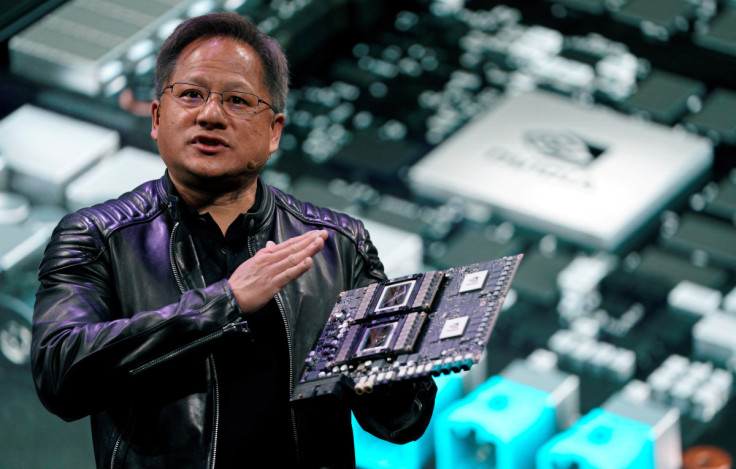

Nvidia results show its growing lead in AI chip race

As the artificial intelligence boom takes off, Nvidia Corp is expected to emerge as the biggest - though not the only - winner among chipmakers after years of focusing on the technology has made it a go-to supplier for tech firms.

As the artificial intelligence boom takes off, Nvidia Corp is expected to emerge as the biggest - though not the only - winner among chipmakers after years of focusing on the technology has made it a go-to supplier for tech firms.

AI has emerged as a bright spot for investments in the tech industry, whose slowing growth has led to widespread layoffs and a cutback on experimental bets.

The surge in interest helped Nvidia report better-than-expected quarterly earnings on Wednesday and forecast sales above beat Wall Street expectations, in stark contrast to a projected loss and dividend cut from rival Intel Corp.

Nvidia's market valuation dwarfs that of Intel, AMD

.png

Nvidia shares rose nearly 8% in trading before the bell on Thursday. They have jumped more than 40% since the turn of the year, nearly three times the gain in the Philadelphia Semiconductor Index.

It now has a market value of more than $500 billion, about five times that of Intel, and is the seventh-largest publicly traded U.S. firm.

The key to the company's success is that it controls about 80% of the market for graphic processing units (GPUs), which are specialized chips that provide the kind of computing power required for services such as Microsoft-backed OpenAI's wildly popular ChatGPT chatbot.

SPECIALIZED CHIPS

Graphics processing units are designed to handle the specific kind of math involved in AI computing very efficiently, while generic central processing units (CPUs) from Intel can handle a broader range of computing tasks with less efficiency.

AI is taking over the tech industry and, according to research firm Gartner, the share of specialized chips such as GPUs that are used in data centers is expected to rise to more than 15% by 2026 from less than 3% in 2020.

Advanced Micro Devices, whose shares also rose after Nvidia earnings on Wednesday, is the second-biggest player in the GPU industry, with a market share of roughly 20%.

"The two companies that are leading the AI revolution on the hardware and processing side are Nvidia and AMD and, in our opinion, these two companies are head and shoulders above everybody else," Piper Sandler analyst Harsh Kumar said.

Lisa Su-led AMD has made big investments in AI in recent years, including a series of chips designed to compete with Nvidia's fastest offerings. Intel holds a less than 1% share of the space.

Chipmakers set to reap gains from AI arms race

"The enthusiasm around ChatGPT and the potential use case it unlocks likely represents an inflection point in adoption of AI," said Lei Qiu, a technology fund portfolio manager at AllianceBernstein, which has a 0.54% stake in Nvidia.

"While it is hard to pinpoint exactly how big AI is today as a percent of (Nvidia's) revenue, it has the potential to grow exponentially as large tech companies race to develop similar types of AI applications," Qiu said.

Nvidia's strength in the AI industry has also attracted the attention of venture capitalists and startups, which are investing billions of dollars and promising improvements such as lower electricity consumption.

None of them have so far made a big dent in Nvidia's business.

INTEL NO LONGER INSIDE

All of this is bad news for Intel, which is also shedding CPU market share to AMD in the data center and personal computer industries that it once dominated. The company now risks losing out on the next growth leg of the industry.

It has in recent months made efforts to sharpen focus on GPUs including a move in December to split its graphic chips unit into two: one focused on personal computers and the other working on data center and AI.

Still, analysts say the company has a long way to go before Intel can make a dent in the market.

"Intel has more designs it has built to try and penetrate the (AI) market ... but to date it's seen a disappointing amount of traction despite its plethora of solutions," Wedbush Securities analyst Matthew Bryson said.

Copyright Thomson Reuters. All rights reserved.