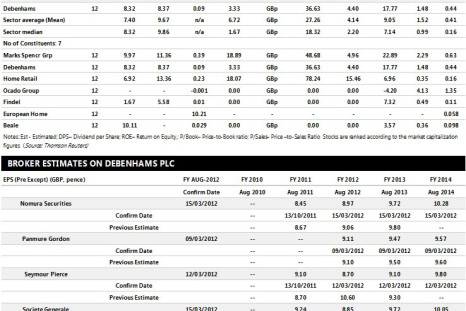

Debenhams Keen on Tight Cost Control and Profit Maximisation

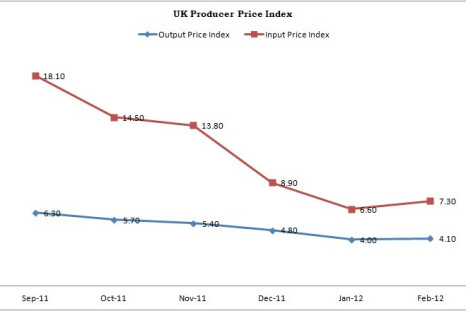

Debenhams, the seller of fashion clothing, accessories, cosmetics and products, expects to benefit from lower input prices in the H2 of FY 2012. Britain's No. 2 department store group is scheduled to release its H1 trading update on Tuesday.

UK Economy on Slow and Steady Growth Path

Britain's slow and steady economic growth helps it in avoiding recession, followed by upbeat data and last week's Greek debt restructuring. The Bank of England holds its asset purchase programme at £325 billion, as economists predicted 0.2 per cent growth in the current quarter.

EMIS Group Continues To Trade In Line With Expectations

EMIS Group Plc, the UK's leading supplier of clinical software and related services, has reported a total revenue of £73.2 million for the year ended 31 December 2011, up £61.9 million in 2010 and EPS from continuing operations at 28.71 pence as compared to 23.31 pence in 2010.

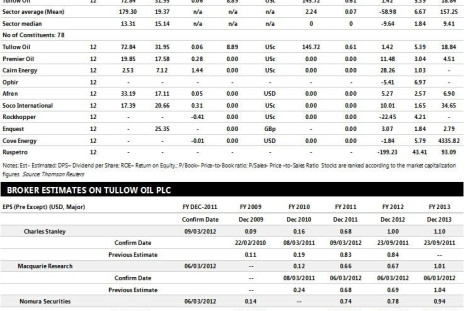

Tullow Oil Reports Success in Enyenra-4A Appraisal Well

Tullow Oil, an independent oil and gas company, announced that it has successfully encountered oil in very good quality sandstone reservoirs in the Enyenra-4A appraisal well, in the Deepwater Tano licence offshore Ghana.

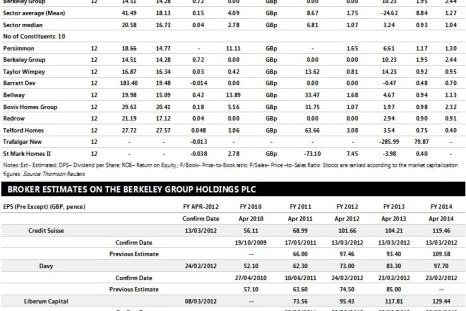

Berkeley Group on Track to Double FY 2013 Revenues, May Return £13 Per Share Over Next 10 Years

The Berkeley Group Holdings, known for its savvy London land purchases, is confident of its ability to meet its targets, buoyed by a pipeline of forward sales that grew 15.2 percent in the six months to October 31, 2011. The group is scheduled to release its interim management statement on March 19, 2012.

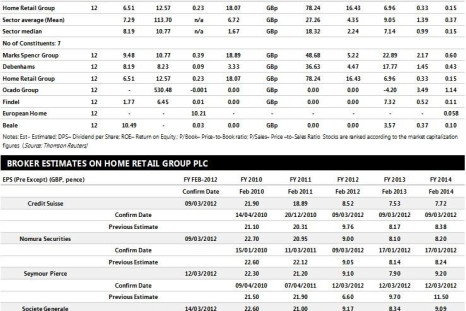

Home Retail Group Expects Major Cut in Full Year Dividends

Britain's household goods retailer, Home Retail Group, focuses on robust cost management along with cash positions due to ongoing uncertainty surrounding the UK economy. It will also prioritise its investment in the ongoing development of its multi-channel capabilities.

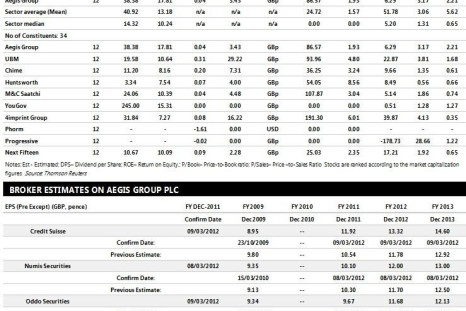

Aegis Group Sees Strong Momentum, Bets on Acquisitions

Aegis group, the marketing services company in the areas of media communications and market research, expects the environment to remain competitive but it remains well positioned to make continued progress.

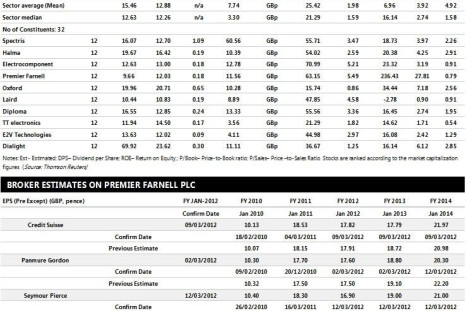

Premier Farnell Cautious on Outlook, Keen on Strategic Cost Actions

Premier Farnell, a multi-channel service distributor of information products and technology solutions, is confident that its strategy will deliver sustainable and profitable growth across the economic and product cycles and is scheduled to release its 2011 Q4 earnings on Thursday.

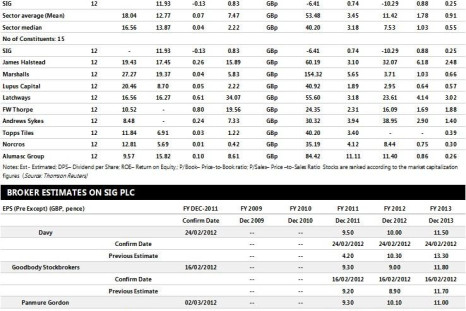

SIG Anticipates Lower Volumes in 2012

SIG, a leading distributor of specialist building products in Europe, expects to continue to gain market share from the branches opened in recent years, but also from other growth initiatives, in spite of weak macroeconomic outlook for the UK and mainland Europe.

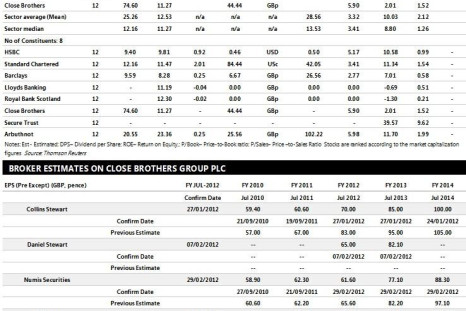

Close Brothers' H1 Profits Unchanged

Close Brothers Group, a specialist financial services company, has reported that its adjusted operating profits for the six months to 31 January, 2012 were broadly unchanged at £63 million due to the difficult economic and financial market uncertainty for securities.

Tullow Oil To Deliver Record FY Earnings, Outlook Positive For Coming Years

Tullow Oil, the independent oil and gas company, expects significant progress in Ghana and Uganda for the FY 2012 and is scheduled to report its full year 2011 results on Wednesday.

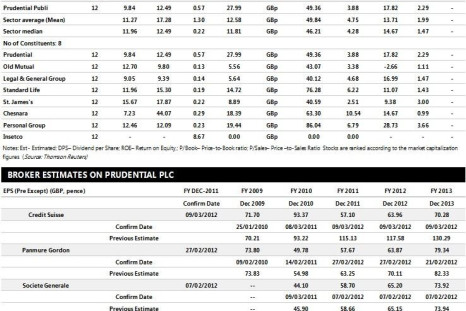

Prudential Positioned to Outperform in the Medium-Term

Prudential, an international financial services group, remains confident to deliver solid growth in earnings for the full year on Tuesday, its superior Q3 2011 earnings were driven by good performance in Asia.

Brady Posts Robust FY Earnings

Brady, a commodity risk management software provider, has reported a rise of 72 per cent in its full year revenue to £19.16 million, up from £11.12 million in 2010, including an increase in recurring revenues of 147 per cent to £9.79 million.

Close Brothers Faces Tough Market Conditions, Uncertain on H2

Close Brothers, the specialist financial services company, expects its first half performance may be affected by a lower

contribution from securities.

UK Jan Industrial Output Falls, Feb PPI Rises

British industrial output posted an unexpected fall in January after a sharp decline in oil and gas production and weaker-than-expected factory output, indicating that Britain's economic recovery could be in peril.

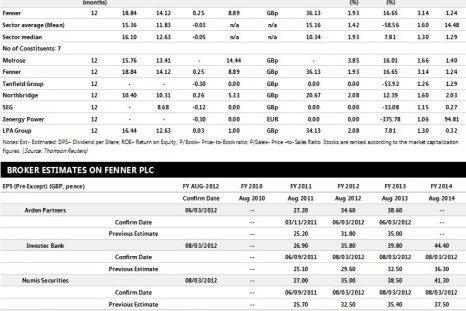

Fenner Upbeat on 2012 Outlook; Investec Recommends Outperform Rating

Fenner, a world leader in the field of reinforced polymer and textile technology, says in spite of the growing uncertainty over the macro economic outlook, trading and demand levels are in line with the group's expectations for 2012.

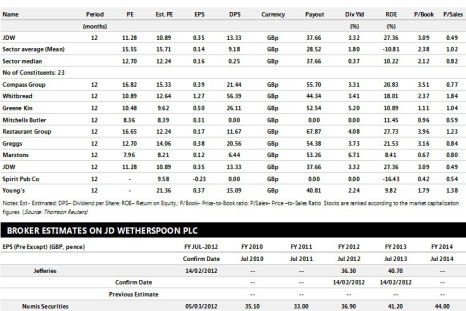

JD Wetherspoon Records Moderate Growth in H1, Vigilant on FY Outcome

The pub group, JD Wetherspoon, has recorded a moderate growth for the first half of 2012 with an increase in sales of 8.4 percent, given the pressures on the UK consumer.

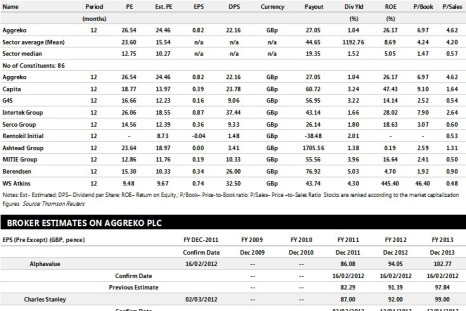

Aggreko Delivers Robust FY Performance, Bets on London Olympics

Aggreko, the leader in the supply of temporary power and temperature control equipment, has reported that its underlying group revenues increased 22% for the year ended December 31, 2011.

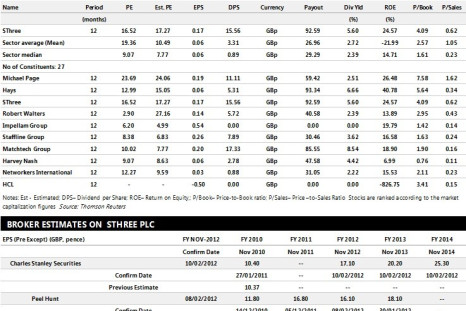

SThree Q1 Gross Profit Rises by 15%

SThree, an international staffing business firm has reported that its first quarter gross profit rose 15 percent year on year to £47.7 million, up 12 percent in the fourth quarter of 2011.

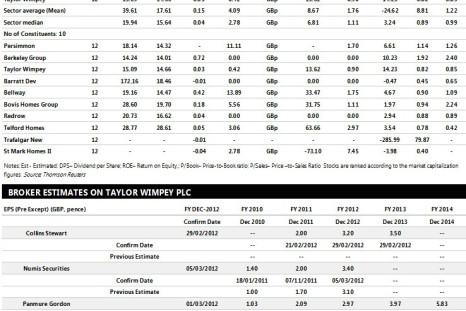

Taylor Wimpey Starts FY 2012 with Encouraging Patterns; HSBC assigns 'Overweight' Rating

Taylor Wimpey, the homebuilding company, says that it is too early to judge the market for the year as a whole, but the early weeks of trading in 2012 have followed the encouraging patterns of the second half of 2011, with good visitor levels, healthy reservations and low cancellations.

SThree Uncertain About Market Conditions in 2012

SThree, the permanent and contract staffing group, says that the GDP growth and the staffing market are not linearly related, given the current levels of global economic and political uncertainty, it is difficult to foretell the kind of market conditions the group will face during 2012 with any accuracy.

J D Wetherspoon Moderate on 2012 Outlook, Expects Continuing Cost Pressures

J D Wetherspoon, the developer and manager of public houses, which is scheduled to release its 2012 interim results on Friday, has moderate views for 2012 outlook, due to cost pressures resulting from government legislation, including further increases in excise duty, business rates and carbon tax.

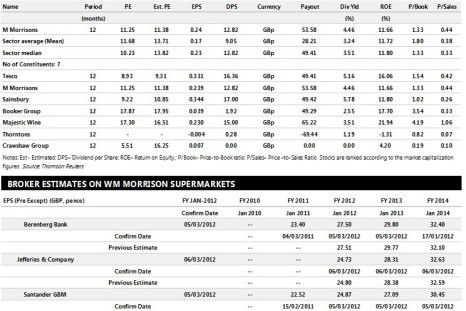

Morrisons Delivers Another Good Year Performance

Morrisons Supermarkets, the food retailer, has reported that its turnover rose 7 per cent to £17.7 billion for the year ended 29 January, 2012. Profit before tax was at £947 million compared to £874 million in the previous year and raised its total dividend by 11 per cent to 10.7 pence.

Schorders Posts Slight Rise in FY Profits

Schroders, an international asset management and private banking group, has reported a slight rise in its profit before tax at £407.3 million for the year ended 31 December, 2011 from £406.9 million a year earlier.

Aggreko keen on expansion, positioned strong for 2012

Aggreko, the rental provider of power generation and temperature control equipment, started its FY2012 with a strong position with at least 20 per cent more on hire in international power projects than at the start of 2011.

Morrison Supermarkets Cautious on 2012 Outlook; Secures 'Buy' rating from Jefferies

Wm Morrison Supermarkets, a food retailer grocer, expects the consumer environment in the UK during 2012 to be cautious despite an anticipated reduction in inflationary pressures. It is expected to release its preliminary results for the year 2011 on March 8, 2012.

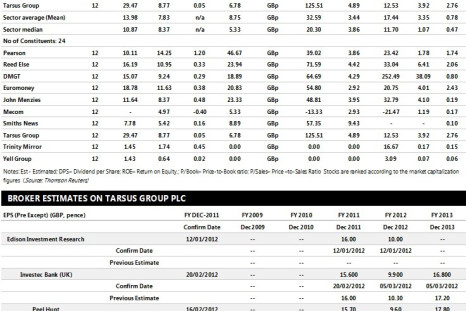

Tarsus Reports Robust Earnings, Confident on 2012 Outlook

Tarsus, the international business to business media company, has reported a rise of 42 percent in its revenues at £61.7m for the year ended December 31, 2011 with adjusted pre-tax profits up 77 percent to £16.8m.

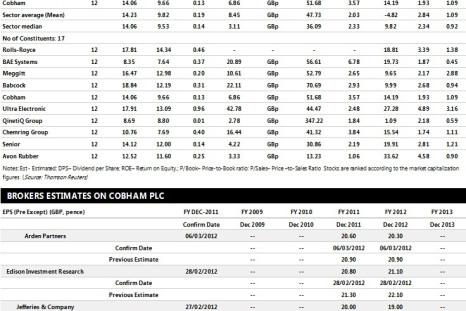

Cobham Uncertain on Defence and Security Market; 2012 Trading Dismal

Cobham, the engineering group anticipates that the US defence and security market will remain challenging with constraints over Government spending tightening, with important and ongoing uncertainty over the size, timing and allocation of federal budget cuts. As a result, there is continued poor visibility for 2012 trading.

Jupiter Fund FY Revenue Up Despite Eurozone Crisis Headwinds

Jupiter Fund Management, an investment holding company has reported a rise in its full year revenue by 8% to £248.5 million from £230.5 million recorded in 2010.

Tarsus Group to Report Major Events in Its History Along With FY Results

Tarsus Group, the international business-to-business media group, expects the second half of 2011 to be the most important trading period in the group's history with major events taking place in the main geographies where it operates.