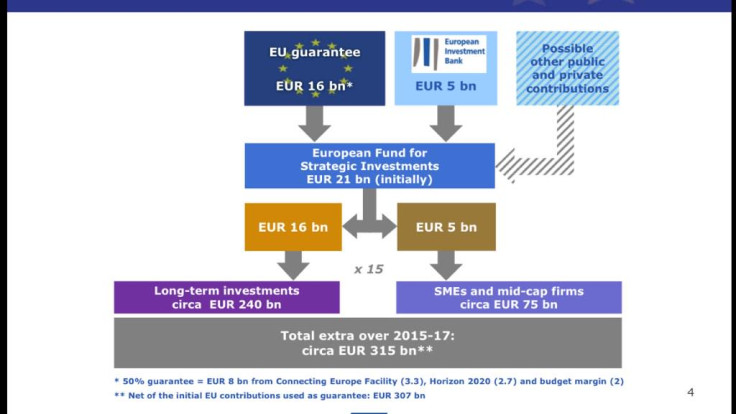

At the crux of the initiative is a €21bn investment fund which will act as seed capital and hope to attract private investment in a host of infrastructure projects across the continent. For every €1 put into the new fund by Europe, Juncker says it will generate €15 in investment.

The European Investment Bank (EIB) – a taxpayer-funded Luxembourg entity – will be responsible for managing the European Fund for Strategic Investment, which will run in tandem to fiscal stimulus from the European Central Bank, which is expected to be expanded in the coming days.

Juncker told the European Parliament: "Europe needs a kick-start and today the Commission is providing the jump kicks. Let me be clear. This money comes on top of all existing programmes."

He added: "We are offering hope to millions of Europeans."

However, he warned that "money will not fall from the sky. We don't have a money-printing machine", which can be read as an effort to answer critics who say that the public sector will bear most of the risk for the initiative, with the private sector reaping the rewards.

The plan was endorsed by the 28 governments of the European Commission yesterday (25 November) but has been given a mixed reaction by analysts and officials.

Manfred Weber, the leader of the centre-right European People's Party grouping, told parliament: "We support the investment plan. It's better to mobilise private capital than create new debt. We must spend money we have."

The leader of the Social and Democratic grouping Gianni Pittella also welcomed the move, telling Juncker: "You have taken a first step into the right path." He added: "We're not interested in what the ratings agencies say, we're interested in people's lives."

The leader of the Alliance of Liberals and Democrats for Europe (ALDE) grouping Guy Verhofstadt called for structural reforms in labour and pensions markets to accompany the stimulus.

The German Chancellor Angela Merkel has already spoken of her support for the fund, saying that Europe requires more private investment.

However, some have questioned the method, scale and viability of the package. Speaking to the Telegraph, Professor Charles Wyplosz of Geneva University said: "The money is chicken feed and it won't do anything to kick-start growth. It is unbelievable they are doing this rather than real fiscal expansion. The private sector will just take governments to the cleaners.

"This is really an excuse to pretend they are they doing something while the austerity is still going on. It will take too long to work and there will be a big fight over the projects as every country tries to get a share of the cake."

Meanwhile the Green MEP Molly Scott Cato has criticised the package, saying it "relies on further leverage at public risk - the same fantasy economics that for us into this mess in the first place".

© Copyright IBTimes 2025. All rights reserved.