Seven banks kick-off Ripple's blockchain network including Santander, UBS and UniCredit - '90 more in the pipeline'

ReiseBank, CIBC, National Bank of Abu Dhabi (NBAD), and ATB Financial also using Ripple.

Ripple, the interbank payment solution using distributed ledgers, has announced the names of seven banks on its network, the first in the world to move real money across borders using any kind of blockchain-based technology.

Santander, UBS, UniCredit, ReiseBank, CIBC, National Bank of Abu Dhabi (NBAD), and ATB Financial are the first to be announced.

ATB in Canada completed the first CAN to EUR blockchain transaction with ReiseBank, a subsidiary of DZ Bank in Germany. In addition, Ripple said it has some 90 banks in the pipeline, 30+ pilots completed and 10 banks in commercial production deal phases.

Marcus Treacher, general manager of Ripple's London office told IBTimes UK: "We are actively working with some very big banks worldwide. It is real. We are starting to build this network."

Blockchain banking consortia enthusiasts will no doubt watch with interest as Ripple's banking network grows to rival that of the mighty R3 group. In fact the two networks complement one another. Ripple CEO Chris Larsen has said he believes sorting out interbank payment plumbing is a rising tide that will help other forms of settlement.

Treacher agreed: "If we can get payments flowing in a much more atomic way than is possible today that is the bedrock on which everything else can run. I'm not sure if you remember the first Eurostar train that went to Waterloo - it went like 300mph across northern France and then 25mph chugging in to London because the tracks just couldn't cope.

"So we can rethink how money moves across borders; it goes by SWIFT these days, but essentially the same model is happening as the Medicis had back in the dark ages. This technology is just as powerful - maybe even more powerful - than completely replacing the track for the Eurostar into London from Paris."

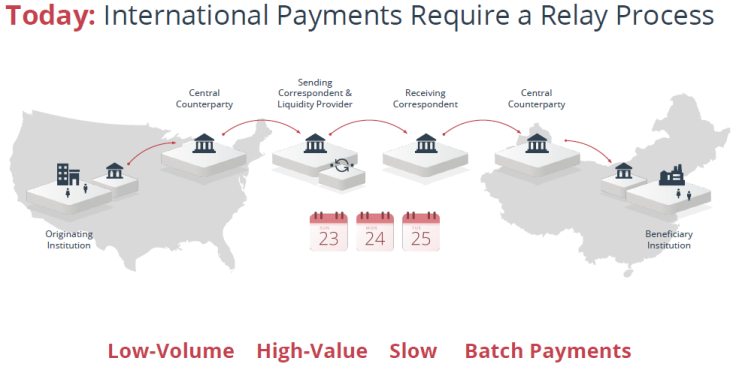

Ripple rethinks the "postal service" existing today between the SWIFT MT messaging series of 100, 200, 300. "Okay it's all computer data now, but the actual model is like a post office: you package up your letter, which is your MT 100, and you send it. Someone receives it, opens it and acts," explains Treacher.

"When you have this kind of a postal service running back and forth between banks that therefore bridge countries, you have always got that latency; you have got that lack of clarity about who has got what and where a payment is and many bad things accrue from that fundamental set-up.

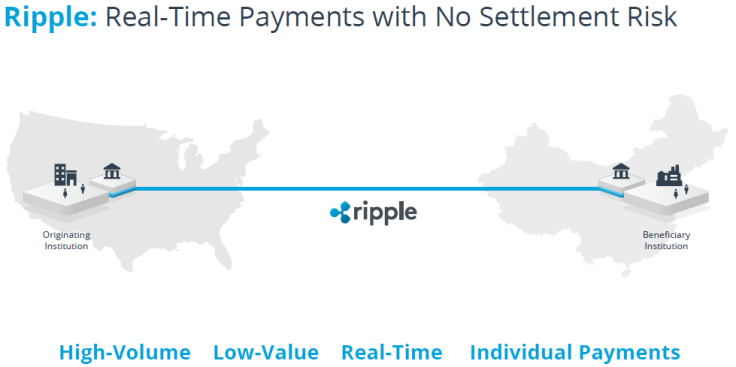

Ripple uses distributed ledger technology to join two banks at either end of a payment in a common temporary blockchain. It can also join a third party bank that holds money in both currencies, if the two banks which are ultimately paying each other don't share money in each other's currencies, for example, which can happen from time to time. A fourth or a fifth player can also be added, who can be the notaries or the checkers or the approvers: the Ripple equivalent of miners to make sure that the transaction is solid.

Treacher continues: "These three or four banks join together and they have a conversation, only for a few seconds. They may say, this payment is AML-cleared, or, wait a minute, this payment doesn't match our filters, or my price is two cents - my price is 8 cents etc. In that conversation Ripple also actually takes control of a tiny chunk of the funds and holds it, rather like when you call the help desk and the guy takes over your PC - Ripple takes over the funds earmarked for the payments."

If everyone is in agreement then the payment goes through and it is absolutely and totally gone, said Treacher, adding that this can be approved by a customer using a mobile phone and Ripple app. "There is no ambiguity. And all of the chasing, inquiries, and where it's gone - all that goes. All the Dodd Frank problems go. I also think much of the compliance problems will also be much more manageable because the data is much more easily shared between banks," he said.

SWIFT

Treacher, who spent six years on the board of SWIFT, is hopeful about Ripple working together with the incumbent bank messaging network. "We often ask - what is the essence of SWIFT, and if you peel it back, interestingly, it's not really the standards because that's run by ISO anyway now, it's not really the physical computers because - okay you needed your own internet in 1974, but arguably you don't really need that today. It's the community and it's the governance."

Treacher said that SWIFT's unique messaging categories – FIN, InterAct, FileAct would be well complemented by a message called "RippleConnect". He said: "SWIFT could run Ripple and the benefit SWIFT would give is that you have the 8,000 banks and the community and the governance and the oversight already.

"I think there are many futures for Ripple. One could be as part of the infrastructure of SWIFT. One could be as entirely new network. As a software company we are pretty agnostic about where it goes.

"SWIFT has run Ripple in its labs and is totally up to speed with what Ripple does. I guess the problem is whereas we are fresh and we are new, we haven't got our feet on the ground and we are establishing our network. SWIFT has got a humongous legacy. It moves the GDP of the world every three days.

"They are very cautious for a good reason. It just takes some time but we are in dialogue with them. We are speaking to their top brass and given time I feel positive," said Treacher.

All in all it's been a pretty good month for Ripple, which has seen Santander UK unveil a Ripple-powered mobile app for cross-border payments of up to £10,000 to be made any time, with the funds appearing in the recipient's account the next working day. This is expected to be ready for consumers later this year.

Ripple was also celebrating receiving a BitLicence for the operation of XRP, the base currency that lubricates its network.

© Copyright IBTimes 2025. All rights reserved.