UK house prices in steepest fall since 2011 as EU referendum looms

UK house prices recorded their steepest monthly fall for more than four and a half years in May. The dip reflects uncertainty around the impending referendum on Britain's membership of the EU and the tail-off in activity from buy-to-let investors after the stamp duty hike in April.

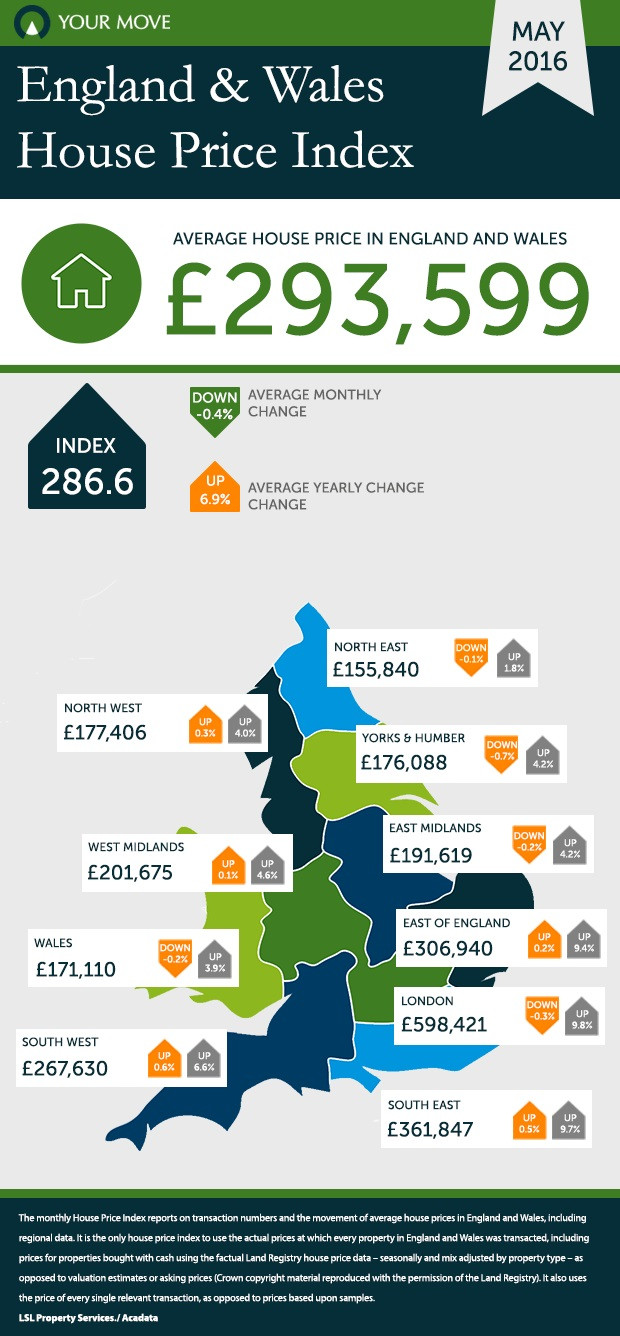

The average UK house price fell by 0.4% month-on-month to £293,599, the biggest decline since November 2011, according to the monthly index from estate agents Your Move and Reeds Rains. On an annual basis, the average price rose 6.8%. "The housing market is holding its breath ahead of the EU referendum and after a rapid sprint at the start of the year," said Adrian Gill, director of Your Move and Reeds Rains.

Prices also fell in London, where property values are highest and investor activity strongest. As well as raising stamp duty on additional property purchases, the Treasury has increased stamp duty on expensive homes, among other tax hikes. This hit demand in the prime property market, which has also been dampened by global economic weakness in China.

The average London price also fell 0.3% over the month in May to £598,421, according to the index, though there is a divide between the boroughs. As prices peak in the most expensive areas like Kensington and Chelsea, property buyers are pushed to find value in cheaper boroughs further out from the centre, accelerating price growth in outer boroughs, such as Barking and Dagenham.

"While house prices in the most expensive eleven boroughs have declined by an average of £4,000 (0.5%) from the previous month, values in the cheapest eleven boroughs continue to rise jumping £3,000 (0.8%) month-on-month," Gill said.

On 23 June, Britain will vote in a referendum on leaving the EU. Some property investors are delaying transactions until after the vote, creating a pause in the market. Several banks forecast sterling to fall in value by as much as a fifth in the event of a Brexit.

© Copyright IBTimes 2025. All rights reserved.