Leaping into the future: Nigeria's rural microfinance community gets connected using Stellar and Oradian

In the 1970s, microfinance took off as people started extending credit to small businesses and farmers as a way of getting them out of poverty. Microfinance works: the only problem is it's hard to scale; it's time-consuming and expensive to disburse and collect loans for instance. People are not able to transfer money within countries like Nigeria because they can't get normal bank accounts or afford to pay 20% for traditional remittance/money transfers.

The conditions to have a bank account are difficult and banks are not that accessible in rural areas. (According to the Gates Foundation, 95% urban Nigeria has access to financial services, while rural is 24%). Money transfer is a financial service that is needed but not accessible.

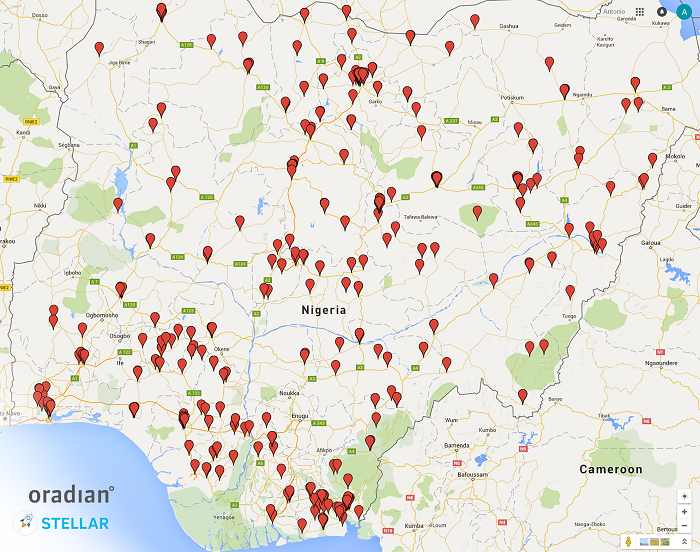

This challenge has brought together Stellar.org, a non-profit technology provider inspired by Bitcoin that allows local currency to be effectively emailed at close to no cost, and Oradian, cloud-based software for local financial organisations in West Africa. Together they are rolling out a pilot payment transfer network among microfinance organisations in Nigeria. This network reaches a total of 200 branches and serves more than 300,000 end clients (more than 90% are women), mainly in rural areas across the country.

Joyce Kim, CEO Stellar, told IBTimes: "To move money from one microfinance institution (MFI) to another, people put money in a bag and then they would put that bag on a bus, and that bus could take 12 hours to get where it needed to go. It's obviously not safe, it's not fast, it's not efficient and it has become more unsafe as the local political situation worsened with Boko Haram. Oradian started to tackle that problem and that's how they found us."

Kim said the aim is to create a kind of open, low-cost version of Western Union, or something like a SWIFT network that these MFIs or local farmers' co-ops can connect to and then transfer money between different branches or entities. Most people have an idea that mobile money is growing in parts of Africa with services like MPesa. However, the continent has some of the highest fees in the world for movement of money. For this reason Africa is often touted as a compelling use case for Bitcoin; companies like Kenya's BitPesa are trying to address this need. Kim said an essential element Stellar provides is delivering local currency.

"In poor communities you actually don't want to expose people to volatility. Even when you look at Bitcoin remittances, there is some exposure when you are transiting in Bitcoin. That's risky; you shouldn't ask poor communities to put their assets into volatile classes. If a family only has five dollars, you don't risk that five dollars turning into four – it's not worth it for that risk."

She said Stellar's low fees (something like 300,000 transactions for a penny) make it possible to handle microtransactions, which can become costly over time in the Bitcoin space. Stellar also differs from Bitcoin in the way the system reaches consensus and verification of transactions across the network. Rather than employ a vast army of computers competing to solve some proof-of-work, "we like to think of it as a green version of cryptocurrency because it doesn't consume a lot of energy," said Kim.

Stellar has rewritten its codebase to arrive at a more robust version of the Stellar Consensus Protocol (SCP). Distributed ledger systems, which replicate a database across many machines on a network, must reach consensus and all agree on the state of the world. Stellar uses a reputation-based system which it calls "flexible trust" whereby each node gets to hand-select a quorum of nodes that it trusts. A given node could decide to trust all the banks and perhaps also trust some reputable nonprofits that would be unlikely to collude; a company might already have a financial relationship with a credit union and want to make sure it and the bank both sign off on all transactions. Based on how these quorums overlap, the SCP algorithm reaches consensus.

In practical terms, organisation A would issue 10,000 naira on to the Stellar ledger and organisation B would be willing to accept it, rather like correspondent banking where each person has a debit and credit from the corresponding institution. They should have money on deposit, which would be enforced at the end points, hence it's like SWIFT for MFIs, Kim explained during a recent Tomorrow's Transactions podcast. She added that the new SCP and algorithm is explained in an extensive white paper which includes academic proofs. Stellar is also now much more scalable and can handle 500 million accounts without any problem, with hundreds of transactions per second on modest hardware.

We don't want the developing world to have a second, separate financial system – we think that the entire world should have a system that helps everybody from top to bottom

Drilling down into use cases, Kim said even the best and most well-capitalised banks have a hard time moving money to poor rural areas, which has a knock-on effect on NGOs and government workers there who may be trying to deploy subsidies to refugee families constantly on the move, for example. She said there is also a huge potential in remittances to the UK and US because of the large Nigerian diaspora. Nigeria with its oil-exporting capabilities is no longer a sleeping giant, and Lagos has become one of the big technology and finance centres of the continent alongside Cape Town and Nairobi.

"As well as addressing the unbanked issue, how do we create an economic system that is robust enough to handle the entire world's needs?" asked Kim. "We don't want the developing world to have a second, separate financial system – we think that the entire world should have a system that helps everybody from top to bottom."

Antonio Separovic, managing director of multi-award winning Oradian, started the company after becoming frustrated with selling core banking systems to frontier countries that were designed for Europe and the US, rather than financial institutions at the base of the social economic pyramid.

He told IBTimes: "We built a core banking system in the cloud, focused on financial institutions servicing the base of the pyramid. That is our sweet spot. We are servicing MFIs – they issue the loans and savings to the client. So we give them the right tools, enterprise software; often they are using pen and paper."

And with a flexible software platform, third-party services such as Stellar can be introduced. Separovic said the pilot will be initiated through MFI loan offices. "For example, individual clients will go to the loan office to access the service with their account. As individual clients begin to demand the service on their mobile phone, then we will start to deliver. Being in the cloud it's easy for us to roll that out."

Oradian currently has close to 500,000 end clients and its user base is growing at between 100% and 300% each year. He added that "loan offices and MFIs themselves are social networks. They have their own customer base so we don't have to go chase new customers."

On the regulatory front, Separovic said his conversations with Nigeria's central bank have been very encouraging. He said parts of the financial system don't have access to reporting and lack standardisation, and the service will prove these tools.

People in the developed world often have a misconception of financial inclusion in places like Africa. There is a tendency to assume everyone is poor, when the challenges are actually more nuanced than that. Separovic recounts how he visited a very remote village off the electricity grid, and was surprised to find people had iPads. The problem is connectivity: "They may not have electricity at home, but they can charge their iPads where they work perhaps, and then it serves them well because they can read at night.

"It's when we start connecting all these dots, then magic can start happening. We have looked at the challenges for MFIs: they don't have consistent access to electricity on the grid — well, let's make something that doesn't require a lot of electricity; let's put everything in the cloud. Now we can take Joyce's technology and, say, let's now address another problem. And over the coming months and years we will keep finding other technologies and plugging them into us."

© Copyright IBTimes 2025. All rights reserved.