What Greece can learn from bitcoin adoption in Latin America

Bitcoin is uniquely positioned to rescue economies in crisis. Owning bitcoin means being a participant in a resilient and rapidly expanding global financial network – one that is independent of politics and central authorities.

In economies where governments strive to establish stability, bitcoin is already providing protection against inflation and access to consumer finance services that allow people to go about their daily lives in the midst of the worst economic circumstances.

As the currency crisis in Greece unfolds, some have proposed that the country's government has an unprecedented opportunity to use bitcoin to restructure its economy. While government adoption of bitcoin as a currency or payment infrastructure may still be years away from reality, consumer and enterprise adoption in developing economies is defying expectations.

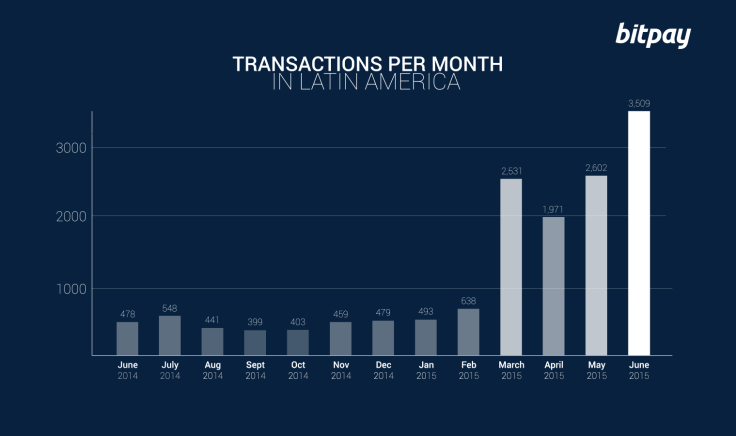

Since 2014, global bitcoin adoption has grown month-over-month despite a general decrease in the bitcoin price. The United States and Europe continue to lead global bitcoin use, but data recently released by bitcoin payment processor BitPay suggests that the most rapid adoption is occurring in Latin America.

BitPay's transaction figures are a testament to just how rapidly this adoption is taking place, revealing a 510% increase in Latin America's bitcoin transactions from 2014 to 2015, compared to an increase of only 70% in Europe.

These numbers are so compelling because they point to the one factor that differentiates Latin American economies from those with more stable currencies– a real need for alternatives.

Inflation and Currency Volatility in Latin America

Latin American countries are no strangers to economic instability. Argentina, for example, has a history of military coups and consequent economic crises dating back to the 1930s. In 2001, Argentina defaulted on over $100bn in international loans, plunging the economy into crippling recession. Argentina's peso now suffers from one of the world's highest inflation rates – often over 20% per year. This high inflation means that the money supply is growing significantly faster than the economy, causing devaluation to the national currency.

These economic policy decisions have real negative impact on average Argentines. Faced with the volatility of the peso, restaurants often write their menus on chalk boards or with pencil in order to avoid reprinting menus each month with different prices.

Inflation and currency devaluation aren't confined to Argentina, however. These currency issues also currently affect Venezuela, Mexico, and Brazil, whose histories of bank crises and economic mismanagement have eroded the confidence their populations have in their governments and banks.

Seeking Refuge

"Now that Bitcoin exists, we hope that Greek workers and merchants can use it to protect their income through this crisis."

To fight inflation, Latin Americans have historically stored their wealth in American dollars. The increasing restrictions some countries have placed on buying dollars have left these citizens financially vulnerable.

In Argentina, even though government restrictions were somewhat relaxed after the peso experienced a sudden drop in value in 2014, those who are approved to buy dollars are limited to purchasing just 20% of their income, capping their monthly savings at $2,000.

Getting this approval is a cumbersome process, leaving most Argentines with a higher restriction barrier to exchange their local currency. However, the numbers are rising from $39.2m p/day bought in June to $60m p/day bought in July, forcing the government to tighten the restrictions.

Extreme restrictions on currency exchange have led to the emergence of a black market specifically for trading pesos for dólar blue, American dollars with an exchange rate that runs about 50% higher than the official exchange rate.

Acquiring dollars this way is illegal and risky, so Argentines seeking to protect their savings often buy ADRs (American Depository Receipts), local bonds denominated in dollars, gold, silver, and other commodities that are traded on local and international stock exchanges.

No Bank Account? No Problem.

News of bank closures in Greece in the past month have sparked panic, then bank runs, leaving many Greek citizens without regular access to their bank accounts.

For Latin Americans, this situation is already too familiar. Among Latin America's 600 million inhabitants, more than 60% are unbanked, meaning they have no access to bank accounts.

Despite the obvious economic need, most financial institutions are unable to serve this unbanked population.

Fortunately, purchasing and using bitcoin does not require a bank account. All it takes is just a mobile phone, which 70% of Latin Americans happen to have. In contrast to the banking system, the Bitcoin network operates 24 hours a day, every day of the year, and can be accessed by anyone on the internet. It presents an immediate, accessible solution to receive wages and securely store savings at very low cost, with no additional resources or hardware required.

Entrepreneurs and companies have already begun to make bitcoin solutions available to consumers in the region. Belize's Advanced Cash is particularly significant example, accepting bitcoin payments for top-ups to its popular digital wallets and prepaid cards which are used throughout Latin America. This mainstream integration of bitcoin payments is allowing both banked and unbanked customers to secure their savings in the cloud.

What Comes Next

Some critics accuse Bitcoin of being a solution in search of a problem, but currency crises like the one Greece now faces prove that current financial frameworks are often part of the problem. The top-down solutions proposed for struggling economies can complicate the road to stability. The IMF recently released a report that states that "benefits do not trickle down," a warning for Greece to consider as it restructures its economy.

Bitcoin can protect the remaining wealth of Greek citizens by providing them a grassroots-level solution for storing value independent of banks. By accepting bitcoin for payment, Greek businesses can protect their own earnings and provide consumers with real uses and a liquid market for bitcoin savings.

This opportunity for lower and middle class citizens to use bitcoin as a method for local exchange has never been greater, and it may be an important insurance against the financial turmoil expected for Greece.

"Living first-hand through the Argentinian economic turmoil following the 2001 default, we could only wish we had bitcoin as a solution to protect our income from inflation and devaluation," said BitPay project leader for the Copay bitcoin wallet, Matias Alejo Garcia.

"Now that Bitcoin exists, we hope that Greek workers and merchants can use it to protect their income through this crisis," he said.

© Copyright IBTimes 2025. All rights reserved.