Aggreko keen on expansion, positioned strong for 2012

Aggreko, the rental provider of power generation and temperature control equipment, started its FY2012 with a strong position with at least 20 per cent more on hire in international power projects than at the start of 2011.

With good momentum in the local business, the group is scheduled to release its full year 2011 results for the period ended 31 December, 2011 on Friday.

In 2012, the local business will benefit from its contract to supply temporary power for the London Olympics, for which it has already committed significant resources. It therefore expects to deliver strong growth in the first half of 2012, unless there is a major change in the macro-economic environment.

The group is more cautious about the second half of 2012, when any downturn in economic activity is more likely to be felt by its businesses, and comparatives will be tougher.

In terms of the rate of investment in the business, the power generation rental provider sees encouraging results from its investment in its local businesses in developing markets, and plans to continue to expand its network and reach in countries with high rates of GDP growth.

In terms of fleet investment, it intends to further expand its fleet capacity and is currently planning to spend around £320 million on fleet in 2012, or 1.6 times fleet depreciation. However, as it has demonstrated in the past, it can adjust capital spending rapidly, and it will manage the rate of fleet investment through the course of the year in the light of demand.

Aggreko believes that it is well placed to deliver a strong profit before tax and amortisation for the year as a whole and will be higher than expected which amounts to £315 million. This would equate to a rate of growth in underlying profits of around 24 per cent. Overall, the group expects to deliver further growth in 2012, but much will depend on the economic environment.

While commenting on the trading update, Rupert Soames, Chief Executive said: "We have had a very successful year in 2011 and have grown our business significantly at the same time as returning capital to shareholders. As we enter 2012, demand for temporary power remains strong and we will continue to invest in the expansion of our fleet and our global network of service centres."

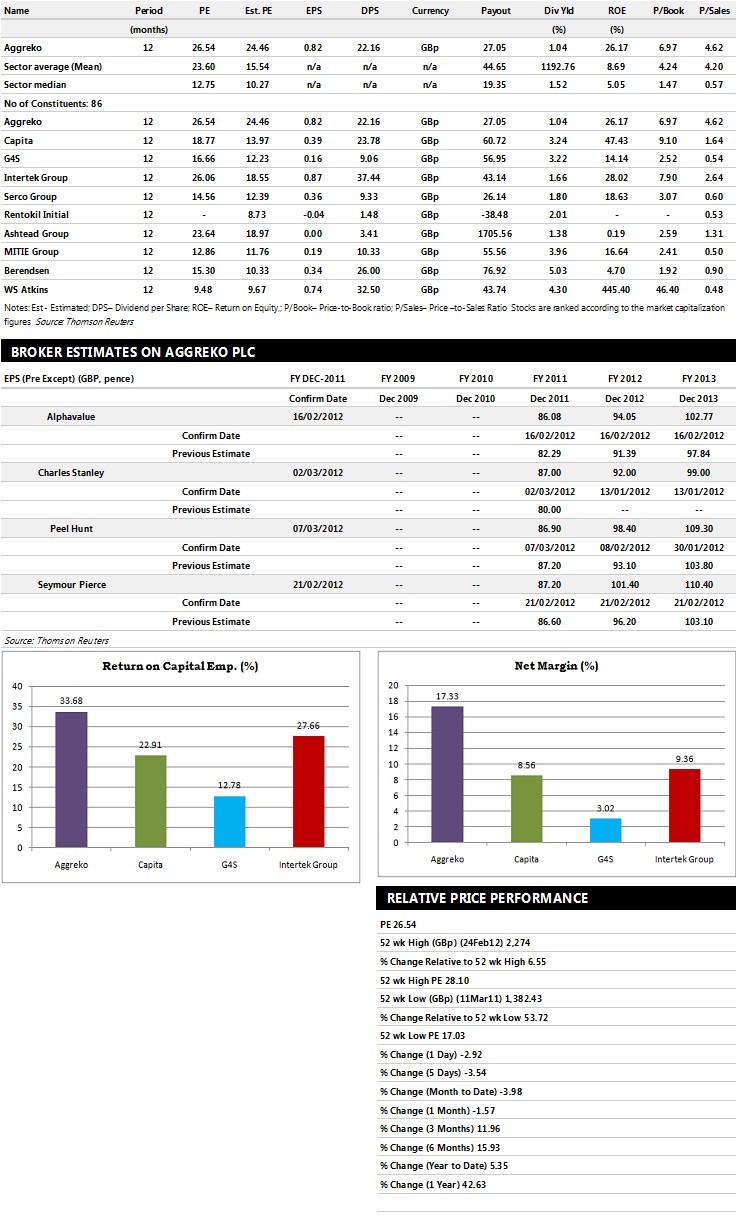

Brokers' Views:

- Peel Hunt recommends 'Hold' rating on the stock

- Seymour Pierce assigns 'Buy' rating with a target price of 2300 pence per share

- Charles Stanley gives 'Hold' rating

- Westhouse Securities assigns 'Buy' rating with a target price of 2500 pence per share.

Earnings Outlook:

- Peel Hunt estimates the company to report revenues of £1,391.50 million and £1,648.60 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £324.00 million and £352.20 million. Earnings per share are projected at 86.90 pence for FY 2011 and 98.40 pence for FY 2012.

- Charles Stanley projects the company to record revenues of £1,260 million and £1,500 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £325 million and £350 million. Profit per share is estimated at 87 pence and 92 pence for the same periods.

- Seymour Pierce expects Aggreko to earn revenues of £1,385 million for the FY 2011 and £1,636.60 million for the FY 2012 respectively with pre-tax profits of £325.30 million and £364.30 million. EPS is projected at 87.20 pence for FY 2011 and 101.40 pence for FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents seven companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.