OECD Unveils Measures to Tackle Tax Avoidance by Multinational Companies

The Organisation for Economic Cooperation and Development (OECD) announced new proposals to eliminate loopholes that enabled multinational companies to save billions of dollars in corporate taxes.

The group recommended the implementation of the OECD/G20 Base Erosion and Profit Shifting Project (BEPS), which is designed to create a single set of international tax rules to end the erosion of tax bases and the artificial shifting of profits to jurisdictions to avoid paying tax.

The proposed BEPS project would help governments protect their tax bases and enhance predictability to taxpayers. At the same time, it would guard against new domestic rules leading to double taxation, unwarranted compliance burdens or restrictions to legitimate cross-border activity.

The action plan involves 15 key elements to be addressed by nations by 2015.They include:

- Ensure the coherence of corporate income taxation at the international level, through new model tax and treaty provisions to neutralise hybrid mismatch arrangements

- Realign taxation and relevant substance to restore the intended benefits of international standards and to prevent the abuse of tax treaties

- Assure that transfer pricing outcomes are in line with value creation, through actions to address transfer pricing issues in the key area of intangibles

- Improve transparency for tax administrations and increase certainty and predictability for taxpayers through improved transfer pricing documentation and a template for country-by-country reporting

- Address the challenges of the digital economy

- Facilitate swift implementation of the BEPS actions through a report on the feasibility of developing a multilateral instrument to amend bilateral tax treaties

- Counter harmful tax practices.

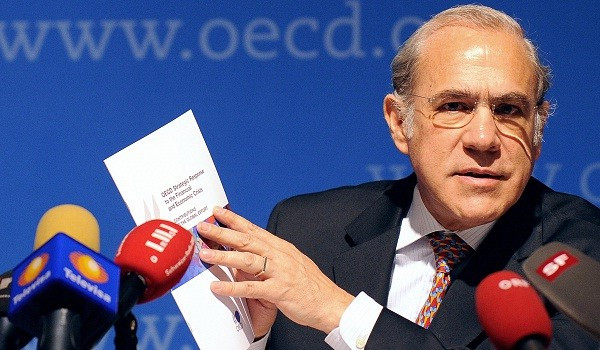

"The G20 has identified base erosion and profit shifting as a serious risk to tax revenues, sovereignty and fair tax systems worldwide," OECD secretary-general Angel Gurría said in a statement.

"Our recommendations constitute the building blocks for an internationally agreed and co-ordinated response to corporate tax planning strategies that exploit the gaps and loopholes of the current system to artificially shift profits to locations where they are subject to more favourable tax treatment."

Tax avoidance by multinational companies has been a serious issue raised at the recent G20 summits, and the OECD has been entrusted with developing a systematic plan to address the issue.

Companies such as Amazon, Google and Starbucks have been criticised in the UK for their minimal tax payments in the country, despite generating huge revenues.

The G20 finance ministers are due to meet in Australia on 20-21 September, and the OECD recommendations will be a key topic of discussion during the event.

© Copyright IBTimes 2025. All rights reserved.